SPX6900 (SPX) value has skilled sharp actions, rising 25% within the final seven days however dropping 15% up to now 24 hours amid a broader meme coin market correction.

The correction follows a interval of overbought circumstances, with technical indicators suggesting potential additional draw back or a potential reversal if shopping for momentum returns. The approaching days will probably be essential in figuring out whether or not SPX value can regain its bullish pattern or face deeper corrections.

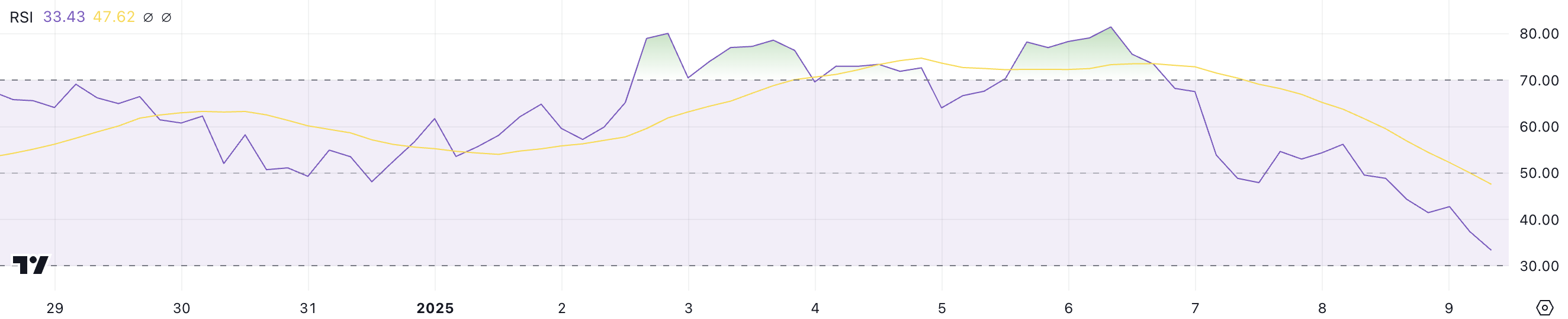

SPX RSI Dropped For Its Lowest Degree In 20 Days

SPX Relative Energy Index (RSI) has sharply dropped to 33.4, a major decline from its overbought stage of 81.4 simply three days in the past. RSI is a momentum indicator that measures the velocity and magnitude of value actions on a scale of 0 to 100.

Readings above 70 sometimes point out overbought circumstances, suggesting a possible for a value pullback, whereas values beneath 30 recommend oversold circumstances, typically signaling the opportunity of a rebound. At 33.4, SPX’s RSI hovers simply above the oversold threshold, marking its lowest level since December 20.

This steep decline in RSI highlights heavy promoting strain and weakening momentum for SPX. Whereas the present stage means that bearish sentiment is dominant, it additionally indicators that SPX value could also be approaching oversold circumstances.

If the RSI drops additional or stabilizes close to 30, it may create circumstances for a value restoration as shopping for curiosity would possibly return. Nonetheless, with out a robust shift in market sentiment, SPX value could proceed to consolidate or decline within the close to time period, like different meme cash.

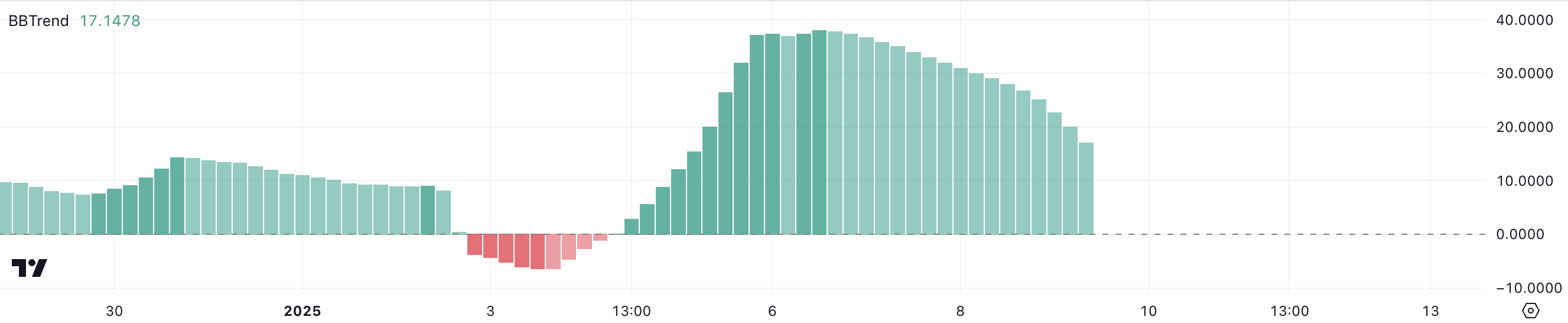

SPX BBTrend Is Declining

SPX BBTrend stays optimistic at 17.1 regardless of a gentle decline from its current peak of 38 on January 6. Derived from Bollinger Bands, BBTrend measures the power and route of a value pattern. Constructive values point out bullish momentum, whereas damaging values recommend bearish circumstances.

At its present stage of 17.1, SPX BBTrend means that whereas the current correction of practically 15% within the final 24 hours has dampened upward momentum, the coin retains some underlying bullish sentiment. Nonetheless, the regular decline in BBTrend signifies that the danger of additional draw back persists except shopping for exercise will increase to stabilize the worth.

A continuation of the present trajectory may result in consolidation or extra corrections. Nonetheless, a restoration in BBTrend may sign a resurgence of bullish momentum, maintaining SPX within the prime 10 rating among the many greatest meme cash.

SPX Worth Prediction: A Additional 48% Correction?

SPX’s EMA strains nonetheless keep a bullish setup, with short-term EMAs positioned above long-term ones. Nonetheless, the short-term strains are trending downward, elevating the opportunity of a dying cross — the place short-term EMAs cross beneath the long-term ones.

This bearish sign may exacerbate SPX value current correction, main the worth to check the help at $0.937.

If this vital stage is misplaced, the meme coin could face additional declines, probably dropping to $0.819 and even $0.615, marking a major 48% correction from present ranges.

Conversely, renewed enthusiasm round meme cash may present SPX value with the momentum wanted to reverse its present pattern. In such a state of affairs, the coin would possibly rise to problem its nearest resistance at $1.64.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.