Main altcoin Ethereum (ETH) has traded beneath $3,500 for seven days, mirroring a broader bearish sentiment throughout the cryptocurrency market. Because it recorded an intraday excessive of $3,744 on January 6, the coin’s worth has plummeted by 13%.

Nonetheless, regardless of this value dip, key on-chain metrics recommend that Ethereum holders stay optimistic in regards to the altcoin’s near-term prospects.

Ethereum Merchants Stay Resilient

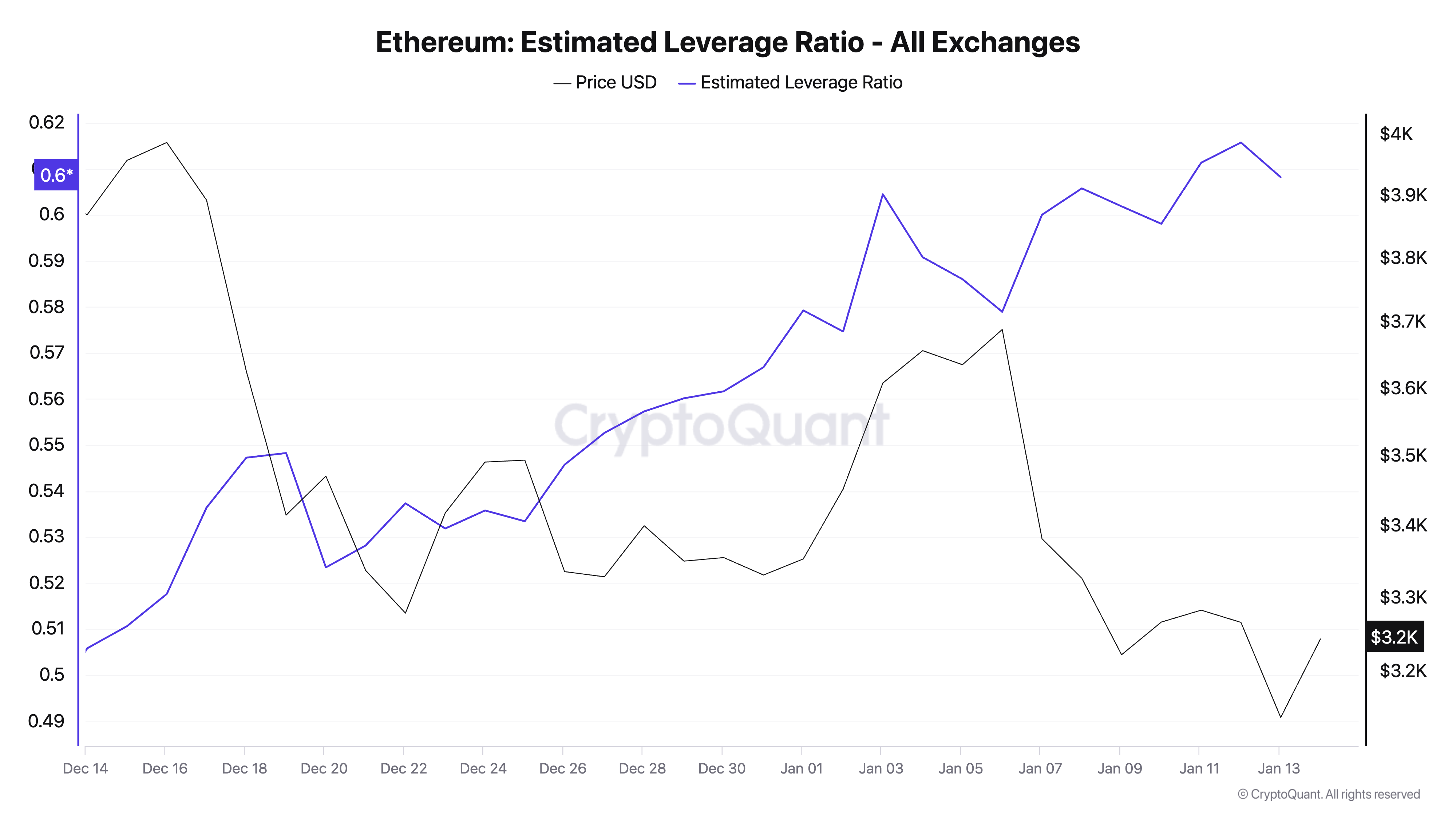

One such indicator is ETH’s rising estimated leverage ratio (ELR). Per CryptoQuant, this metric has maintained an upward development regardless of ETH’s value decline in current weeks. At 0.60 as of press time, ETH’s Estimated Leverage Ratio (ELR) has elevated by 20% over the previous month, regardless of a 15% drop in its value throughout the identical interval.

The ELR measures the typical leverage merchants use to execute trades on a cryptocurrency trade. It’s calculated by dividing the asset’s open curiosity by the trade’s reserve for that foreign money.

ETH’s climbing ELR signifies an elevated threat urge for food amongst its merchants. It means that the altcoin’s merchants are more and more prepared to tackle threat regardless of its present value weak point. A constantly excessive leverage ratio is an indication of robust conviction amongst merchants that the worth of ETH is poised for a rebound despite current headwinds.

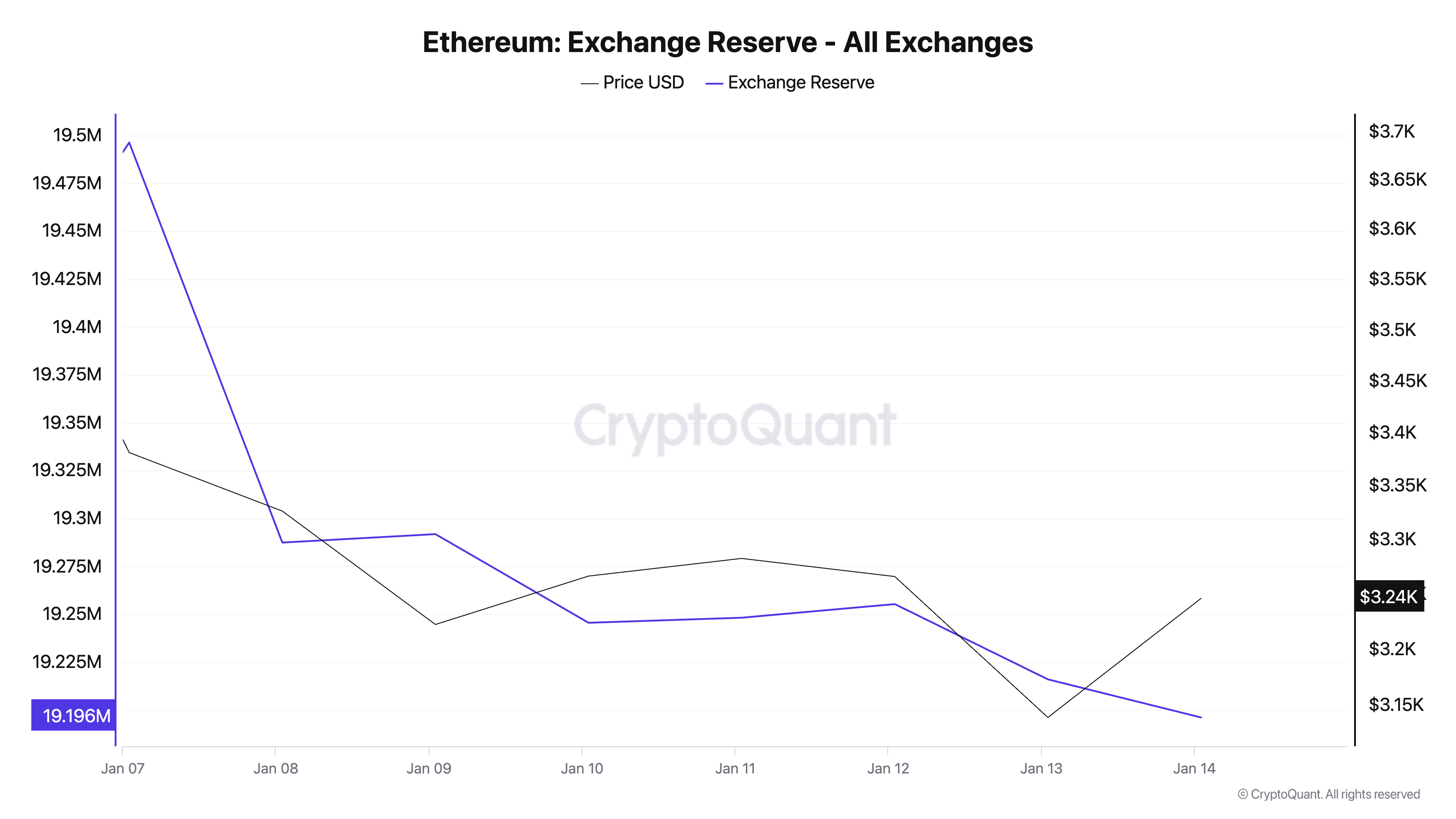

Moreover, ETH’s trade reserve has dropped to a two-month low of 19.19 million ETH, with the quantity held in trade wallets lowering by 2% over the previous week. This discount means that market members are reducing promoting strain and selecting to carry onto their ETH tokens.

Because of this, it seems that ETH’s current value decline is extra influenced by the broader market’s bearish tendencies than by vital selloffs of ETH itself.

ETH Value Prediction: All Rests on the Broader Market

As of this writing, ETH trades at $3,226, simply above the help stage at $3,186. If broader market sentiment improves and ETH accumulation picks up, its value may rise towards $3,563.

Nonetheless, if the market continues to expertise a downturn, ETH might take a look at the $3,186 help. If this stage fails to carry, the coin’s worth may drop to $2,945.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.