Bitcoin’s value has dropped practically 10% since hitting an intraday excessive of $102,735 on Tuesday. This decline has considerably affected miners, with each day income on the Bitcoin community sinking to a 30-day low.

As shopping for stress weakens, BTC dangers slipping under $90,000, probably amplifying losses for miners already going through monetary pressure.

Bitcoin Miner Income Declines Amid Value Drop

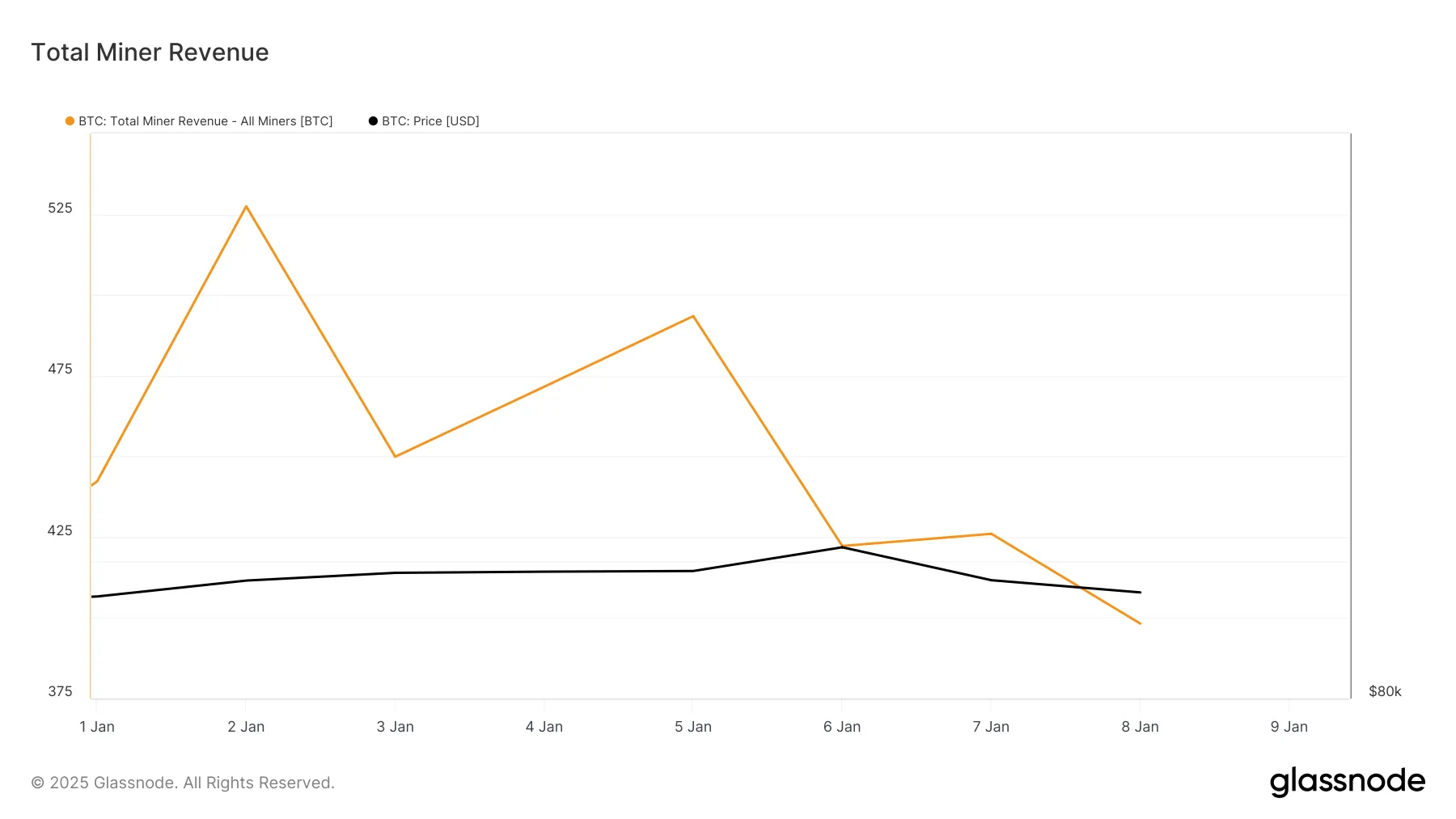

BTC miner income derived from transaction charges and block rewards has fallen steadily since January 2. Based on Glassnode, it’s at the moment at 398.20 BTC, down 24% over the previous week.

When Bitcoin miner income falls, it implies that miners are incomes much less from validating transactions and securing the community. This decline sometimes happens when Bitcoin’s value drops, decreasing the worth of rewards paid to miners.

Over the previous two days, Bitcoin has famous a big fall. For context, throughout Tuesday’s intraday buying and selling session, the main cryptocurrency traded briefly at a excessive of $102,735. Nevertheless, promoting exercise quickly gained momentum, inflicting the coin’s value to pattern downward. At press time, BTC trades at $93,419.

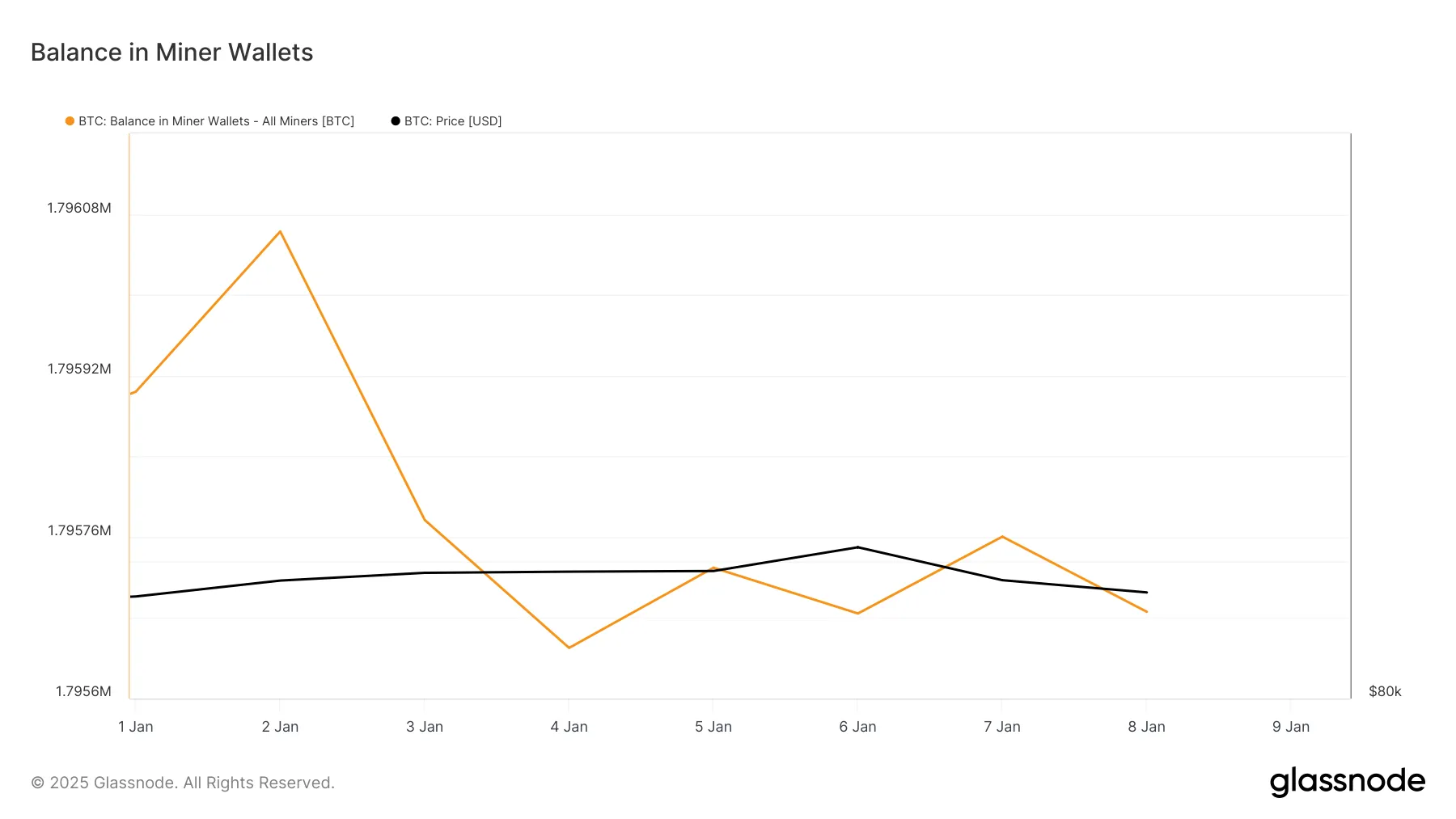

As extra Bitcoin miners rush to dump their cash to stop additional losses to their BTC holdings, the quantity of BTC held in miner wallets has steadily declined. As of this writing, this stands at 1.79 million BTC, a drop of 0.005% since January 2.

BTC Value Prediction: Will it Maintain or Break Beneath $90K?

On the BTC/USD each day chart, BTC trades barely above the assist shaped at $91,437. If selloffs persist, the coin’s value might break under this degree and the $90,000 vary to commerce at $85,224. On this state of affairs, Bitcoin miner income would plunge additional, inflicting extra miners to promote their cash to cowl operational prices.

Nevertheless, if market sentiment improves and the demand surges, this will drive the coin’s value towards $102,538, growing BTC miner income.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.