The native token of the XRP Ledger has, in response to a well-liked cryptocurrency analyst, damaged out of a key technical sample and will quickly see its value surge by round 42% to the $4.4 mark.

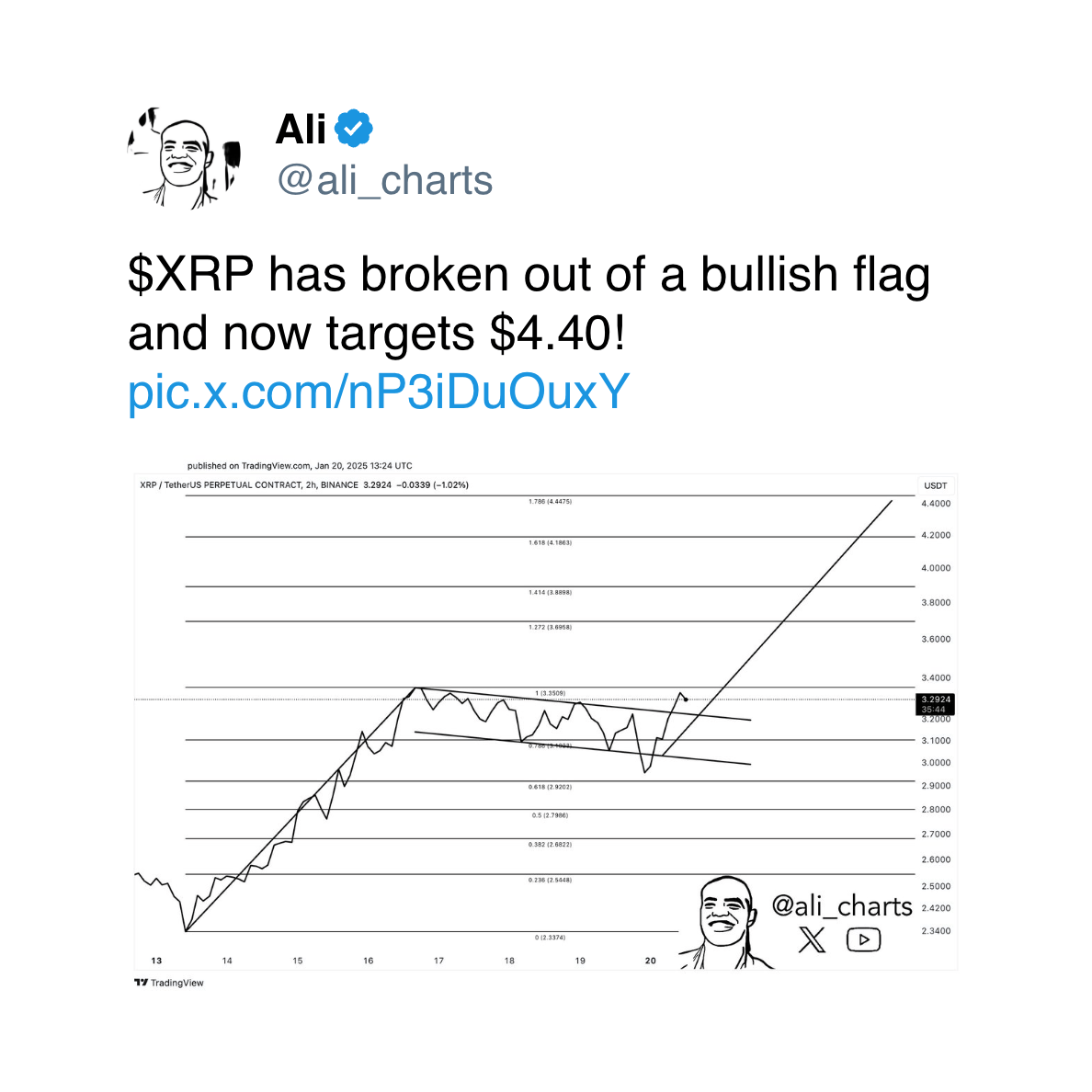

The worth of XRP has damaged out of a bullish flag, in response to cryptocurrency analyst Ali Martinez, who identified that its new value goal given the latest breakout is on the $4.4 mark, representing a greater than 40% potential upside for the cryptocurrency, which on the time of writing is altering arms round $3.1.

As CryptoGlobe reported earlier this week, XRP’s market capitalization briefly surpassed that of Wall Avenue big Goldman Sachs, reaching a exceptional $193.5 billion. A number of elements have contributed to this surge in XRP’s value efficiency.

A latest report from JPMorgan highlighted the potential for a spot exchange-traded fund (ETF) to draw billions of {dollars} in investor funds. Moreover, expectations of a extra favorable regulatory surroundings underneath President-elect Donald Trump’s administration have considerably boosted XRP’s worth.

Anticipated coverage modifications, such because the institution of a strategic Bitcoin reserve and the appointment of Paul Atkins as the top of the Securities and Alternate Fee (SEC), have instilled investor confidence. Atkins’ status as a crypto-friendly determine to guide the regulatory company, which has been concerned in a authorized battle with Ripple, a distinguished participant within the XRP ecosystem, has additional contributed to this optimistic sentiment.

Trump’s pro-crypto stance has led many to invest that XRP might quickly launch a spot exchange-traded fund (ETF) that gives publicity to the cryptocurrency. A number of firms, together with Bitwise, Canary Capital, WisdomTree, and 21Shares, have already filed for spot XRP ETFs. Ripple’s CEO, Brad Garlinghouse, has expressed the idea that such a fund is “inevitable.”

Featured picture through Pexels.