- Nate Geraci shared some main crypto predictions for 2025

- SEC’s management change has fueled optimism for Solana and XRP ETF approvals in 2025

The 2024 U.S. presidential election sparked renewed optimism within the cryptocurrency market, with Donald Trump’s victory because the forty seventh president fueling important momentum.

Shortly after the election outcomes had been introduced, Bitcoin [BTC] surged previous the $100k-mark for the primary time. This marked a historic milestone for the main cryptocurrency.

Not surprisingly, this rally was mirrored within the Bitcoin ETF sector. December 2024 alone noticed ETFs buying a powerful 51,500 BTC—Almost quadrupling the 13,850 BTC mined throughout the identical interval.

Nate Geraci outlines 2025 ETF predictions

Amid this market frenzy, ETF Retailer President Nate Geraci has shared his prime predictions for the evolving crypto ETF ecosystem. The exec has positioned a highlight on Ripple [XRP] and Solana [SOL].

Geraci predicted that Spot XRP and Solana ETF merchandise will safe regulatory approval this 12 months. For these unaware, momentum already gathered steam again in June 2024 when VanEck launched the primary Solana ETF submitting within the U.S. This paved the way in which for comparable functions from Grayscale, Canary Capital, and 21Shares.

Notably, the Solana ETF proposals stay underneath assessment by the SEC. In the meantime, Canary Capital’s XRP ETF submitting in October 2024 marked a pivotal second. It reshaped the outlook for crypto ETFs, encouraging different asset managers to comply with go well with.

Geraci’s different prediction

Whereas the SEC is but to ship a definitive verdict, optimism for approval is rising.

Geraci additionally highlighted that Spot Bitcoin ETFs may surpass bodily gold ETFs in property underneath administration, with the primary 12 months of Bitcoin ETFs reaching outstanding milestones – An indication of the rising maturity of this market.

As anticipated, Bitcoin ETF merchandise have achieved a historic milestone, surpassing $150 billion in AUM—A document that took gold ETFs 20 years to achieve.

Past this success, Geraci anticipates groundbreaking developments in 2025, together with SEC approval for Solana and XRP ETFs, alongside Ethereum staking ETF merchandise.

Lastly, the exec additionally predicts that Vanguard might pivot its positiom to help crypto ETFs, whereas additionally foreseeing approvals for filings from Grayscale and Bitwise.

Influence on Solana and XRP’s value

If SOL and XRP ETFs acquire approval, their costs may register important shifts. This might mirror the affect Bitcoin ETFs have had on BTC’s value trajectory.

Nevertheless, present market traits appear to be flashing blended indicators. Whereas BTC and ETH have confronted bearish stress following ETF outflows, Solana’s bearish outlook will be supported by an RSI beneath the impartial stage.

Quite the opposite, XRP, with an RSI above the impartial threshold, pointed to an imminent bullish part – Hinting at a possible divergence in efficiency for these altcoins.

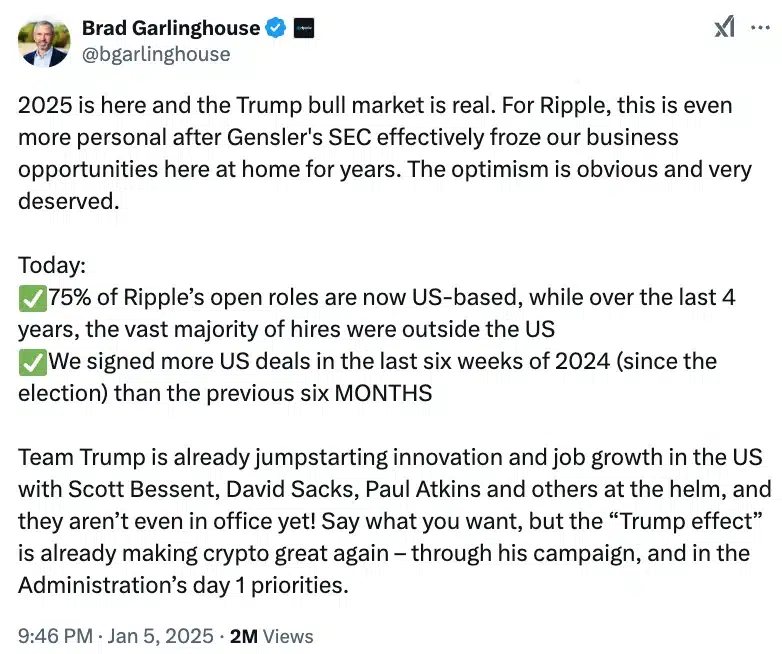

Therefore, seeing the optimism surrounding the XRP ETF, Ripple CEO Brad Garlinghouse shared his ideas on X. He said,

Supply: Brad Garlinghouse/X

How will the SEC’s management change the crypto ecosystem?

Right here, it’s price noting that the anticipated shift within the U.S. SEC management is being considered as a key issue that would speed up the approval of crypto ETFs.

With President Trump nominating Paul Atkins as the following SEC Chair, many count on a departure from the stringent crypto insurance policies seen underneath Gary Gensler’s tenure.

In addition to Geraci, different trade consultants are additionally optimistic that this regulatory transition will pave the way in which for important developments in 2025. Significantly the approval and launch of Solana and XRP ETF merchandise.