VIRTUAL value has surged over 18% within the final 24 hours, reclaiming its $2 billion market cap as AI cash get better from the latest correction. Regardless of this rally, technical indicators just like the ADX and BBTrend spotlight ongoing challenges, with momentum nonetheless weak and promoting strain but to dissipate absolutely.

Key ranges, together with the $2.81 help and $3.27 resistance, will decide whether or not VIRTUAL can maintain its upward momentum or face renewed bearish strain.

VIRTUAL Downtrend Has Misplaced Its Steam

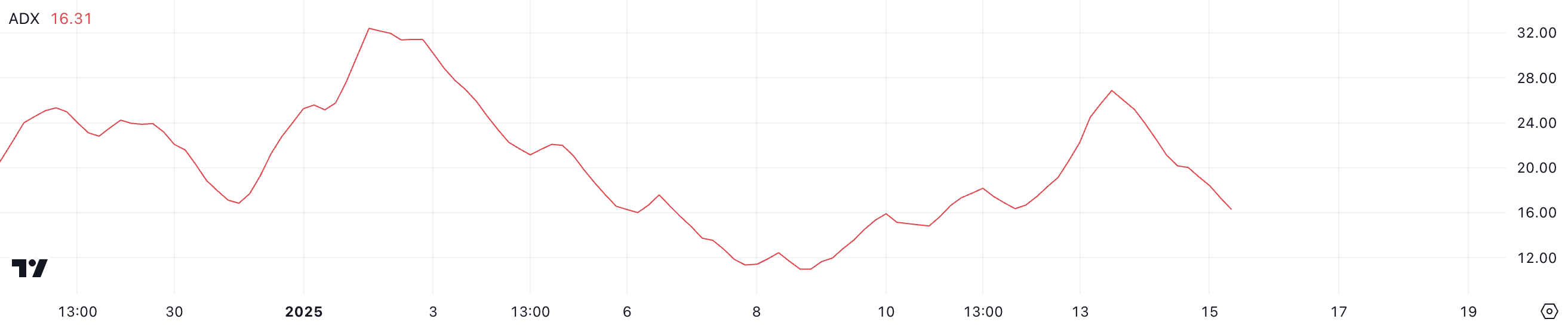

VIRTUAL ADX has dropped to 16.3 from 26.8 within the final two days, indicating a major weakening in development energy. An ADX under 20 usually signifies an absence of a powerful development, suggesting consolidation or market indecision.

This decline in ADX displays that the continuing try to transition from a downtrend to an uptrend lacks enough momentum to determine a transparent directional transfer.

The ADX, or Common Directional Index, measures the energy of a development with out indicating its path. Values under 20 sign a weak development and above 25 mirror a stronger, extra outlined development. VIRTUAL present ADX at 16.3 means that whereas it’s making an attempt to shift into an uptrend, the development just isn’t but solidified.

For a transparent affirmation of an uptrend, the ADX would wish to rise above 25, accompanied by sustained shopping for strain to construct stronger momentum, because the hype round crypto AI brokers recovers its momentum.

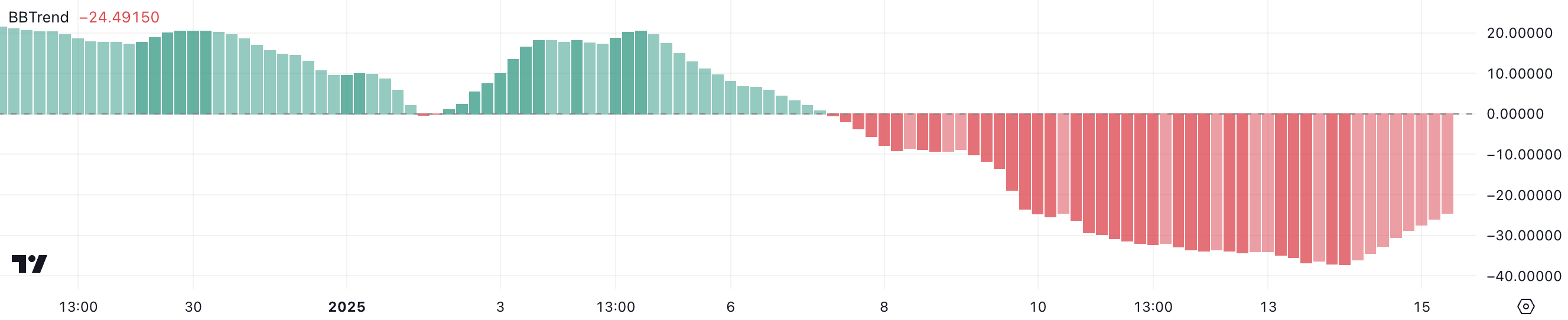

VIRTUAL BBTrend Stays Detrimental Since January 7

VIRTUAL’s BBTrend has been detrimental since January 7, just lately peaking at -37.2 yesterday earlier than recovering to -24.4. Though nonetheless in detrimental territory, the advance means that bearish momentum is easing.

This shift signifies a possible stabilization in VIRTUAL value, although the detrimental BBTrend highlights that promoting strain nonetheless outweighs shopping for exercise.

The BBTrend, or Bollinger Band Pattern, measures value deviations relative to Bollinger Bands to evaluate development energy and path. Detrimental values point out bearish situations, whereas constructive values sign bullish tendencies. With VIRTUAL BBTrend at -24.4, the present studying displays ongoing bearish sentiment however hints at a attainable transition towards neutrality.

If the BBTrend continues to get better, it might sign a weakening downtrend and pave the best way for potential value stabilization or reversal.

VIRTUAL Worth Prediction: Potential 26% Upside

VIRTUAL value has a essential help at $2.81, which, if breached, might end in an extra decline to $2.23. Whereas VIRTUAL EMA traces nonetheless show a bearish setup, with short-term traces under long-term ones, the upward motion of the short-term traces suggests a possible shift.

If these traces cross to type a golden cross, it might sign a bullish reversal, making VIRTUAL one of many largest synthetic intelligence cash available in the market. In such a situation, VIRTUAL might check the resistance at $3.27 and, if damaged, intention for $3.73, providing a possible 26% upside.

Disclaimer

Consistent with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.