On-chain information exhibits the US-based platforms have just lately seen their Bitcoin reserve dominance spike to a brand new all-time excessive (ATH).

Bitcoin US To The Relaxation Reserve Ratio Has Shot Up Not too long ago

As identified by CryptoQuant founder and CEO Ki Younger Ju in a brand new publish on X, the platforms based mostly within the US have seen their Bitcoin dominance develop just lately.

The on-chain indicator of relevance right here is the “US to The Relaxation Reserve Ratio,” which retains observe of the ratio between the BTC holdings of the American platforms and that of the offshore ones. ‘Platforms’ right here embody not simply the exchanges, but additionally the opposite giant entities like spot exchange-traded funds (ETFs).

When the worth of this metric goes down, it means a switch of cash is going on from the American platforms to overseas ones. Alternatively, it going up implies the US-based entities are gaining dominance.

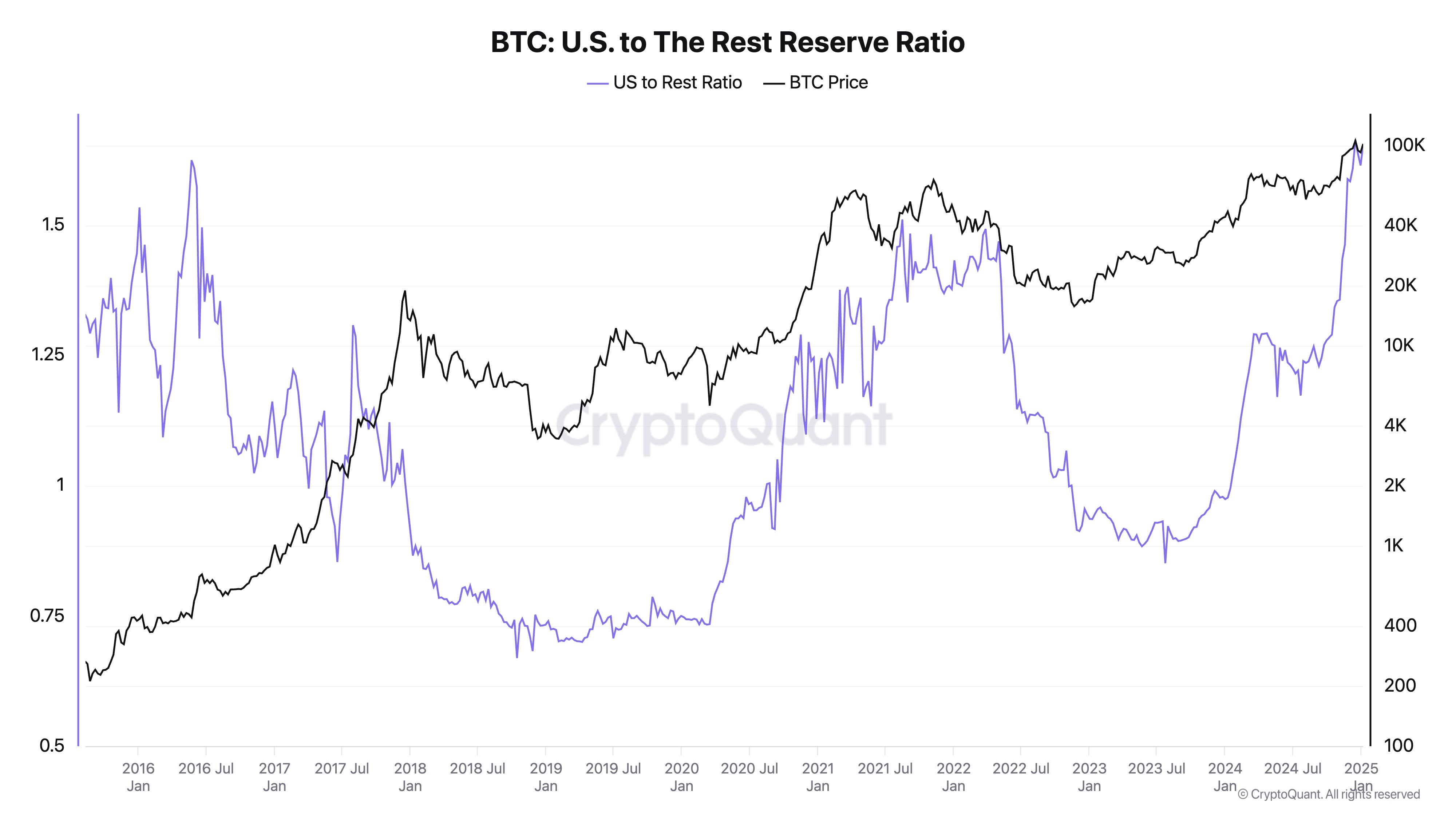

Now, right here is the chart shared by Younger Ju that exhibits the pattern within the Bitcoin US to The Relaxation Reserve Ratio over the previous decade:

The worth of the metric appears to have been using an uptrend over the past couple of years | Supply: @ki_young_ju on X

As displayed within the above graph, the Bitcoin US to The Relaxation Reserve Ratio fell underneath the 1 mark through the 2022 bear market, implying the American platforms held a smaller share of the BTC provide than the offshores entities.

The indicator continued to consolidate sideways round its lows throughout 2023, however in the direction of the top of the yr, the pattern lastly shifted once more, with the metric beginning on an increase this time.

2024 then made the indicator shoot again above the 1 stage with a pointy surge. This trajectory of fast improve maintained all year long, aside from a part within the center that coincided with the sideways motion in BTC’s value.

The rationale behind this rotation of tokens into the wallets related to US-based platforms is partially right down to the truth that the spot ETFs have been launched within the US in the beginning of 2024 and have since established themselves as a well-liked alternate technique of publicity into BTC’s value motion.

Following the most recent continuation of the rise, the Bitcoin US to The Relaxation Reserve Ratio has reached a brand new ATH that corresponds to the American entities holding 65% extra BTC than the overseas ones.

Within the present cycle, a progress in US dominance has confirmed to be bullish for the asset’s value up to now, identical to it did through the 2021 bull market. Thus, the indicator could also be to control within the close to future, as any additional will increase in it may also result in optimistic value motion for the cryptocurrency.

BTC Worth

Bitcoin has solely continued its latest bearish momentum over the past 24 hours as its value has now dropped to $92,700.

Appears like the value of the coin has been sliding down over the previous few days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com