Bitcoin skilled vital volatility within the days main as much as President Donald Trump’s inauguration on Jan. 20. The market noticed sharp worth swings the week earlier than, with heightened exercise from US merchants throughout the weekend. Political uncertainty surrounding the inauguration and the launch of $TRUMP and $MELANIA memecoins added to the turbulence, pushing Bitcoin’s worth to a brand new ATH of $109,460 earlier than retracting.

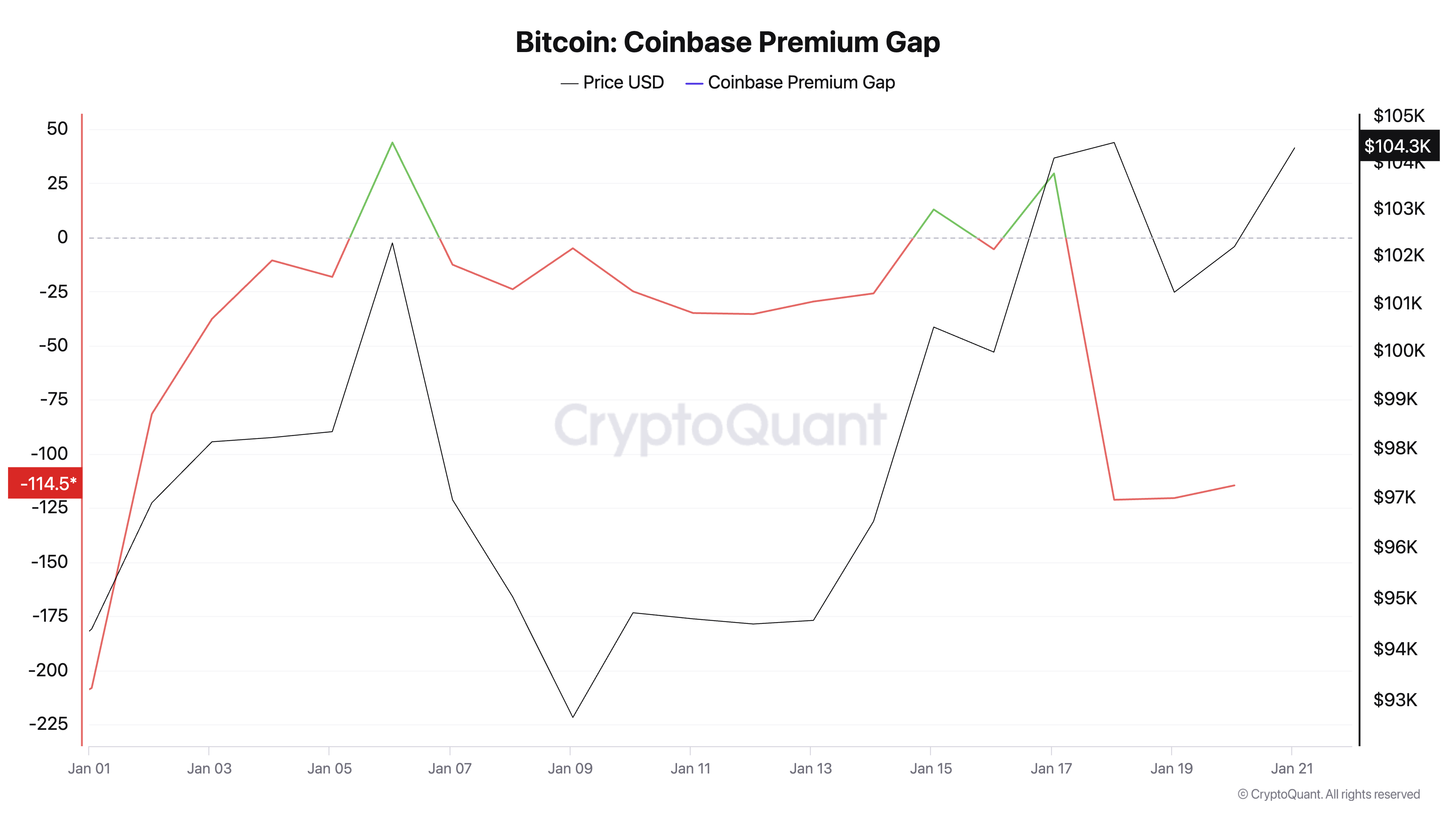

Knowledge from CryptoQuant means that the US market was the principle driver of this volatility. The Coinbase premium, which measures the worth distinction between Bitcoin on Coinbase and Binance, dropped noticeably within the days main as much as the inauguration.

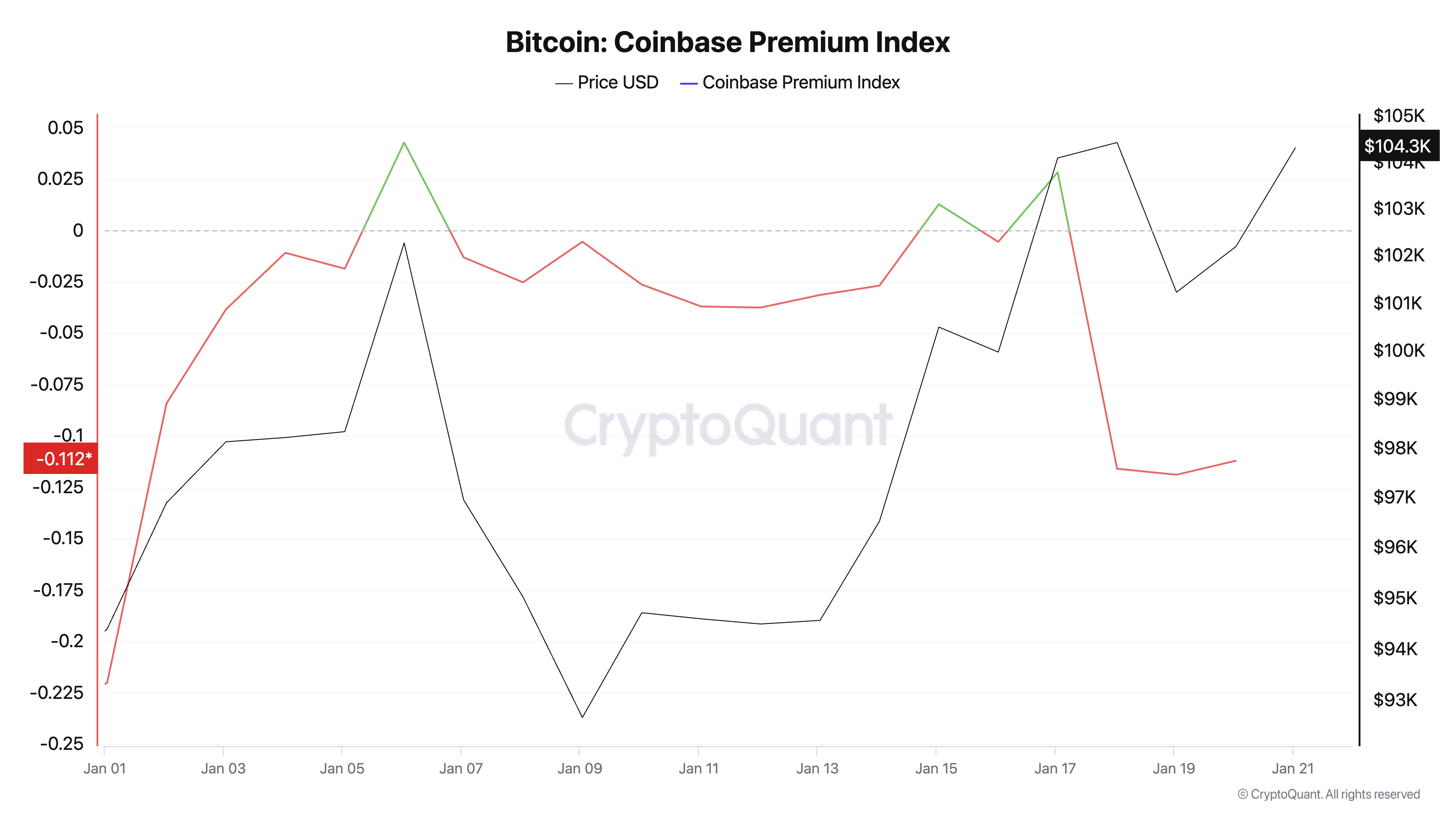

Its relative metric, the Coinbase premium index, additionally turned detrimental.

These declines point out both a diminished demand or elevated promoting strain from US traders. Traditionally, a optimistic Coinbase premium mirrored sturdy institutional demand, making this dip a transparent sign of uncertainty amongst US traders.

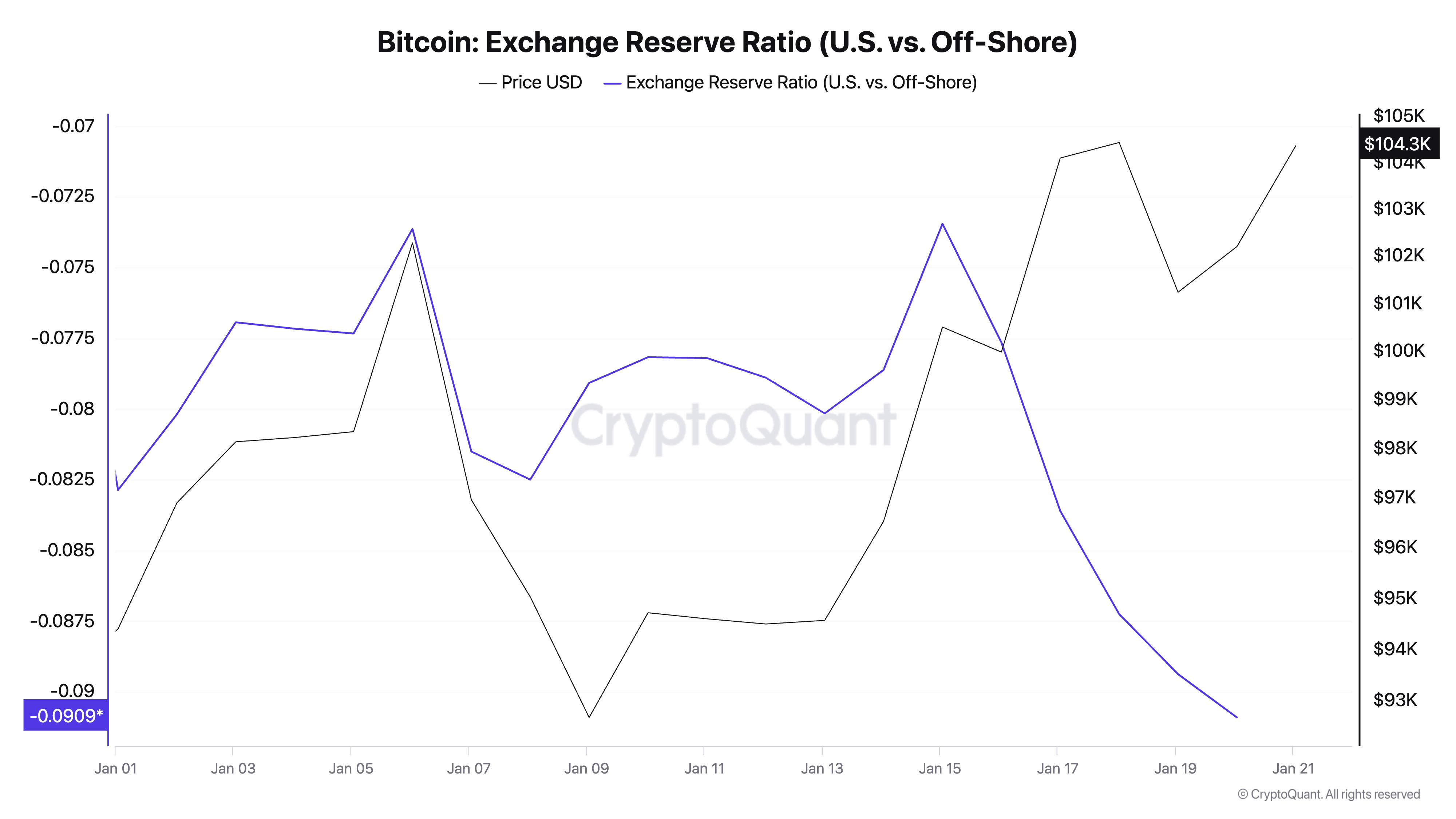

The elevated promoting from US traders will also be seen by the alternate reserve ratio, which tracks the relative reserves on US exchanges in comparison with offshore platforms. The alternate reserve ratio started trending downward on Jan. 15, exhibiting that Bitcoin reserves on US-based exchanges declined quicker than on offshore exchanges. Such actions sometimes point out heightened withdrawals or diminished home liquidity, amplifying volatility from the US market.

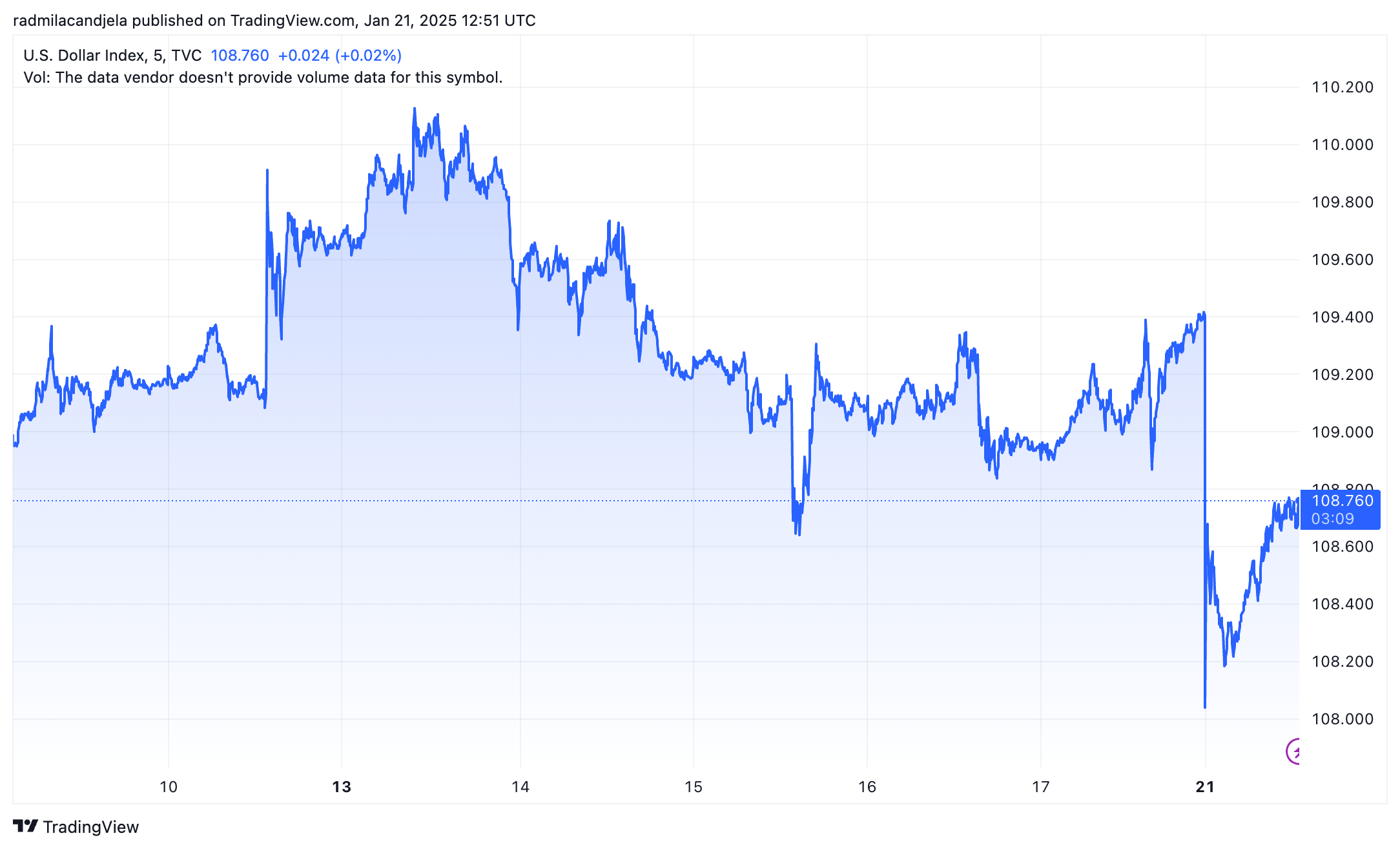

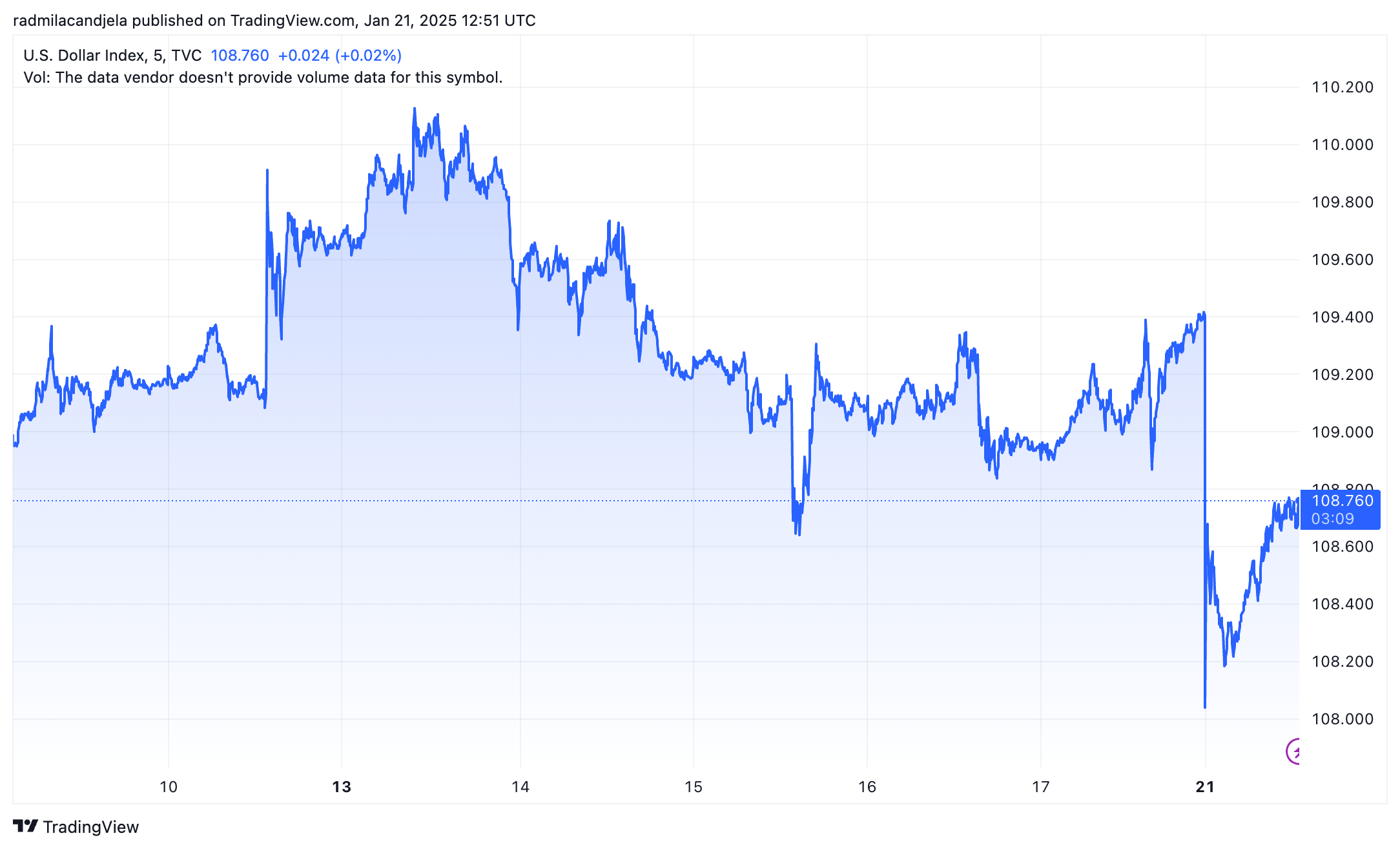

The US Greenback Index (DXY) additionally steeply declined over the identical interval, reflecting macroeconomic uncertainty tied to the political transition. Bitcoin’s inverse correlation with the greenback additional helps the idea that US-based promoting was pushed by broader market danger aversion.

Whereas the US market drove preliminary volatility, international markets stabilized Bitcoin’s worth. Offshore exchanges confirmed relative energy, with reserves rising as US reserves fell. This means that international members, notably exterior the US, amassed Bitcoin throughout the selloff. This absorption of promoting strain helped stop a deeper worth drop.

The slight restoration within the Coinbase premium after Jan. 19 exhibits that international demand continued. As US promoting subsided, offshore liquidity possible supported Bitcoin’s worth, demonstrating the worldwide market’s capacity to counterbalance localized volatility. This additionally exhibits the US market’s outsized affect on Bitcoin’s worth. Political and macroeconomic occasions within the US have all the time been one of many fundamental drivers of sentiment, primarily as US exchanges like Coinbase cater to a major variety of institutional and high-profile traders.

The information confirms that US traders have been the first drivers of Bitcoin’s weekend volatility main as much as the inauguration, as evidenced by declining Coinbase Premiums, a pointy drop within the US to offshore reserve ratio, and DXY’s weakening. Nonetheless, international markets—notably offshore platforms—stabilized Bitcoin’s worth. This reinforces Bitcoin’s place as a resilient, globally traded asset able to weathering localized shocks whereas sustaining long-term stability.

The put up US market drove Bitcoin’s volatility forward of Trump’s inauguration appeared first on CryptoSlate.