Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.At present. The monetary and market info supplied on U.At present is meant for informational functions solely. U.At present just isn’t chargeable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding selections. We imagine that every one content material is correct as of the date of publication, however sure gives talked about could now not be obtainable.

The US reported a higher-than-expected Client Worth Index (CPI) for December, displaying a month-to-month enhance of 0.4% after seasonal adjustment, surpassing the forecast of 0.3%. The annual CPI price climbed to 2.9%, the best since July 2024, marking its third consecutive month-to-month rise.

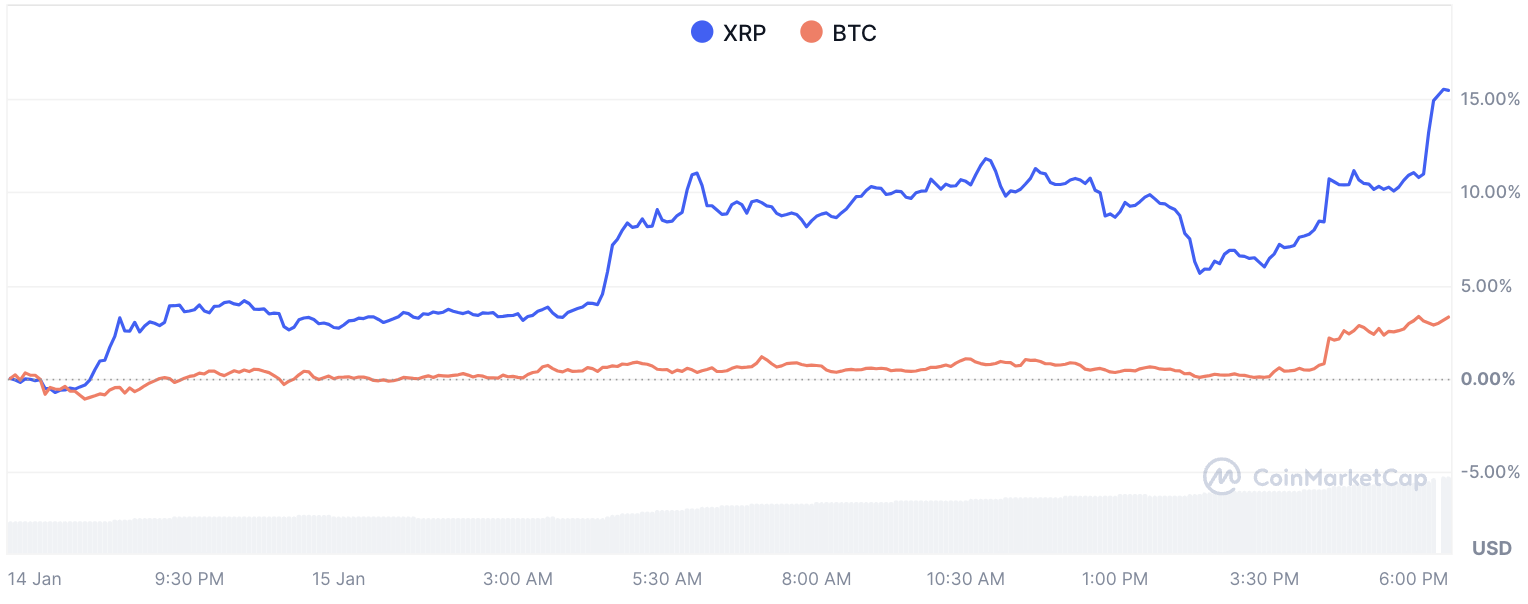

The markets, each conventional and cryptocurrency, embraced the information with positivity. And what a transfer it was, as the worth of Bitcoin actually shot up by over 2% in a matter of minutes.

Different in style cryptocurrencies similar to XRP confirmed much more loopy dynamics, with a 3.5% achieve in a single minute. We’re speaking a few multi-billion greenback asset, and such a fast change in value is value not even tens of millions, however billions, of {dollars}, so it’s analogous to an earthquake.

For a particular group of buyers — the sellers, or bears, as they’re additionally referred to as — it was certainly a bit like that.

Bears crushed: What’s subsequent?

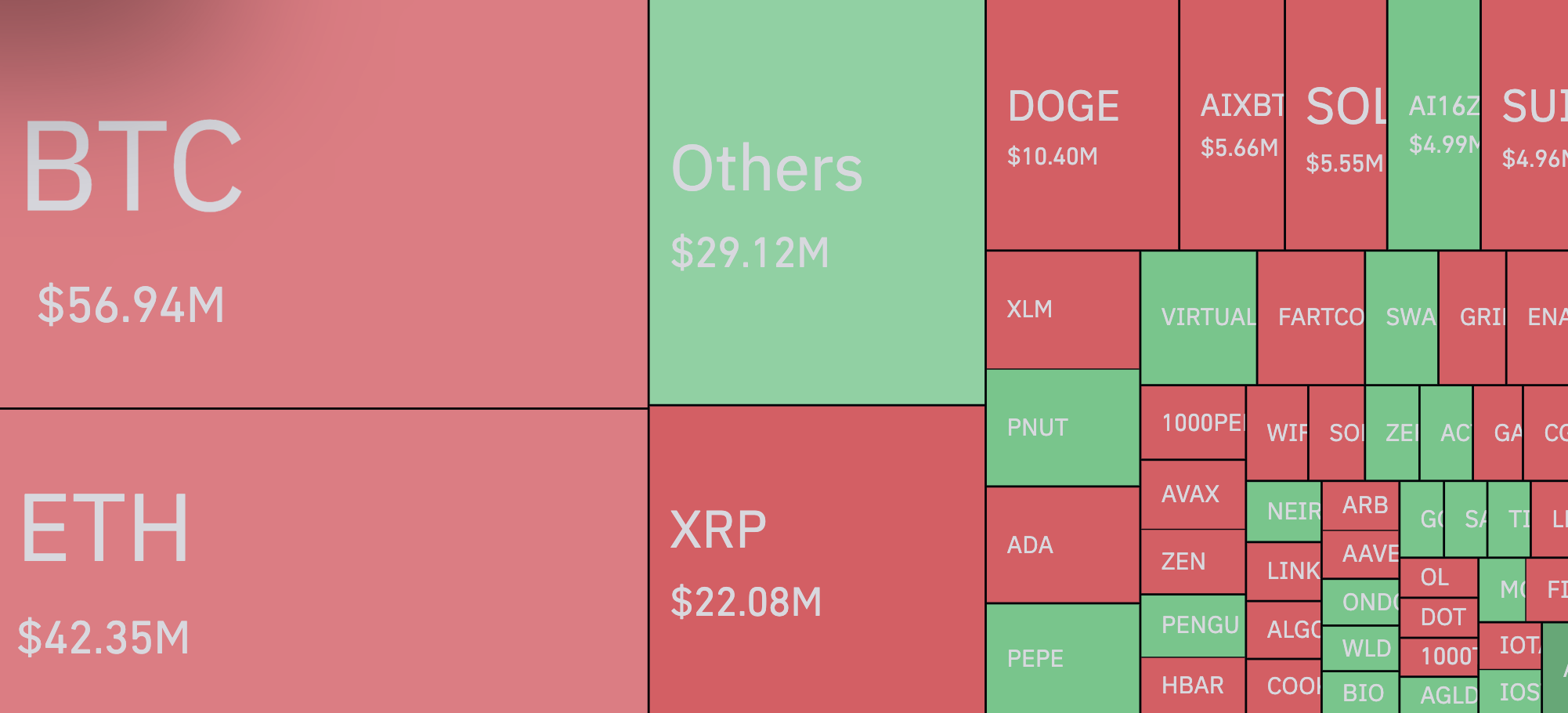

As grew to become recognized because of knowledge from CoinGlass, the quantity of brief positions liquidated because the CPI launch totaled $87.23 million, which is thrice greater than the quantity of longs. In complete, the liquidation of brief positions amounted to $250 million, or an infinite quarter of a billion {dollars}, in simply 24 hours.

What’s 63% of that? Shorts, and most of them had been liquidated after the CPI.

Among the many high bear annihilators are historically Bitcoin and Ethereum, and this time XRP additionally made it to the highest. Because the third largest cryptocurrency, XRP jumped as excessive as $2.90, liquidating over $14 million in shorts alone. To place that in perspective, Bitcoin made $39 million and Ethereum made $28 million.

The place the market goes from right here stays to be seen. All the foremost information of January, not less than on the financial coverage facet, has occurred. Upcoming is the resignation of Gary Gensler, the present SEC chairman, in 5 days, and a change within the U.S. administration.

These developments may introduce new dynamics for cryptocurrencies like Bitcoin, Ethereum and XRP, leaving buyers speculating on whether or not bullish or bearish tendencies will dominate within the coming weeks.