Hyperliquid (HYPE) value has fallen almost 15% during the last seven days, pushing its market cap to $6.8 billion and dropping it out of the highest 20 cryptocurrencies to twenty fifth place. This decline comes amid mounting criticism specializing in the challenge’s transparency and perceived centralization points.

Regardless of the downtrend, technical indicators counsel contrasting alerts. The DMI factors to continued bearish momentum, whereas the BBTrend hints at a doable stabilization. Whether or not HYPE can reverse its present course will probably rely on renewed investor confidence and overcoming its present market challenges.

Hyperliquid Downtrend is Getting Stronger

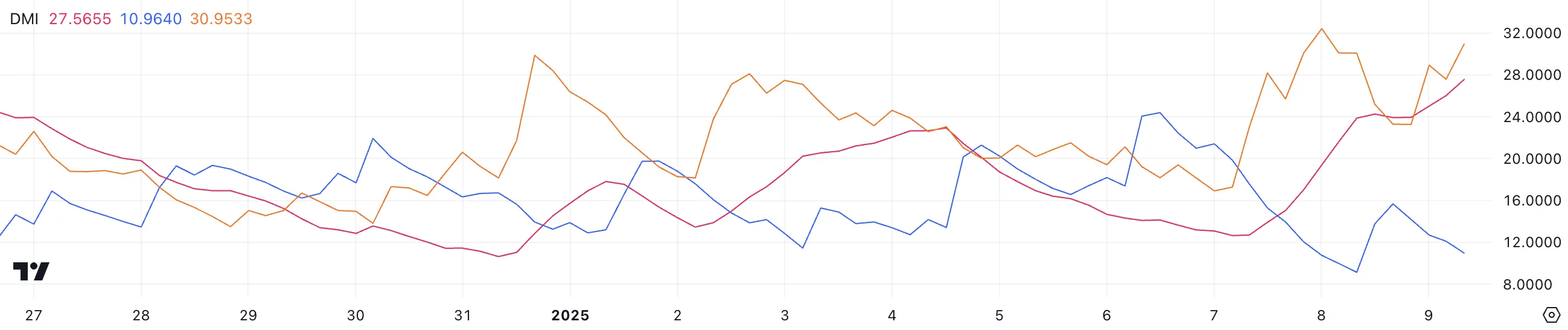

The Common Directional Index (ADX) for HYPE has climbed to 27.5, up from 12.6 on January 7, signaling a strengthening pattern. The ADX is a technical indicator that measures the power of a pattern, no matter its course, on a scale from 0 to 100. Values above 25 point out a powerful pattern, whereas these under 20 counsel weak or absent momentum.

The rise in ADX means that HYPE’s present downtrend is gaining traction, reflecting heightened market exercise and solidifying bearish management.

Supporting this, the +DI, representing shopping for strain, has dropped considerably from 24.3 to 10.9 over the previous three days, highlighting weakened bullish sentiment. In distinction, the -DI, which measures promoting strain, has surged from 18.1 to 30.9 throughout the identical interval, displaying intensified bearish exercise.

This shift in directional indicators confirms that sellers are answerable for the market, probably driving Hyperliquid to additional draw back until a considerable resurgence of shopping for strain happens. The rising ADX, coupled with the declining +DI and growing -DI, factors to a continuation of the downtrend within the quick time period.

Constructive BBTrend Gives Hope for HYPE

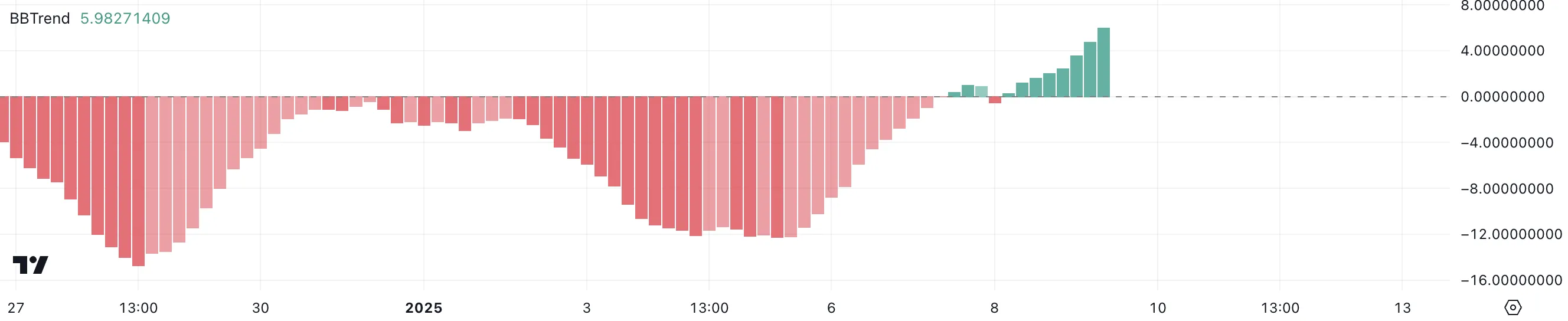

Hyperliquid marked one of many largest airdrops of 2024 and at present has a BBTrend at 5.9, displaying regular development from 0.27 simply yesterday. BBTrend, derived from Bollinger Bands, measures the power and course of a pattern. Constructive values point out bullish momentum, whereas adverse values counsel bearish situations.

HYPE’s BBTrend had remained adverse between December 26 and January 7, reaching a low of -14.7 on December 28, reflecting important bearish strain throughout that interval.

The current transfer into optimistic territory means that promoting strain could also be easing, at the same time as HYPE stays in a downtrend and is down virtually 15% over the previous seven days, with current critics round its transparency and decentralization issues.

The bettering BBTrend may point out a possible stabilization or shift in sentiment. If the BBTrend continues to rise, it would sign a possibility for a value restoration. Nonetheless, sustained shopping for curiosity will likely be wanted to counteract the prevailing bearish momentum and ensure a reversal.

HYPE Value Prediction: Will the Downtrend Proceed?

HYPE downtrend seems poised to proceed, as its whole worth locked (TVL) has dropped to a year-low, and its short-term EMA strains have crossed under the long-term ones.

This bearish setup suggests growing draw back momentum, with $14.99 recognized as the following essential help degree. If this degree fails to carry, HYPE value may face an extra decline, probably dropping to $12, marking a major 40% correction from present ranges.

Conversely, if HYPE manages to reverse its pattern, it may retest the resistance at $22. A breakout above this degree, mixed with robust upward momentum, may push the worth to $29 and probably above $30, bringing HYPE again to the highest 20 altcoins available in the market.

Such a restoration would convey HYPE nearer to the degrees it maintained in the course of the latter half of December 2024.

Disclaimer

In step with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.