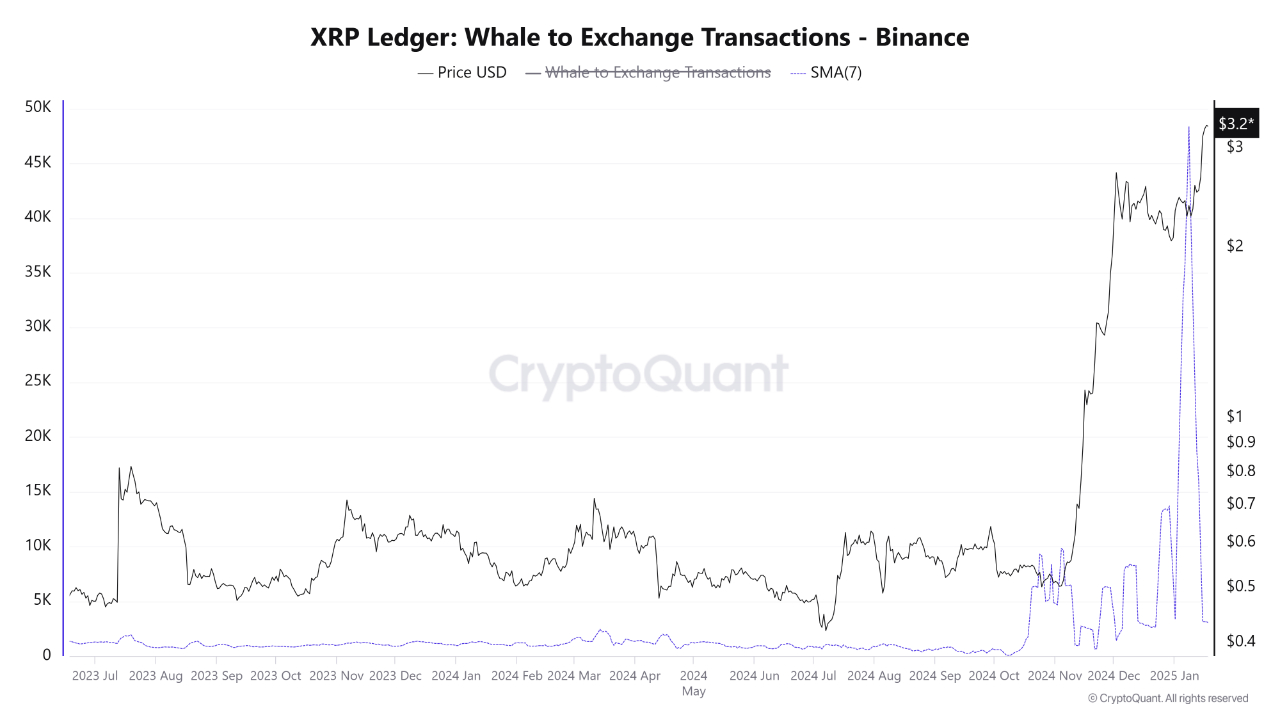

A latest surge within the variety of whale transactions on the XRP Ledger means that these giant token holders are on the brink of take revenue after the value of the cryptocurrency jumped greater than 40% year-to-date.

A chart displaying XRP whale transactions has just lately proven a big spike that “aligns with XRP’s sharp worth rise to $3.2,” in accordance with CryptoQuant analyst Woominkyu, who added that traditionally related whale exercise spikes have “been adopted by notably market actions, usually indicating profit-taking by whales.”

The latest spike, in accordance with the analyst, suggests a “robust chance that whales could also be positioning themselves for revenue realization.”

As CryptoGlobe reported, XRP’s market capitalization briefly surpassed that of Wall Road big Goldman Sachs, reaching $193.5 billion, earlier this week. This surge in XRP’s worth efficiency is attributed to a number of elements.

A latest report from JPMorgan highlighted the potential for a spot exchange-traded fund (ETF) to draw billions of {dollars} in investor funds. Moreover, expectations of a extra favorable regulatory surroundings below President-elect Donald Trump’s administration have contributed to the token’s worth improve.

Anticipated coverage adjustments, such because the institution of a strategic Bitcoin reserve and the appointment of Paul Atkins as the pinnacle of the Securities and Change Fee (SEC), have considerably boosted investor confidence.

It’s price noting that Atkins is taken into account a crypto-friendly determine to guide the regulatory company, which has been concerned in a authorized battle with Ripple, a distinguished participant within the XRP ecosystem. This authorized dispute facilities round Ripple’s XRP gross sales.

Trump’s pro-crypto stance has led many to invest that XRP may quickly launch a spot exchange-traded fund (ETF) that gives publicity to the cryptocurrency. A number of firms, together with Bitwise, Canary Capital, WisdomTree, and 21Shares, have already filed for spot XRP ETFs. Ripple’s CEO, Brad Garlinghouse, has expressed the idea that such a fund is “inevitable.”

Featured picture by way of Pexels.