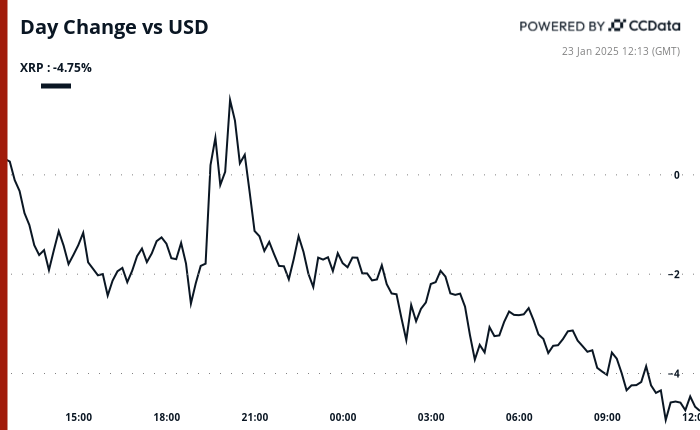

XRP is down by almost 5% over the past 24-hour interval to seemingly transfer to retest the $3 mark in a drawdown that’s coming after it briefly noticed its whole market capitalization surpass that of Wall Road big Goldman Sachs.

Since then, XRP’s market cap has plunged by round $20 billion as the broader cryptocurrency market endures a slight downturn. The native token of the XRP Ledger has plunged greater than different main property right this moment after the Chicago Mercantile Alternate (CME) denied it was itemizing futures tied to the cryptocurrency.

The CME is commonly seen as a proxy for institutional exercise within the cryptocurrency house and earlier screenshots of pages exhibiting the potential launch of futures contracts for each XRP and SOL began circulating on social media. These sparked rumors the launch would come on Feb. 10.

The change has, nonetheless, revealed that these have been “beta pages” from its web site that have been “launched in error.” A spokesperson for the agency advised CoinDesk that mock-ups have been included in its testing atmosphere, with no selections having really been made on these futures contracts.

As most cryptocurrencies, XRP noticed its worth surge late final yr resulting from expectations of a extra favorable regulatory atmosphere below President-elect Donald Trump’s administration. Anticipated coverage adjustments, such because the institution of a strategic Bitcoin reserve and the appointment of Paul Atkins as the top of the Securities and Alternate Fee (SEC), have considerably boosted investor confidence.

It’s value noting that Atkins is taken into account a crypto-friendly determine to guide the regulatory company, which has been concerned in a authorized battle with Ripple, a outstanding participant within the XRP ecosystem. This authorized dispute facilities round Ripple’s XRP gross sales.

Trump’s pro-crypto stance has led many to take a position that XRP may quickly launch a spot exchange-traded fund (ETF) that gives publicity to the cryptocurrency. A number of corporations have already filed for spot XRP ETFs, together with Bitwise, Canary Capital, WisdomTree, and 21Shares. Ripple’s CEO, Brad Garlinghouse, has expressed the idea that such a fund is “inevitable.”

Featured picture through Pexels.