The NFT market suffered a dismal 2024, with buying and selling volumes and gross sales counts dropping to their weakest ranges since 2020.

Annual buying and selling volumes fell by 19%, whereas gross sales counts dipped by 18% in comparison with 2023, in response to a report by blockchain analytics platform.

Regardless of a surge in crypto market exercise, pushed by Bitcoin’s all-time highs and booming DeFi progress, NFTs appeared to battle underneath the burden of their very own inflated valuations.

Early within the 12 months, NFT buying and selling volumes reached $5.3 billion in Q1, a modest 4% improve in comparison with the identical interval in 2023.

Nevertheless, this momentum proved fleeting, as volumes plummeted to $1.5 billion in Q3 earlier than recovering barely to $2.6 billion in This autumn.

Even with these fluctuations, annual gross sales counts fell sharply, pointing to a broader development: whereas particular person NFTs turned dearer consistent with rising crypto token costs, general market engagement dwindled.

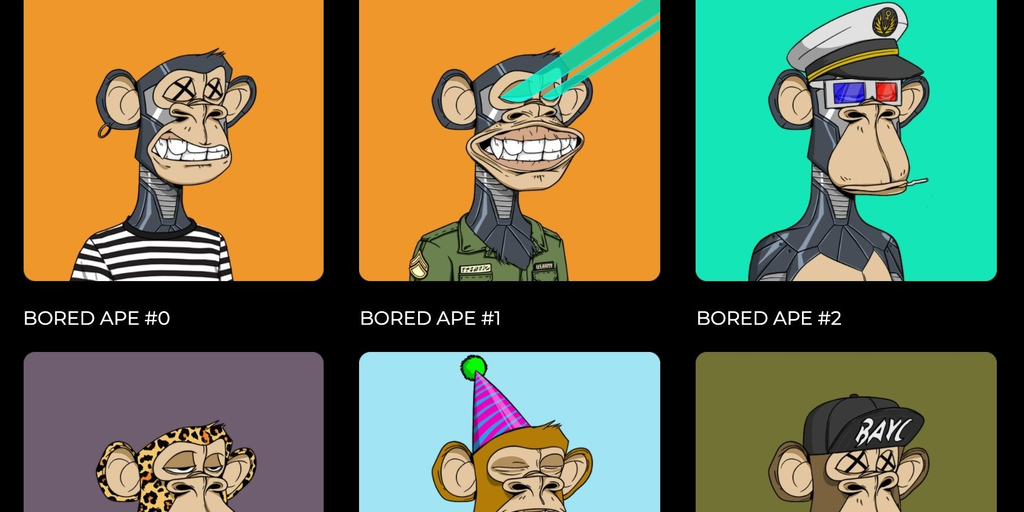

Yuga Labs’ flagship collections Bored Ape Yacht Membership (BAYC) and Mutant Ape Yacht Membership (MAYC) hit historic lows, with ground costs dropping to fifteen ETH and a pair of.4 ETH, respectively.

Even Otherdeeds for Yuga Labs’ Otherside metaverse plummeted to 0.23 ETH, a far cry from their preliminary minting worth, exposing cracks in Yuga’s high-priced, membership-driven mannequin.

This coincided with DappRadar’s commentary that “Maybe 2024 helped us notice that NFTs don’t have to be costly to show their significance within the broader Web3 ecosystem,” a critique of the market’s reliance on exclusivity and inflated pricing.

Amid this downturn, the NFT market witnessed a paradox in November when CryptoPunk #8348, a uncommon seven-trait collectible from the NFT assortment, was collateralized for a $2.75 million mortgage through the NFT lending platform GONDI.

Touted as a milestone for NFTs as monetary property, this occasion confirmed speculative extra when juxtaposed with DappRadar’s insights about affordability and utility.

Whereas high-profile transactions like this purpose to affirm NFTs’ worth, in addition they spotlight a market nonetheless pushed by exclusivity and inflated pricing, whilst wider participation wanes.

Even inside the struggling sector, blue-chip collections like CryptoPunks defied tendencies, practically doubling in USD worth in 2024 with notable gross sales driving transient restoration durations.

NFT platforms like Blur dominated market exercise, leveraging zero-fee buying and selling and aggressive airdrop campaigns to seize the biggest share of buying and selling volumes.

In distinction, rival market OpenSea struggled with regulatory headwinds and declining market sentiment, forcing important layoffs by year-end.

By This autumn, Blur and OpenSea have been neck-and-neck in market share, however Blur’s potential to generate excessive exercise from a smaller, extra energetic consumer base gave it the sting, as per the report.

Whereas buying and selling volumes in late 2024 hinted at a possible restoration—November gross sales hit $562 million, the very best since Might—the general trajectory means that affordability, accessibility, and utility will probably be essential for sustained progress in 2025.

Each day Debrief Publication

Begin day-after-day with the highest information tales proper now, plus unique options, a podcast, movies and extra.