Solana (SOL) has surged 15% over the previous seven days, holding close to the $200 mark. Its market cap has risen to $107 billion, overtaking BNB. This robust efficiency is backed by bullish alerts, together with elevated whale exercise earlier this month and the formation of a number of golden crosses on SOL’s EMA charts.

Though some profit-taking amongst whales has occurred, their exercise stays elevated in comparison with historic ranges. With this momentum, SOL is well-positioned to check key resistance ranges and probably break above $240.

Solana Whales Decline From ATH however Stay at Elevated Ranges

The variety of addresses holding a minimum of 10,000 SOL considerably elevated between January 4 and January 5, rising from 5,032 to five,090. This upward development continued with some fluctuations, reaching an all-time excessive of 5,104 on January 11.

Monitoring these massive holders, sometimes called whales, is essential as a result of their exercise can strongly affect the market. Elevated accumulation by whales usually displays confidence within the asset’s future, probably driving costs increased as their positions develop.

After peaking on January 11, the variety of whale addresses declined, dropping from 5,096 on January 14 to five,063 by January 16. Whereas this lower would possibly counsel some profit-taking, it’s necessary to notice that the present variety of whales stays considerably increased than historic ranges.

This sustained curiosity amongst main holders means that confidence in Solana uptrend potential remains to be robust, even with latest fluctuations. Such stability at elevated ranges may present a stable basis for SOL worth progress.

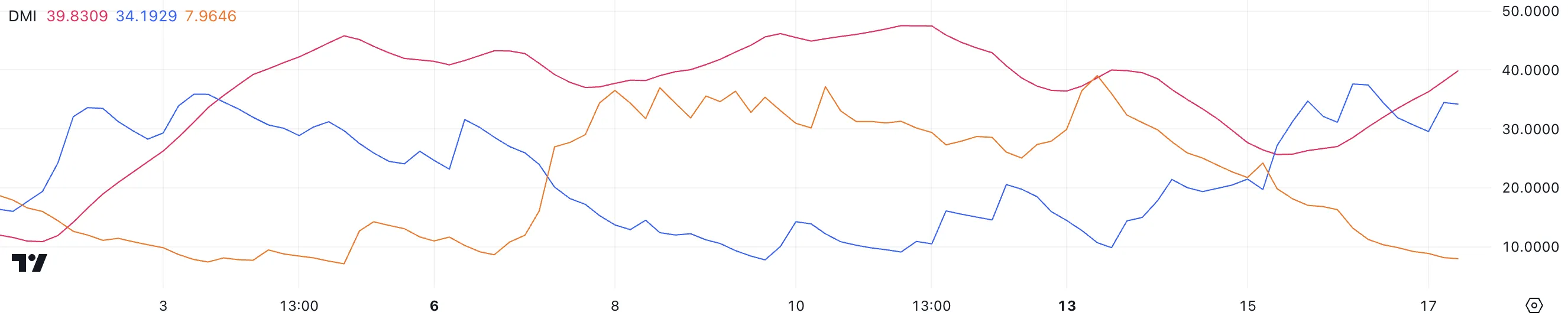

SOL DMI Exhibits the Present Uptrend Is Robust

The DMI (Directional Motion Index) chart for Solana reveals a pointy improve within the ADX (Common Directional Index), rising from 25.6 to 39.8 over the previous two days. This surge coincides with the beginning of SOL’s present uptrend and the formation of golden crosses.

The ADX measures development power, with values above 25 indicating a robust development and values above 40 signaling much more highly effective momentum. A rising ADX throughout an uptrend suggests rising confidence within the path of the value motion.

In the meantime, the +DI (optimistic directional index) has climbed from 19.7 to 34.1, reflecting elevated shopping for stress, whereas the -DI (adverse directional index) has dropped from 24.2 to 7.9, indicating a decline in promoting stress. Collectively, these shifts level to a robust bullish development, with patrons firmly in command of the market. 2

If this dynamic continues, it may sign additional upward momentum for SOL, because the widening hole between +DI and -DI suggests strengthening purchaser dominance. Mixed with the rising ADX, these indicators paint an optimistic image for SOL’s near-term worth motion.

SOL Value Prediction: Will Solana Get well December Ranges?

SOL’s EMA (Exponential Shifting Common) strains have just lately proven a number of golden crosses, with the shortest-term line crossing above a number of others. This means robust upward momentum, suggesting a continuation of the present uptrend. If this momentum persists, Solana worth may take a look at the subsequent resistance degree at $229.

Breaking by this resistance may open the trail to $234 and even $243, pushing SOL above $240 for the primary time since early December 2024.

Nonetheless, if the uptrend reverses and a downtrend begins, the assist at $211 will play an important position. Ought to this degree be examined and fail to carry, SOL worth may drop additional to $203, with a doable extension to $185 if bearish stress intensifies.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.