Institutional adoption of Bitcoin (BTC) continues to speed up, with treasuries now collectively holding 3,000,000 BTC valued at $317 billion. This represents 14% of the whole provide that may ever exist, reveals self-proclaimed Bitcoin historian Pete Rizzo.

MicroStrategy stays the most important single company holder, having just lately acquired a further 11,000 BTC for $1.1 billion at a mean value of $101,191 per BTC. The corporate’s complete holdings now stand at 461,000 BTC, price roughly $29.3 billion, with a mean acquisition price of $63,110 per BTC.

Different notable holders embody MARA Holdings, a outstanding Bitcoin mining firm, which ranks second, with 44,893 BTC valued at $4.65 billion. Riot Platforms, one other mining agency, follows in third place, with 17,722 BTC price round $1.84 billion.

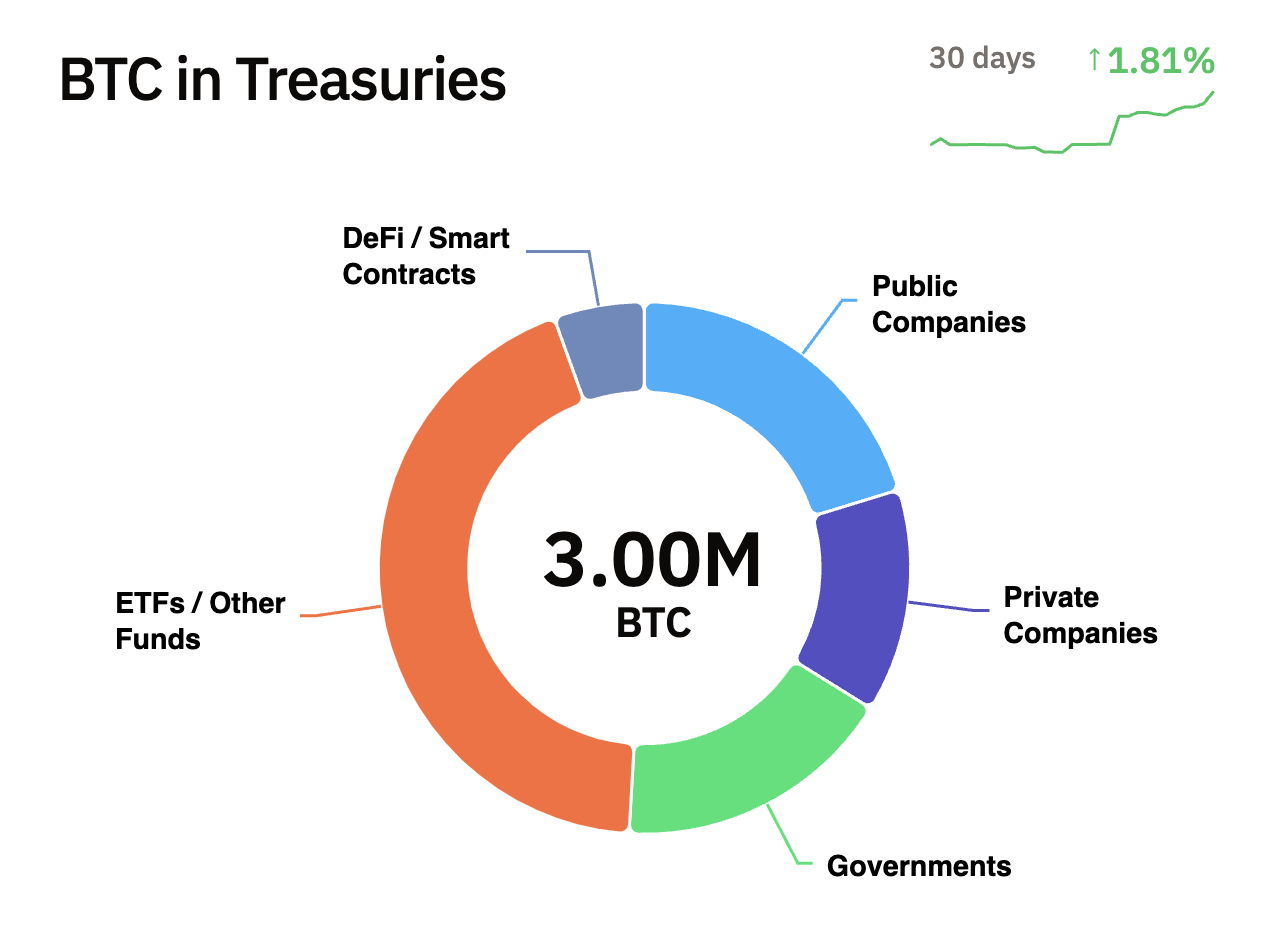

A broader evaluation exhibits that the construction of those institutional holdings is various. Spot Bitcoin ETFs account for 1,307,868 BTC, with BlackRock commanding a good portion of this class, holding 563,134 BTC valued at $58.29 billion. Public firms, together with MicroStrategy, collectively maintain 608,381 BTC.

Governments, equivalent to these of China and america, personal 513,199 BTC, with every holding not less than 190,000 BTC. Moreover, 407,212 BTC are held by non-public firms like Block One, and 165,677 BTC are locked inside DeFi protocols as wrapped Bitcoin.

The truth that Bitcoin is rising in popularity as an funding is proven by the truth that establishments are moving into it. Massive entities are enjoying a key position available in the market’s progress, whether or not they’re investing instantly, utilizing it as collateral or diversifying their treasury.

As this development continues, the long-term influence on Bitcoin’s adoption and its value dynamics might be large.