Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.As we speak. The monetary and market data offered on U.As we speak is meant for informational functions solely. U.As we speak shouldn’t be responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding choices. We imagine that every one content material is correct as of the date of publication, however sure affords talked about could not be accessible.

The worth of the main cryptocurrency Bitcoin (BTC) has actually skyrocketed at present as the potential of the Bitcoin Strategic Reserve being introduced within the close to future has shortly soared after a publish by Senator Cynthia Lummis.

Lummis mentioned in her X publish that one thing large goes to be introduced at present. The senator is well-known for her pro-Bitcoin stance and was one of many first voices in U.S. politics to advertise the thought of constructing a strategic reserve in BTC.

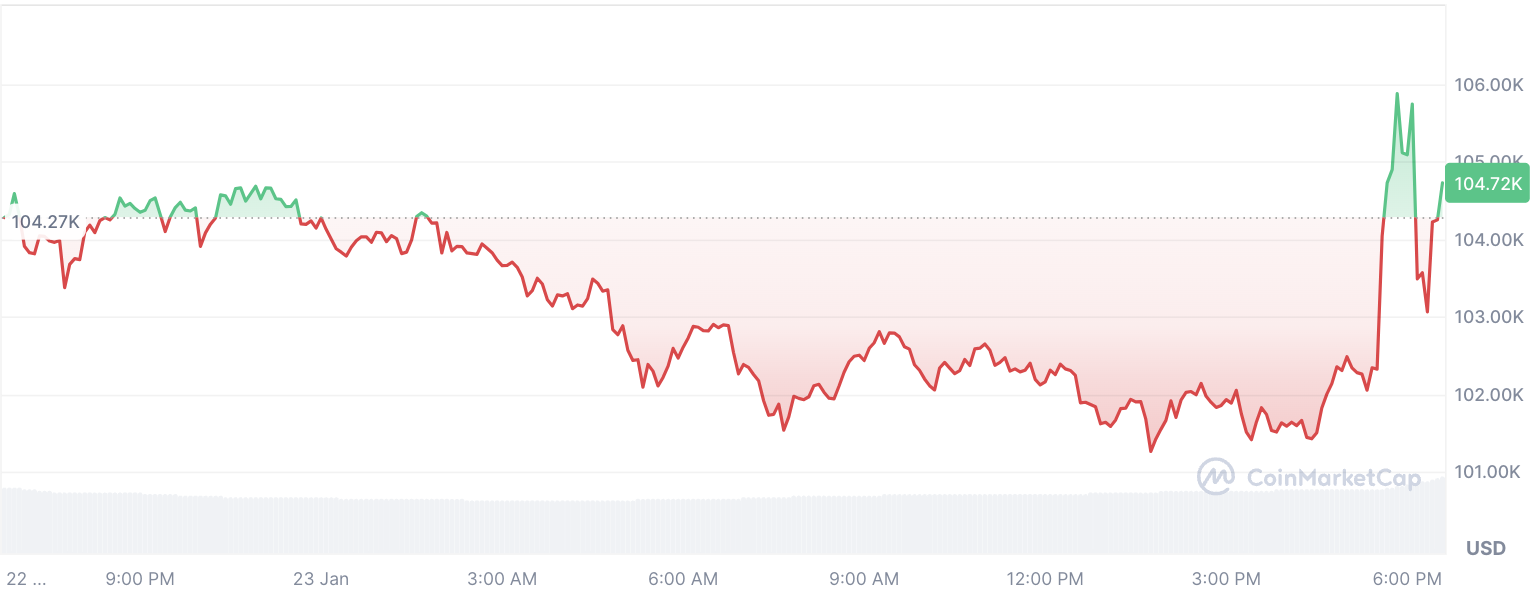

Because of this announcement, the worth of Bitcoin surged by over 4.5% in an hour, which is so much for an asset with a market cap of over $2 trillion.

Curiously, Lummis’s announcement got here simply as the worth of the cryptocurrency hit the underside of the $101,300-$107,100 vary it had been buying and selling in for the previous few days.

Consequence

The senator in the end didn’t ship on a promised 10:00 a.m. announcement, and based on journalist Eleanor Terrett, the problem is that the Senate Banking Committee is about to vote on Senator Lummis changing into chairman of the Subcommittee on Digital Belongings presently, and that could be the “large information.” It’s unclear if anything might be introduced, Terrett added.

Because of this, the worth of Bitcoin has skilled a painful reversal, falling as a lot as 3.2% within the final 25 days from native highs of $106,000. Whether or not the Bitcoin Strategic Reserve might be introduced within the close to future stays an open query. However it’s now clear that such issues will not be but priced in.

It may very well be a Bitcoin ETF faux announcement state of affairs as soon as once more, although, as, in 2023, after such an occasion, we noticed a large pump and dump of the cryptocurrency, which finally resulted in a gentle BTC value rally because the market realized that the approval of the ETF shouldn’t be but priced in.