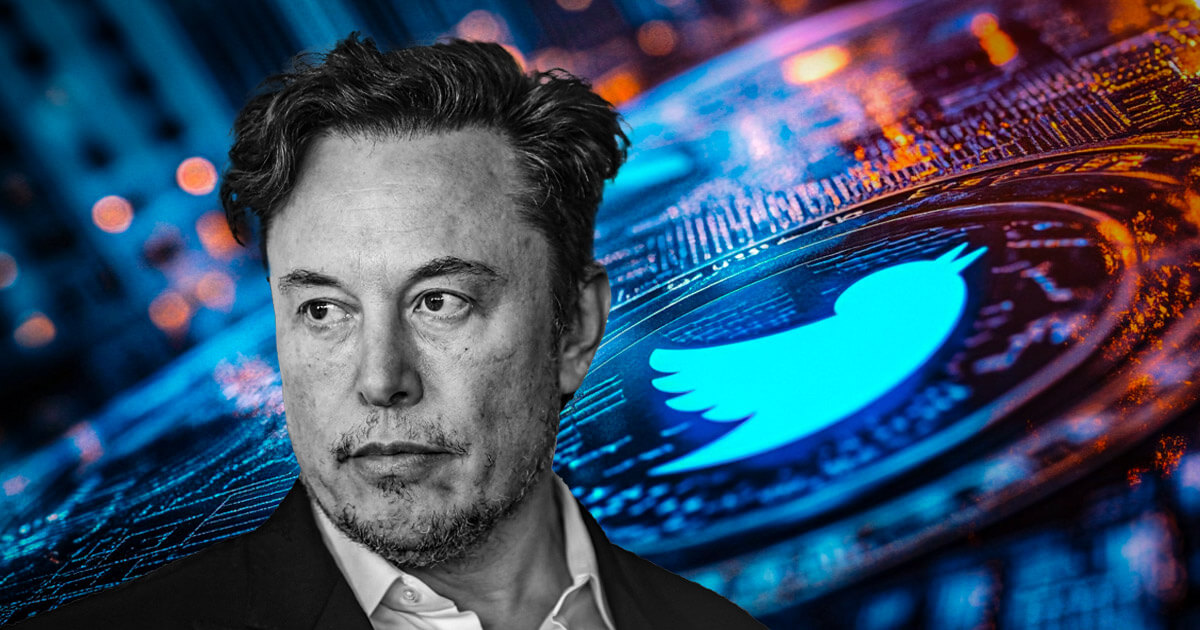

Elon Musk, the billionaire entrepreneur and CEO of Tesla, has criticized the US Securities and Trade Fee (SEC) over its lawsuit concerning his delayed disclosure of a major stake in Twitter, now rebranded as X.

The lawsuit marks a fruits of the SEC’s scrutiny of Musk’s funding actions with the social media platform in 2022.

SEC claims

On Jan. 14, Musk failed to satisfy the authorized requirement to reveal his acquisition of greater than 5% of Twitter’s shares throughout the mandated 10-day interval.

The monetary regulator identified that Musk surpassed the 5% threshold by March 14, 2022, however he delayed submitting his disclosure till April 4—11 days previous the deadline.

In line with the submitting:

“As a result of Musk didn’t well timed disclose his helpful possession, he was capable of make these purchases from the unsuspecting public at artificially low costs, which didn’t but replicate the undisclosed materials info of Musk’s helpful possession of greater than 5 p.c of Twitter widespread inventory and funding objective.”

The SEC claimed that the disclosure delay saved Musk over $150 million, disadvantaged different buyers of potential monetary good points, and induced financial hurt to those that offered their shares throughout that window.

Notably, the Gary Gensler-led Fee identified that Twitter’s inventory worth jumped 27% after Musk lastly revealed his stake, elevating his holdings’ price to $2.89 billion.

The SEC asserts that these actions breached the Securities Trade Act of 1934, which mandates well timed disclosures to forestall unfair benefits and shield market integrity.

The Fee has requested the courtroom to impose a civil penalty and compel Musk to return the income allegedly gained by way of the delayed disclosure.

Musk slams SEC

On Jan. 15, Musk publicly dismissed the lawsuit in a put up on X, calling the SEC an ineffective group that prioritizes trivial issues over addressing critical monetary crimes.

In line with him:

“[The SEC is a] completely damaged group. They spend their time on sh*t like this when there are such a lot of precise crimes that go unpunished.”

Some business consultants have additionally questioned the SEC’s priorities on this case.

John Reed Stark, a former official within the SEC’s Web Enforcement division, described the investigation as a possible waste of assets. He steered that Musk’s attorneys may argue that his preliminary intentions have been to safe a board seat fairly than pursue an entire acquisition of Twitter.

Stark added:

“This case appears virtually as absurd because the SEC 2008 case in opposition to Mark Cuban, and a clear try by Chair Gensler to garner some final minute headlines days earlier than his exit and to additionally stick it to President Trump.”