Solana (SOL) value has skilled vital volatility in current days because it faces key technical challenges. After reaching a brand new all-time excessive on January 19, SOL has pulled again 14.5%, although it maintains a 16.7% acquire over the previous seven days.

Technical indicators recommend the sturdy uptrend is dropping momentum, with key assist and resistance ranges more likely to decide the following main value transfer. The rising variety of whale addresses holding giant SOL positions signifies sturdy institutional curiosity, regardless of the current value correction.

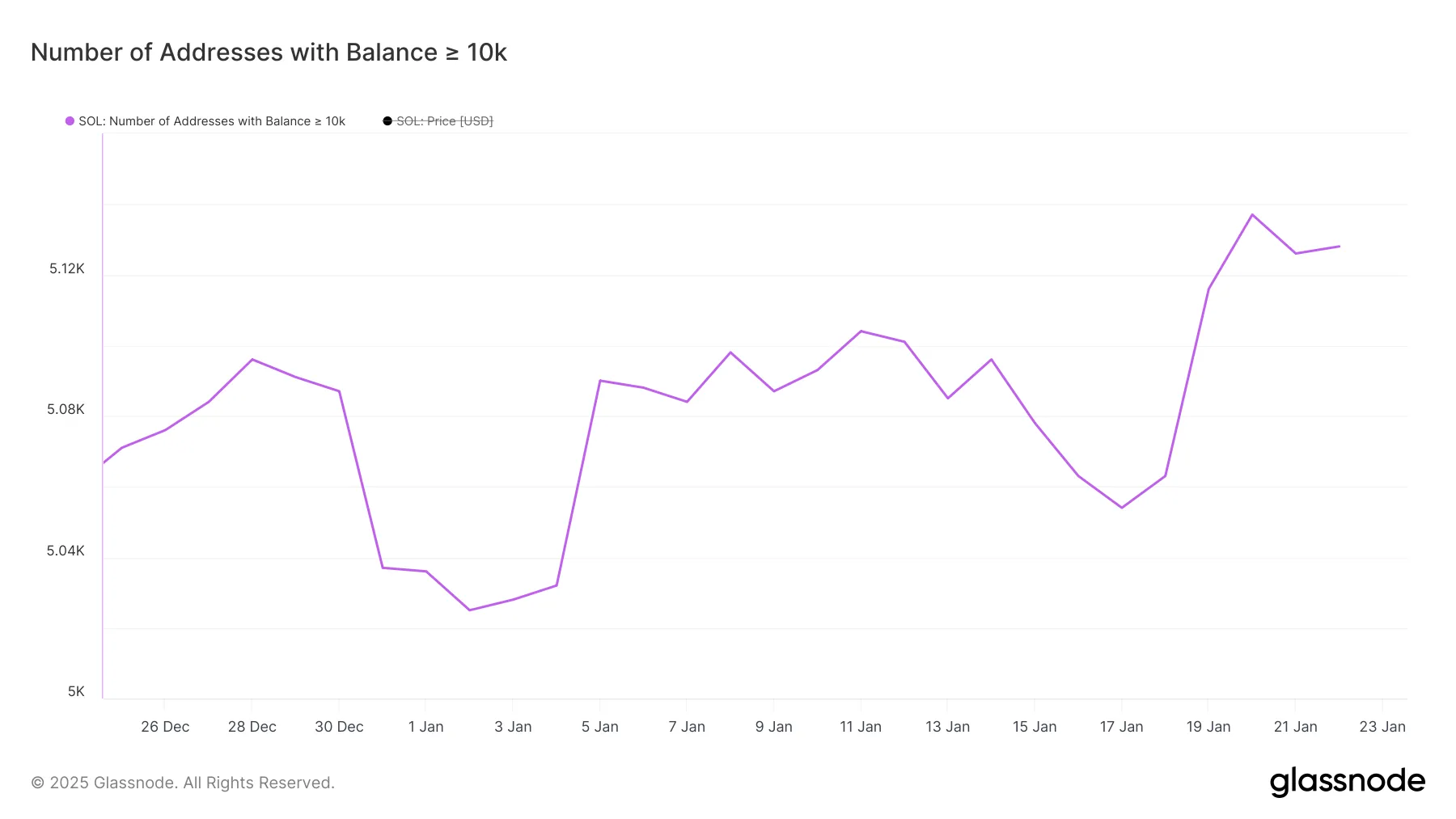

SOL Whales Are Reaching All-Time Ranges

Solana whales have reached historic ranges, with addresses holding 10,000+ SOL peaking at 5,137 three days in the past earlier than barely declining to five,128.

Monitoring these giant holders is essential for market evaluation since whales can considerably influence value actions by means of their buying and selling choices and infrequently symbolize institutional gamers whose actions can sign broader market sentiment and potential value traits.

The present elevated whale depend, which jumped from 5,054 on January 17 to five,128 in simply six days, suggests sturdy institutional confidence in SOL regardless of the minor current decline.

This fast accumulation by giant holders might point out constructive value momentum for Solana. Nevertheless, traders ought to stay conscious that concentrated holdings additionally carry the danger of elevated volatility if whales make coordinated strikes.

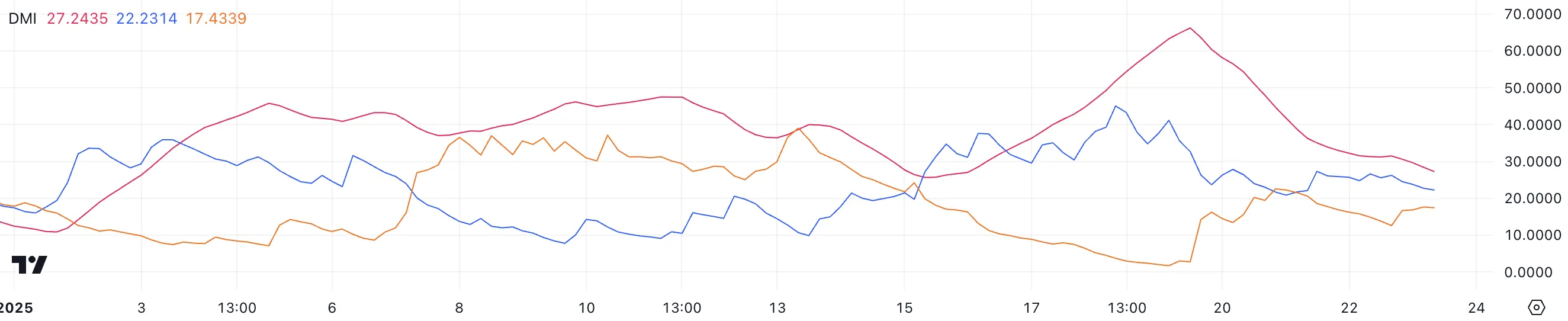

Solana DMI Reveals the Pattern Is Dropping Its Steam

Since SOL value current all-time excessive, the common directional index (ADX) for Solana has declined sharply from 66.2 to 27.2 over the previous 4 days.

ADX measures development energy no matter course, with readings above 25 indicating a robust development and under 20 suggesting a weak development. The present 27.2 studying reveals the development continues to be sturdy however considerably weakening from its current extraordinarily sturdy ranges.

The decline in +DI (Constructive Directional Indicator) from 26.2 to 22.2 alongside a rise in -DI (Unfavorable Directional Indicator) from 12.5 to 17.4 suggests momentum is shifting. Whereas SOL stays in an uptrend, these DMI parts point out promoting stress is rising whereas shopping for stress is lowering.

This technical setup typically precedes a interval of consolidation or potential development reversal, although the present ADX studying above 25 signifies the uptrend nonetheless has some energy remaining.

SOL Worth Prediction: Will Solana Attain $300 In January?

The narrowing distance between SOL’s EMA traces, whereas sustaining their bullish alignment (short-term above long-term), sometimes alerts lowering momentum within the uptrend.

This sample typically suggests a possible interval of consolidation or value correction, although the maintained bullish construction signifies that the general uptrend has but to interrupt.

The technical evaluation reveals important assist and resistance ranges that might decide SOL’s near-term course. A break under $223 might set off a cascade to $211, with additional draw back potential to $191.85 if these helps fail.

Conversely, reclaiming bullish momentum might drive Solana value towards $295, with a possible breakthrough above $300 marking a historic milestone.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.