Motion (MOVE) has dropped roughly 11% previously 24 hours, extending its correction to 26% over the past seven days. Technical indicators, together with the RSI and Ichimoku Cloud, level to a strongly bearish outlook, with MOVE buying and selling close to oversold ranges and much under the cloud.

The latest formation of a demise cross has intensified the downtrend, signaling elevated promoting strain. For MOVE to get well, it should break by way of key resistance ranges. Nonetheless, failing to carry its present help might end in additional declines.

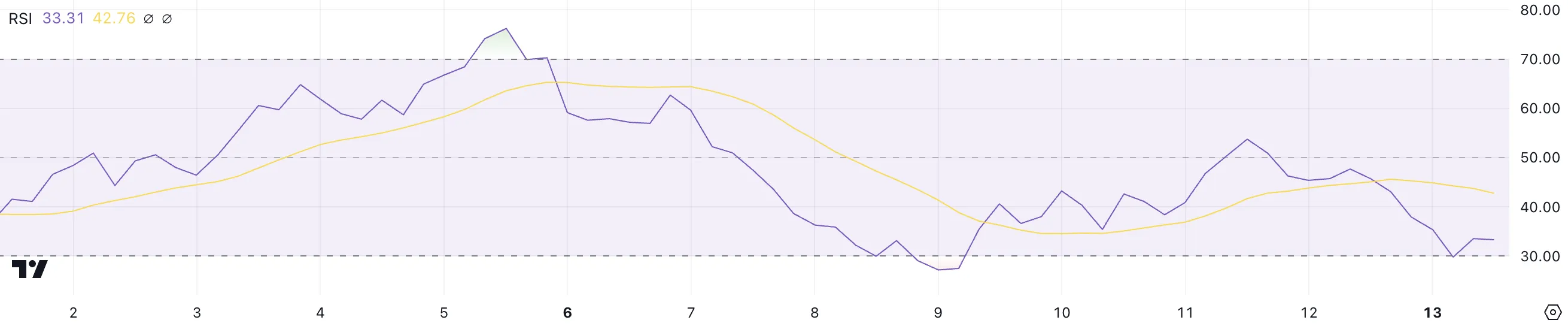

Motion RSI Is Nonetheless Near the Oversold Zone

MOVE RSI is at present at 33.3, recovering barely after dropping to 29.7 a number of hours in the past. This represents a pointy decline from its RSI of 53 simply two days in the past, highlighting the asset’s fast shift from impartial territory into oversold circumstances.

The RSI (Relative Power Index) is a momentum oscillator starting from 0 to 100, used to evaluate whether or not an asset is overbought or oversold. Sometimes, values under 30 point out oversold circumstances, signaling that the asset could also be undervalued, whereas values above 70 recommend overbought circumstances, indicating potential worth corrections.

With MOVE’s RSI at 33.3, it stays close to oversold territory, which might appeal to patrons in search of discounted entry factors. This stage means that the latest promoting strain could also be easing barely, providing a possible for worth stabilization or restoration.

Nonetheless, if the RSI fails to climb again towards impartial ranges, it might point out persistent bearish momentum, holding MOVE’s worth beneath strain within the quick time period, even after Motion Labs, the corporate behind MOVE, raised $100 million in funding.

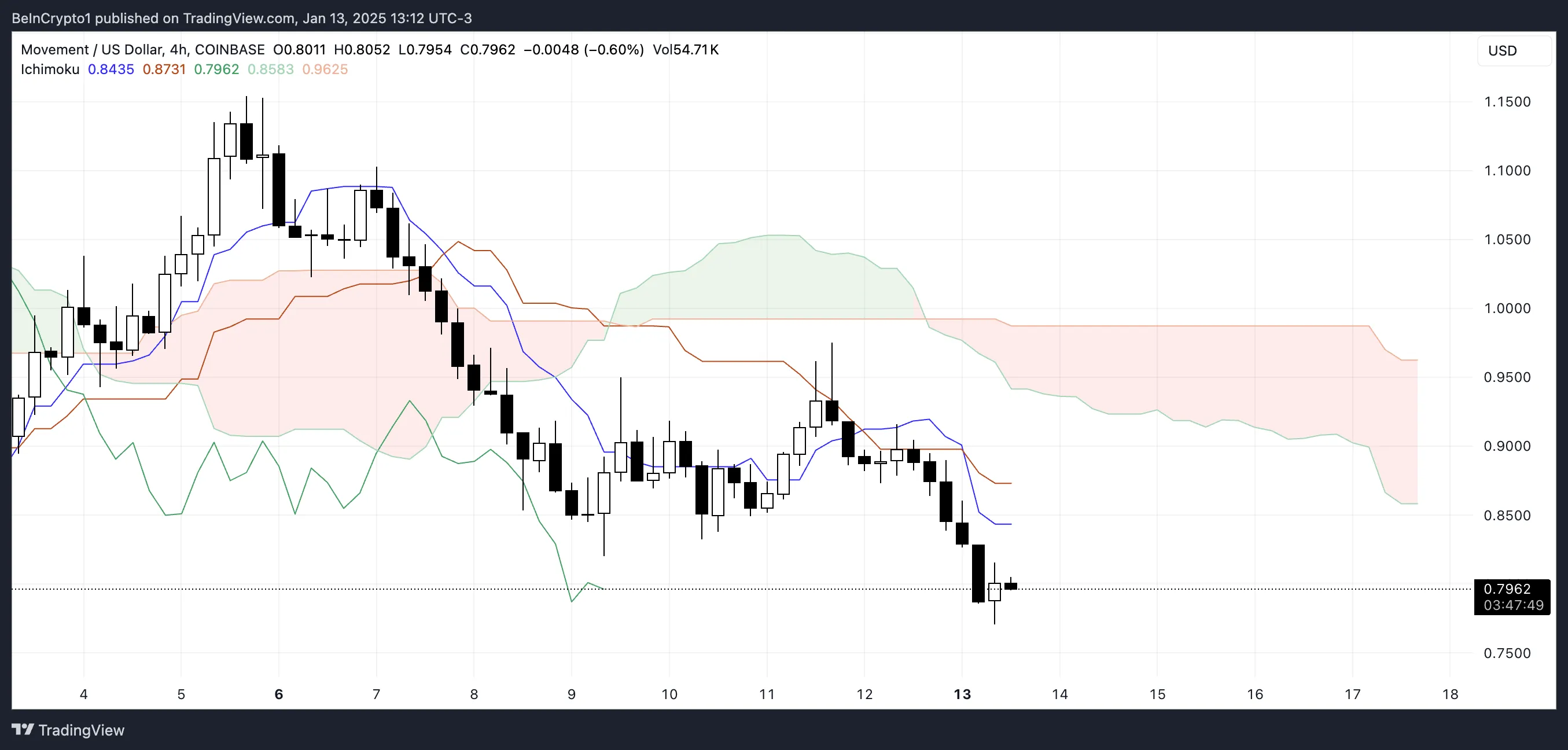

MOVE Ichimoku Cloud Paints a Bearish Image

The Ichimoku Cloud chart for MOVE reveals a strongly bearish configuration, with the value positioned nicely under the cloud (Kumo).

The cloud is pink and widening, signaling rising bearish momentum and a continuation of downward strain. This implies that the prevailing development is firmly bearish, with no indicators of weakening within the close to time period. This latest correction precipitated MOVE to lose its place among the many high 50 altcoins, now sitting at 59.

The conversion line (blue) stays under the baseline (pink), confirming short-term bearish momentum. Moreover, the lagging span (inexperienced) is under each the value and the cloud, reinforcing the bearish outlook.

These alignments throughout the Ichimoku indicators recommend a persistent downtrend, with no fast indications of a development reversal. The cloud’s general construction and contours mirror a market setting dominated by sellers.

MOVE Worth Prediction: Will MOVE Get better $1 Ranges Quickly?

MOVE worth lately fashioned a demise cross, a bearish sign the place its shortest-term shifting common crossed under its longest-term one, indicating elevated downward momentum. This technical alignment reinforces the continued bearish development and means that promoting strain stays dominant.

If the present downtrend persists and the help at $0.70 fails, the value might decline additional towards $0.59. Conversely, if an uptrend emerges, MOVE might break the resistance at $0.83 and probably rally to $1.15, marking a 43% upside, which might make Movemnet take again a spot among the many high 50 altcoins.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.