Scott Bessent, nominated by President-elect Donald Trump as Treasury Secretary, faces a major monetary restructuring if confirmed by Congress.

This course of consists of divesting a number of investments to adjust to moral requirements for public workplace.

Bitcoin ETF Stake Beneath Assessment for Treasury Nominee

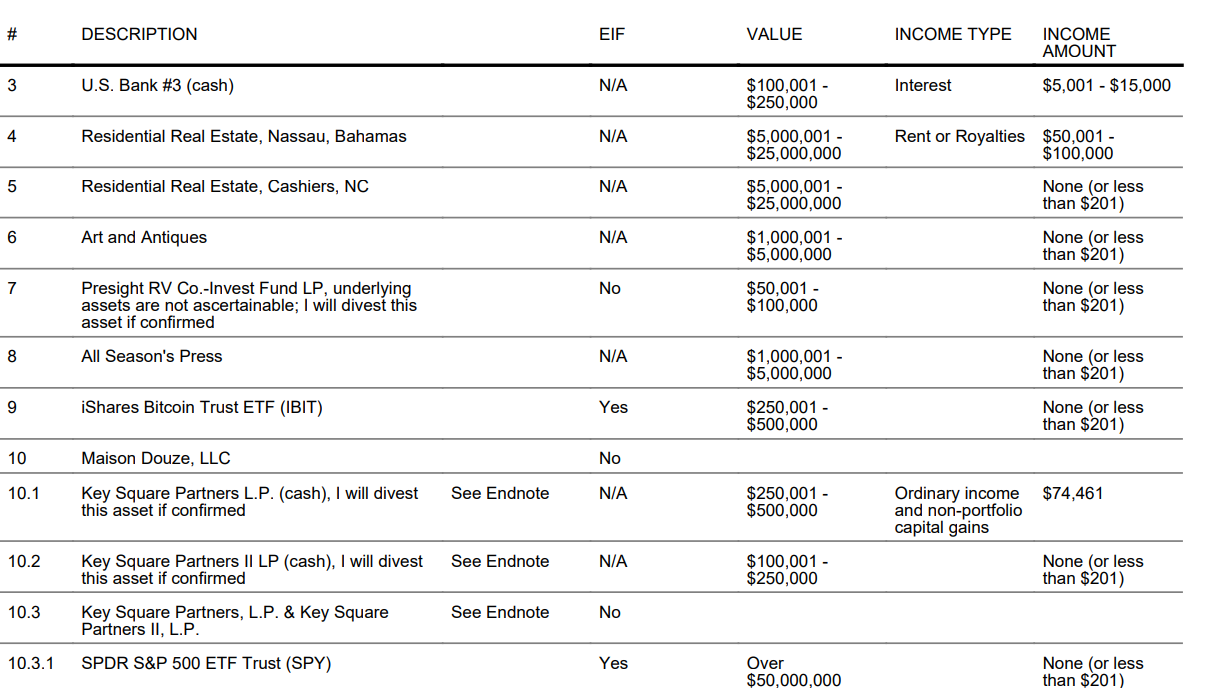

Bessent holds a considerable stake in BlackRock’s Bitcoin exchange-traded fund (ETF), IBIT, valued between $250,001 and $500,000. This ETF manages over $50 billion in belongings, making it the most important spot Bitcoin fund globally.

Bessent’s funding aligns together with his well-known help for cryptocurrency. The Treasury Secretary nominee has championed as a software for monetary empowerment and a viable choice for youthful buyers searching for options to conventional finance.

Past his Bitcoin ETF stake, Bessent’s monetary disclosures reveal a various and expansive portfolio. His belongings embody main investments in main ETFs such because the SPDR S&P 500 Belief (SPY), Invesco QQQ Belief (QQQ), and Invesco S&P 500 Equal Weight ETF (RSP). Moreover, he holds smaller stakes in gold and silver trusts, reflecting a broader curiosity in diversified asset courses.

His complete monetary belongings, as disclosed, are valued at roughly $521 million. The report signifies a number of high-value holdings, together with hedge fund-linked investments, US Treasury payments, and forex market positions.

Bessent should promote a few of these belongings inside 90 days to keep away from potential conflicts of curiosity if Congress confirms him. He may also resign from his position at Key Sq. Group, the hedge fund he based, and promote his shares within the firm.

In the meantime, Mathew Sigel, head of analysis at VanEck, has raised questions on whether or not Bessent may also have to promote his Bitcoin ETF holdings. Notably, Bessent’s monetary disclosures had highlighted the belongings he can be divesting.

His affirmation listening to is scheduled for January 16, 2025. As Treasury Secretary, he’ll play a key position in advancing the financial insurance policies of the incoming administration and shaping methods for fiscal and monetary reform.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.