Este artículo también está disponible en español.

In a daring collection of posts on X on January 14, outstanding crypto analyst Miles Deutscher delivered a surprising forecast regarding the long-debated phenomenon of an altcoin season. His commentary rapidly drew consideration from crypto analysts, significantly because it appeared to problem, moderately than reinforce, the long-standing hopes of a 2021-style altcoin mania.

RIP Crypto Altcoin Season?

Deutscher started his put up by acknowledging the renewed dialog inside crypto circles on whether or not an “alt season” may come round once more. He distinguished two completely different interpretations of the time period altcoin season. “Will there ever be an ‘alt season’ once more? Seeing plenty of dialogue about this on the TL,” Deutscher famous. “Firstly, it will depend on your definition of ‘alt season’. If you happen to’re referring to the index, then sure, I count on it to spike once more in some unspecified time in the future this 12 months.”

Associated Studying

Nevertheless, he cautioned {that a} reoccurrence of the euphoric, multi-month surge skilled in 2021 can be exceedingly unlikely: “If you happen to’re referring to the multi-month up-only mania of 2021, then no. The distinctive mixture of QE/stimulus and V-shaped equities repricing created circumstances which can be nearly unattainable to copy. Anticipating that may be a recipe for catastrophe. Key phrase right here: ‘anticipating.’”

Deutscher’s overarching recommendation emphasised flexibility and preparedness moderately than counting on prolonged bullish waves. He advocated for taking earnings in what he expects to be comparatively short-lived rotations into altcoins—although he did acknowledge the opportunity of a shock rally: “If a bigger ‘alt season’ DOES occur, nice. That makes our job so much simpler, and complacency gained’t be punished as a lot. Go in with the mindset of the rotation into alts being short-lived (this can pressure you to take earnings). It might not truly be short-lived, however a minimum of you’re securing earnings.”

Associated Studying

He careworn that prudent methods ought to take into account “a number of mini-cycles or pockets of narrative outperformance,” underlining the significance of not hoping for a second coming of the 2021 market circumstances. Deutscher’s recommendation finally hinged on portfolio building and proactive buying and selling: “As a substitute of holding every little thing and every little thing, have a extra concentrated basket of high-conviction property. Juxtapose these holdings with the willingness to commerce in worthwhile playgrounds (i.e. AI) – however deal with them as trades, don’t bag maintain.”

Deutscher’s feedback got here in response to an announcement from crypto influencer Ansem, who had asserted: “No alt szn ever once more. Pockets of maximum outperformance all the time there, with individuals shifting down the chance curve in cyclical phrases however by no means to the extent as earlier than. What’s the true motive BTC.d doesn’t should go up and to the precise for a decade straight?”

Whereas each analysts imagine {that a} 2021-style altcoin season appears extremely unlikely, they spotlight the nonetheless current alternatives on this bull run. “Particular property/sectors are going to have loopy runs when circumstances permit it. As a substitute of holding every little thing and every little thing, have a extra concentrated basket of high-conviction property,” Deutscher concludes.

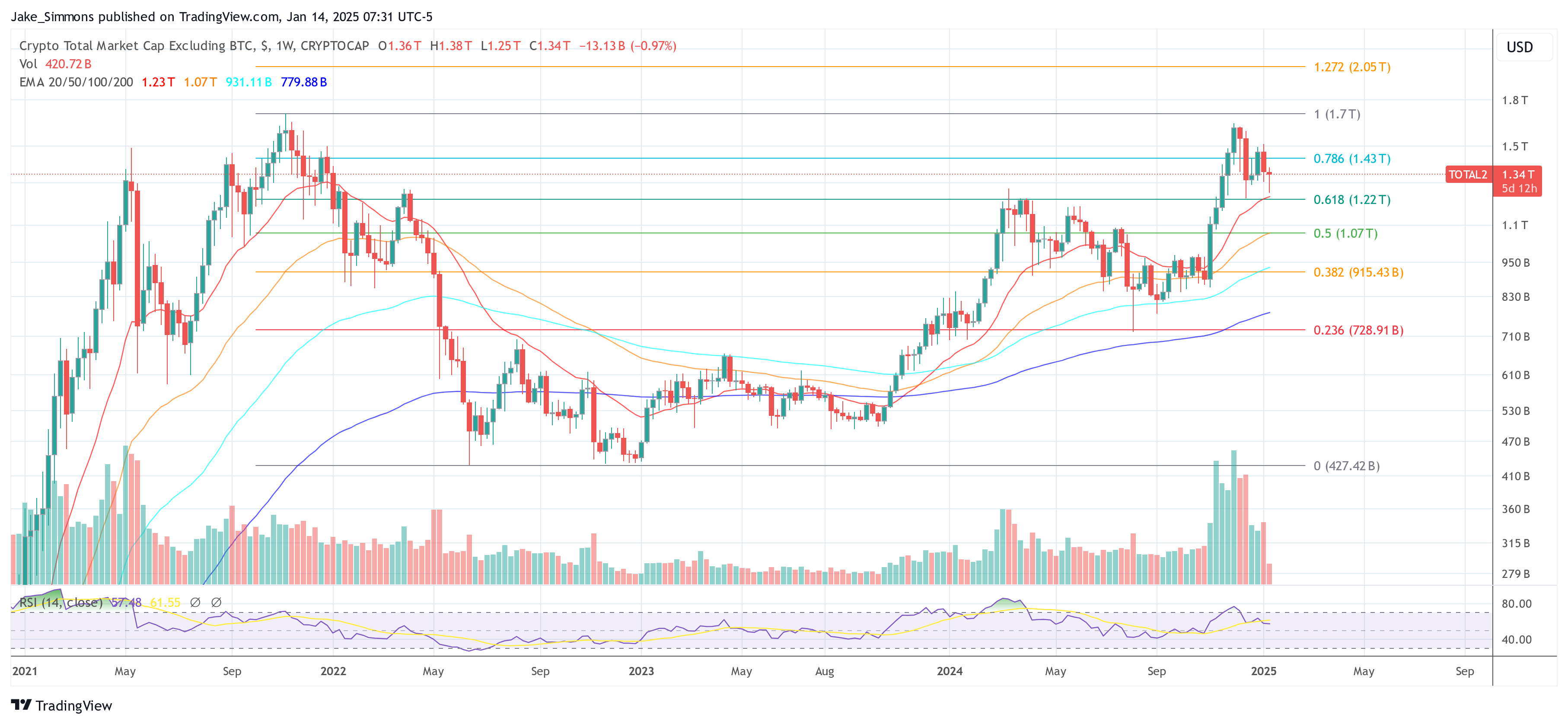

At press time, whole crypto market cap excluding Bitcoin (TOTAL2) stood at $1.34 trillion.

Featured picture created with DALL.E, chart from TradingView.com