Bitcoin and Ethereum – Market leaders

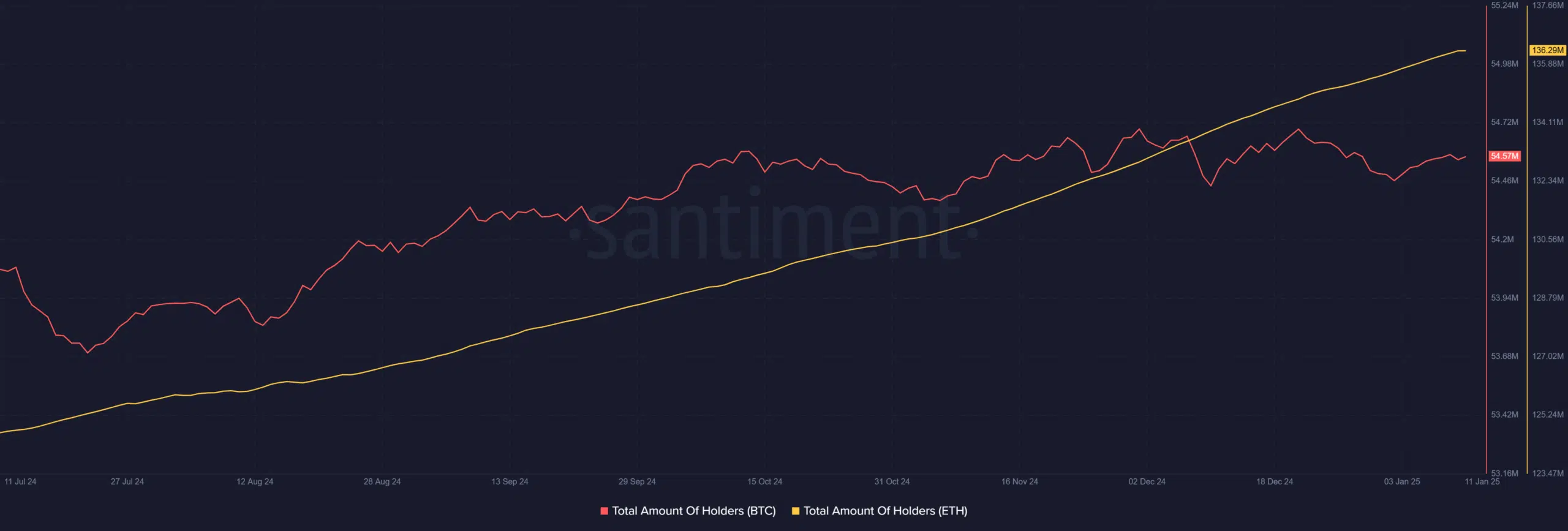

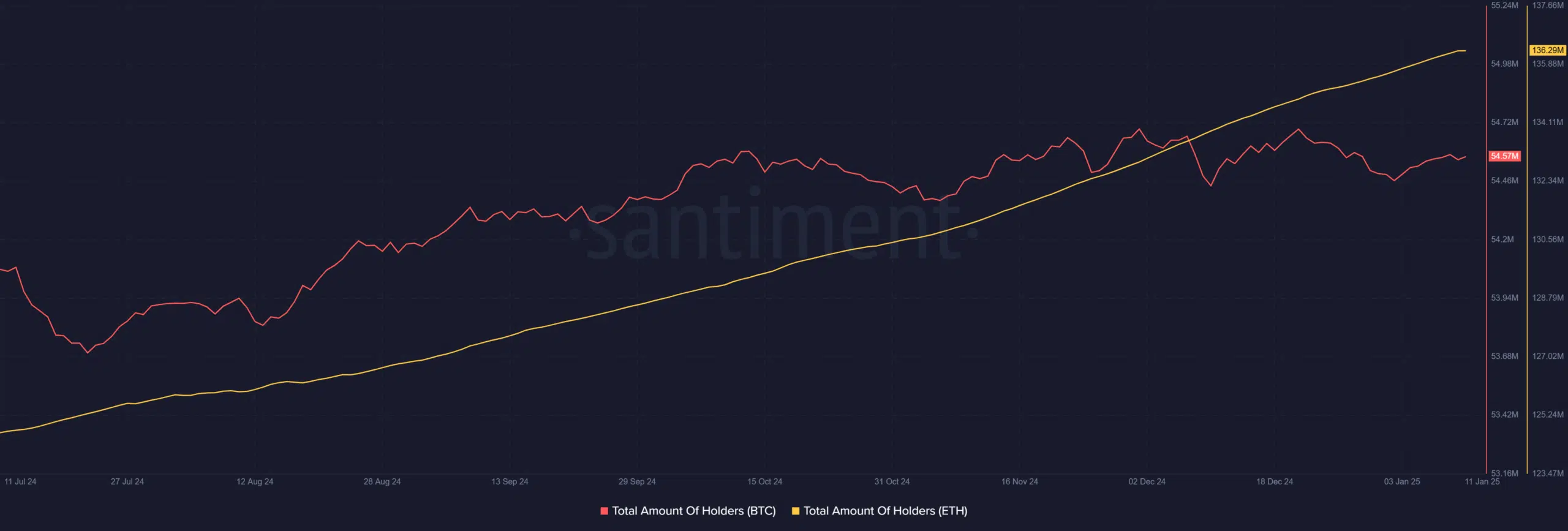

Bitcoin added over 102,000 new wallets in 2025, reaffirming its place because the market’s unshakable anchor. The attraction lies in its simplicity and robust narrative of being a hedge towards macroeconomic uncertainty. Even throughout turbulent occasions, BTC’s capacity to draw new holders showcases its unmatched trustworthiness amongst traders.

Supply: Santiment

In the meantime, Ethereum’s explosive progress – with 645,000 new wallets – underscores its dominance as a multi-faceted blockchain. This hike highlights market confidence in Ethereum’s increasing ecosystem, notably its scaling options like Layer 2 networks.

These improvements are making Ethereum extra accessible and cost-efficient, driving adoption. Collectively, Bitcoin and Ethereum highlighted that the market’s religion in established giants stays unyielding, regardless of challenges.

Different property with optimistic progress

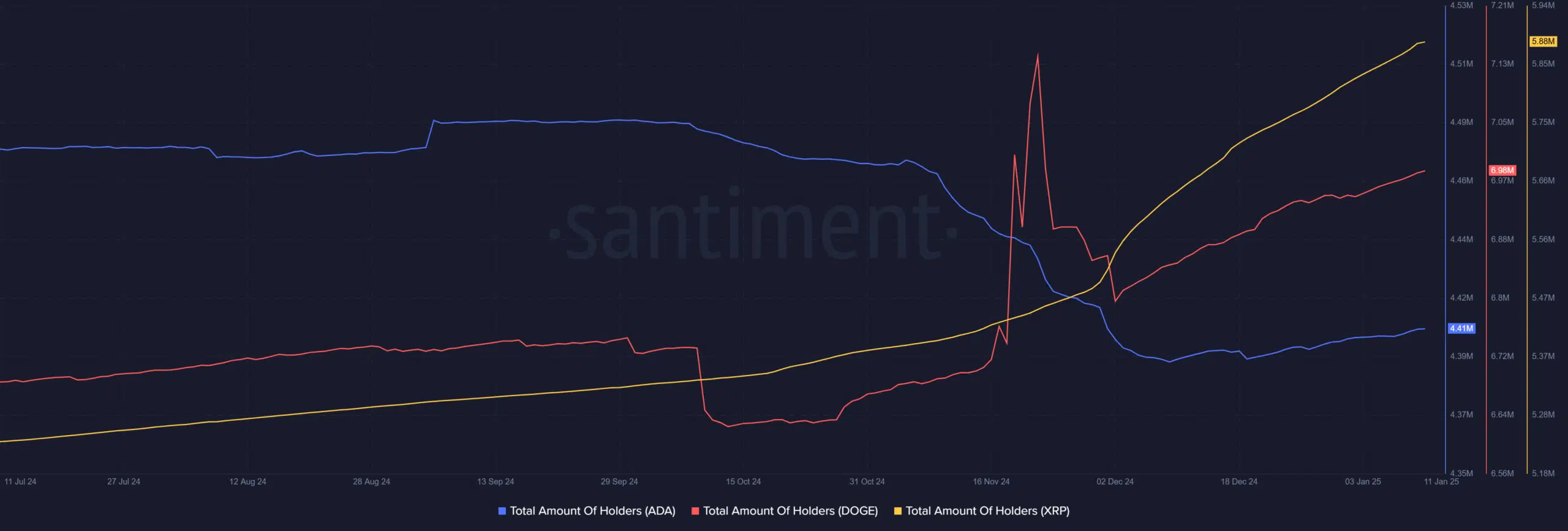

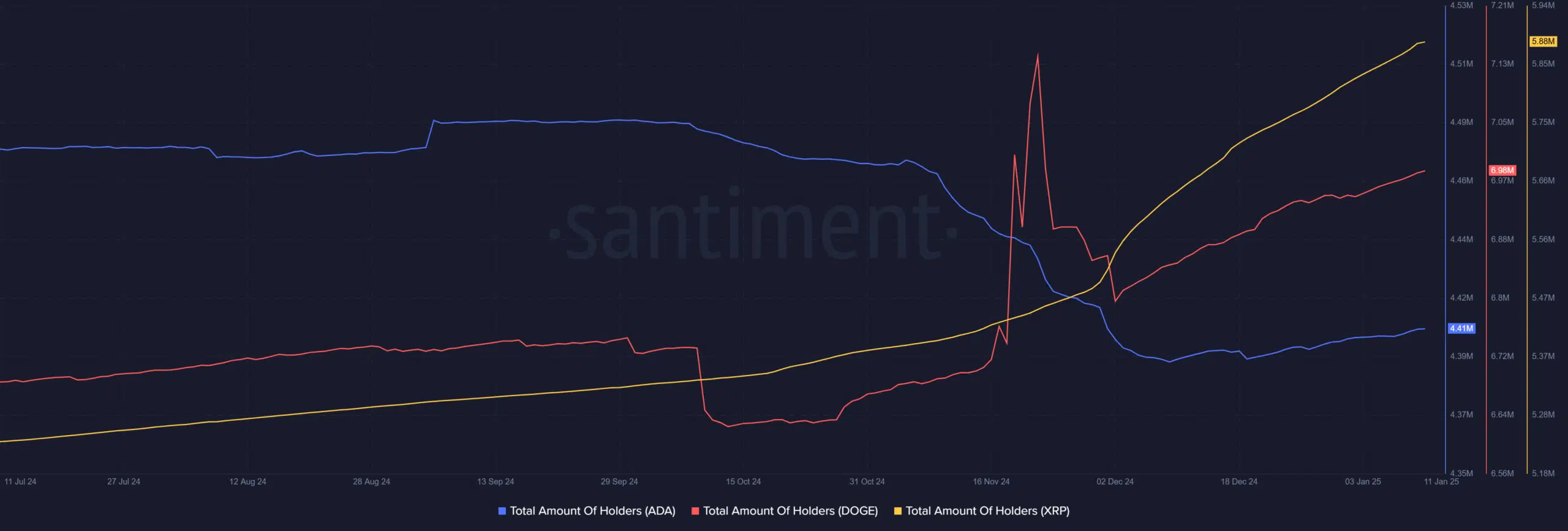

Because the starting of 2025, XRP has seen the creation of 58,000 new wallets. This uptick has been bolstered by Ripple’s latest regulatory achievements, such because the NYDFS’s approval of its stablecoin, RLUSD, in December. This approval enhanced Ripple’s digital fee platform, attracting extra customers and rising XRP’s worth.

Supply: Santiment

Dogecoin [DOGE], regardless of its inherent volatility, has added 29,000 new wallets over the identical interval. Its enduring attraction stems from its meme origins and a vibrant neighborhood that actively engages in fundraising and promotional actions. This grassroots help continues to drive adoption, even in a fluctuating market.

Quite the opposite, Cardano [ADA] solely noticed a modest hike of two,800 new wallets, indicating a slower adoption price. This can be attributed to the platform’s deliberate growth strategy and the aggressive panorama of sensible contract platforms, which might be influencing investor curiosity.

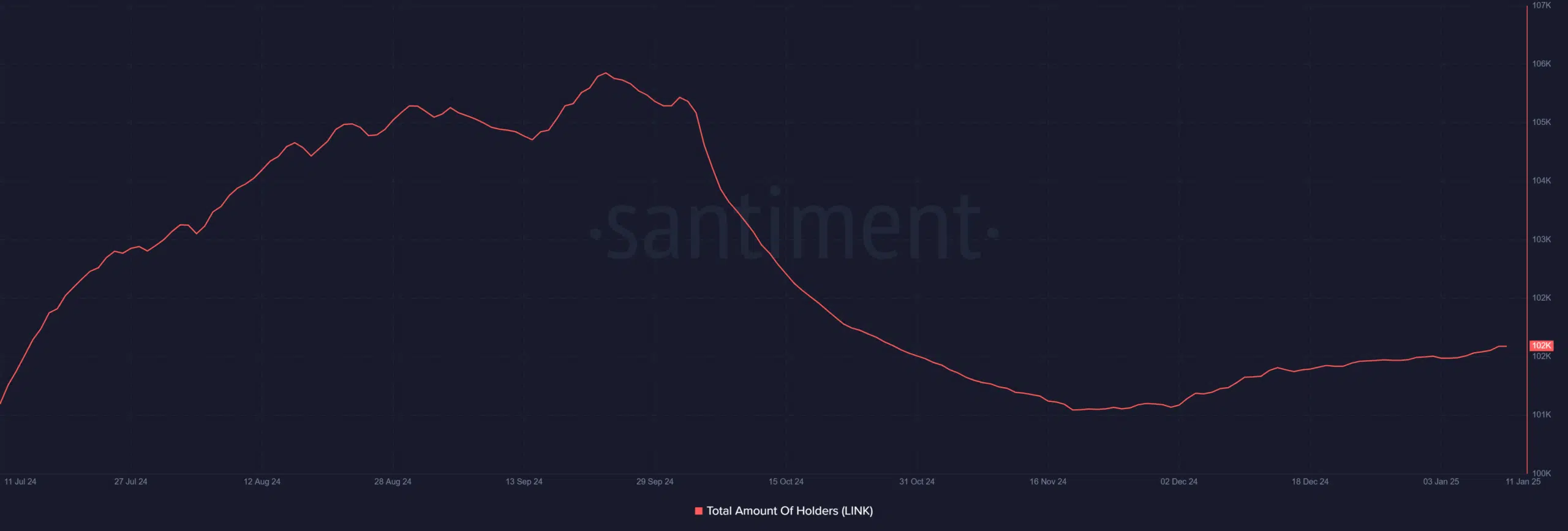

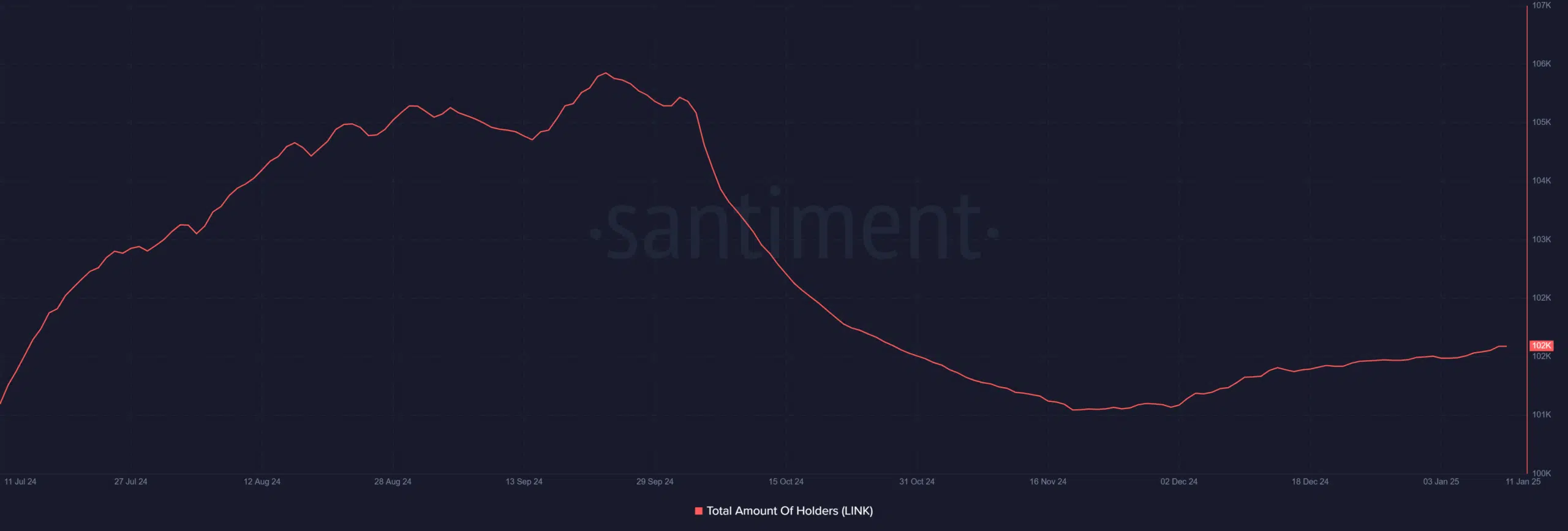

Chainlink’s contrarian pattern

Chainlink [LINK] noticed a fall of three.3K wallets – This decline mirrored a shift in market sentiment, doubtlessly pushed by a number of components. This record included – Higher competitors from rising decentralized oracle networks, market-wide bearish tendencies, or doubts concerning scalability.

Supply: Santiment

Curiously, such a drop in pockets holders could be seen as a contrarian indicator. Traditionally, vital sell-offs and pockets declines have usually preceded restoration phases. For astute traders, this state of affairs could current a possibility to build up LINK whereas others stay cautious.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

Why pockets progress is a greater indicator than worth fluctuations

Value volatility usually instructions consideration, however it might probably obscure the underlying investor sentiment. Pockets progress, in distinction, serves as a extra dependable metric for gauging long-term confidence in a challenge.

For instance, short-term worth fluctuations are a part of pure market cycles, pushed by buying and selling psychology, macroeconomic occasions, and exterior hypothesis. Pockets progress, nevertheless, signifies an rising variety of holders who imagine within the asset’s future. This regular accumulation displays real adoption and dedication to the community, signaling a extra optimistic outlook.

By specializing in pockets progress, traders can acquire a clearer image of an asset’s potential, even throughout worth corrections. On this context, Bitcoin’s regular pockets additions of over 102,000 and Ethereum’s 645,000 exemplify how robust fundamentals proceed to draw new individuals to established networks.