Litecoin (LTC) has lately skilled a surge in whale exercise. Its giant traders, holding over 10,000 LTC, have gathered cash value $30 million over the previous seven days.

This surge in shopping for strain coincides with rising anticipation surrounding the potential launch of a Litecoin spot exchange-traded fund (ETF).

Litecoin Whales Fill Their Luggage

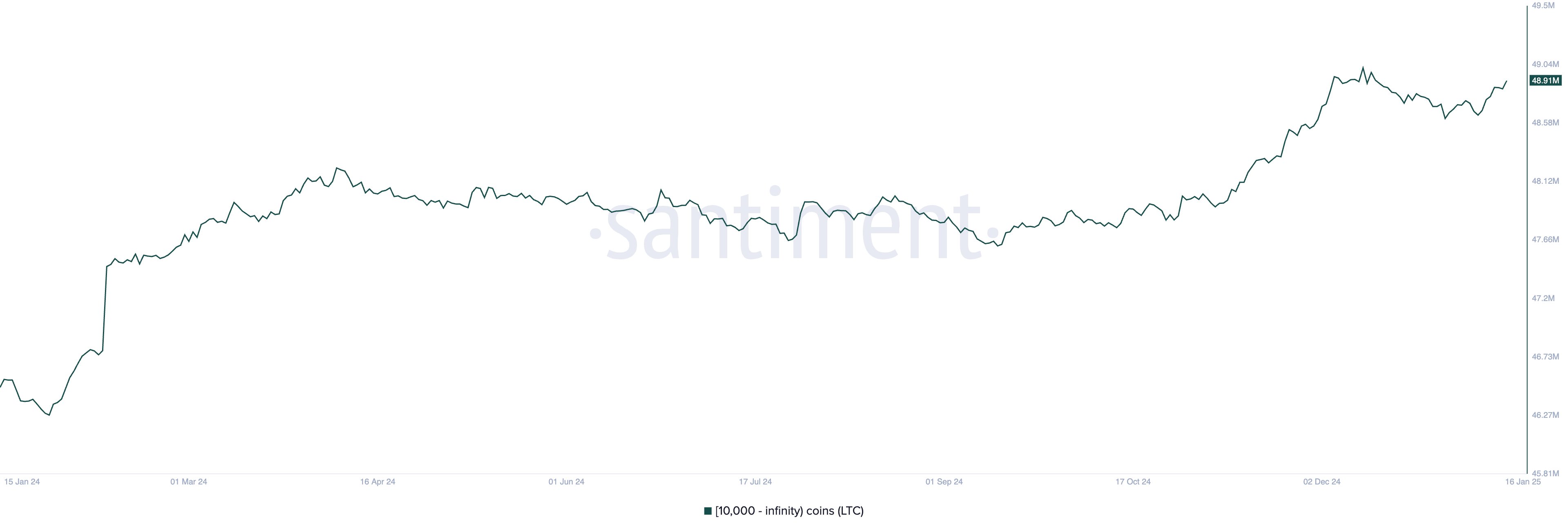

In line with Santiment, since January 9, Litecoin’s giant traders, who maintain greater than 10,000 LTC, have acquired 250,000 cash valued at $30 million at present market costs. This brings the group’s whole holdings to 49 million LTC, its highest up to now 30 days.

This whale accumulation has triggered a rally in LTC’s worth. Buying and selling at $117.55 at press time, the altcoin has famous a 15% uptick up to now seven days.

When whales enhance their coin accumulation, it indicators confidence within the asset’s future efficiency. This conduct reduces circulating provide, creating upward value strain, and infrequently influences smaller traders to observe swimsuit.

LTC’s present momentum is fueled by rising optimism across the potential approval of a spot Litecoin exchange-traded fund (ETF) within the US. On January 15, Canary Capital filed an modification to its S-1 registration type with the Securities and Alternate Fee (SEC), signaling progress towards this approval.

In a put up on X, Bloomberg analyst James Seyffart famous that the modification signifies the SEC is actively reviewing the proposal. Bloomberg’s Eric Balchunas additionally famous that current stories recommend the SEC has offered suggestions on the Litecoin S-1, strengthening hope across the ETF’s probabilities of approval.

“This appears to be like to substantiate that which bodes nicely for our prediction that Litecoin is most probably to be the following coin authorised,” Balchunas wrote on X.

LTC Worth Prediction: Can It Break $124 Resistance and Attain $147?

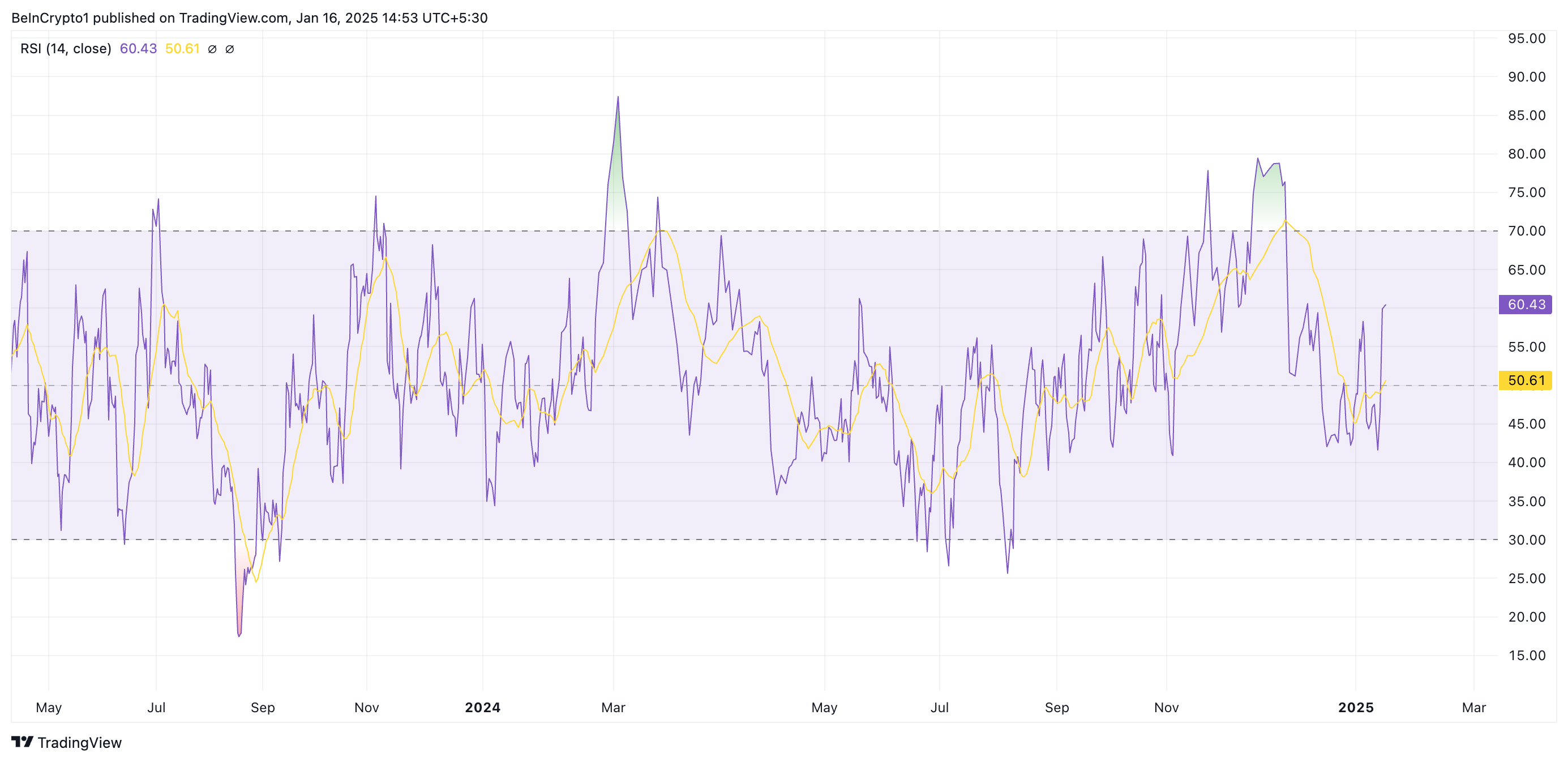

On the day by day chart, LTC’s Relative Energy Index (RSI) confirms the rising demand for the altcoin. At press time, it’s in an uptrend at 60.43.

This momentum indicator measures an asset’s overbought and oversold market situations. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 recommend that the asset is oversold and should witness a rebound.

At 60.43, LTC’s RSI suggests it’s experiencing bullish momentum, with extra shopping for strain than promoting strain. If this continues, its value may break above the resistance at $124.03 to revisit the three-year excessive of $147.

Nevertheless, if the whales stall on their accumulation and selloffs resume, LTC’s value may drop to $109.81.

Disclaimer

In keeping with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.