On-chain knowledge exhibits the Bitcoin transaction quantity has seen a pointy plunge since its excessive final 12 months. Right here’s what this might indicate for BTC.

Bitcoin Switch Quantity Has Declined To Simply $11.2 Billion

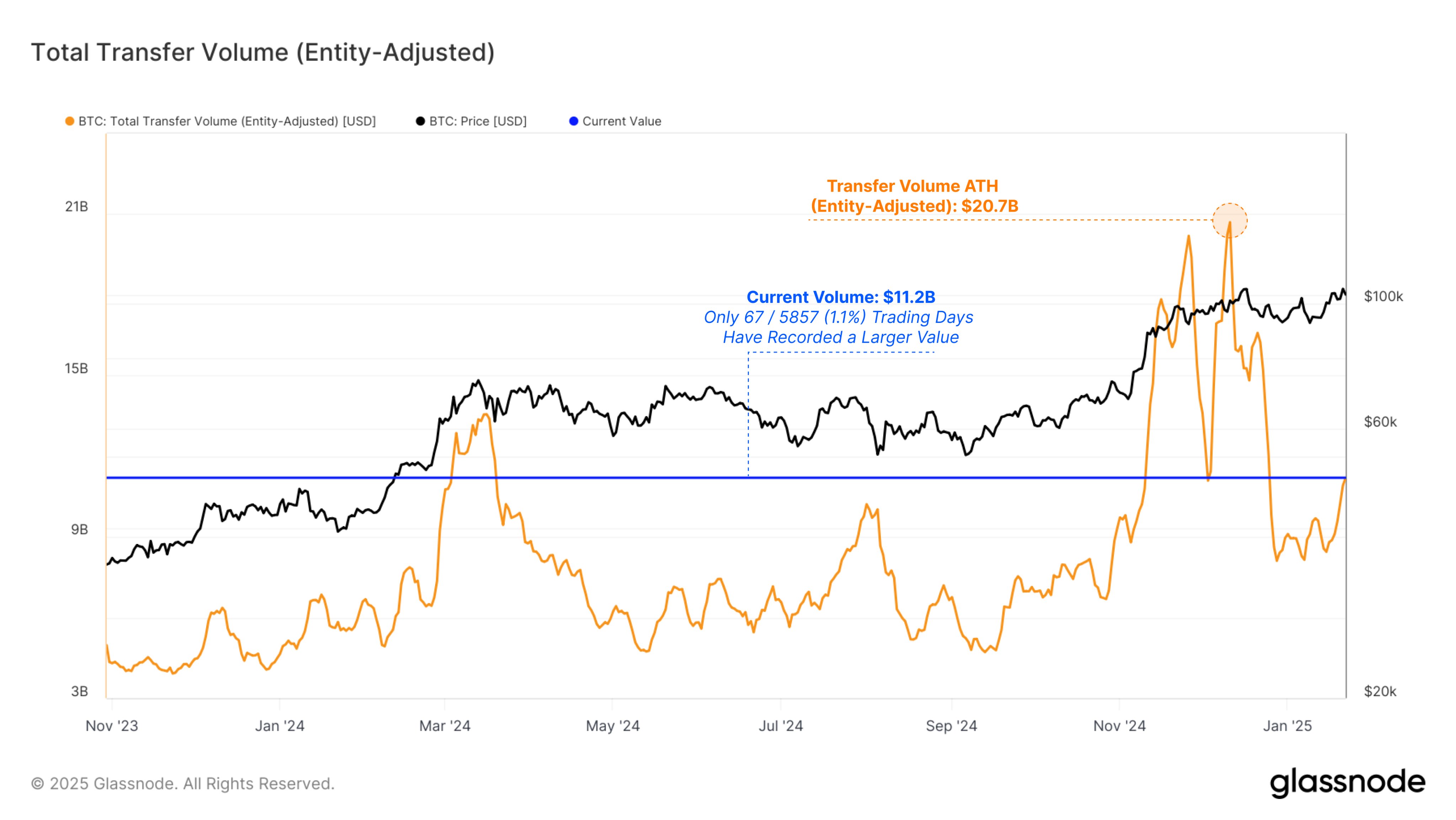

In a brand new publish on X, the on-chain analytics agency Glassnode has talked concerning the newest development within the Complete Switch Quantity for Bitcoin. The “Complete Switch Quantity” right here refers to a metric that measures the entire quantity of the cryptocurrency (in USD) that’s changing into concerned in transactions on the community day by day.

When the worth of this indicator is excessive, it means the traders are shifting round massive quantities on the blockchain. Such a development suggests the buying and selling curiosity within the asset is excessive.

Then again, the metric being low implies the merchants might not be paying a lot consideration to the asset as they aren’t collaborating in a lot transaction exercise.

Now, right here is the chart shared by Glassnode, that exhibits the development within the Bitcoin Complete Switch Quantity during the last couple of years:

The worth of the metric seems to have been climbing in latest days | Supply: Glassnode on X

Within the graph, the model of the Bitcoin Complete Switch Quantity displayed is the “Entity-Adjusted” one. What this implies is that the indicator solely retains monitor of the transfers taking place between totally different entities, not particular person addresses.

An ‘entity‘ is a cluster of addresses that the analytics agency has decided to belong to the identical investor. Transactions between the wallets of the identical proprietor are naturally not related for the broader market, so adjusting for entities could make the indicator output extra correct outcomes.

From the chart, it’s seen that the Entity-Adjusted Complete Switch Quantity witnessed a pointy surge in the direction of the tip of final 12 months. This improve within the indicator got here because the cryptocurrency explored new all-time highs (ATHs) past the $100,000 mark.

Buyers often discover such rallies to be thrilling, so it’s not shocking that the one from the final couple of months of 2024 additionally amassed a considerable amount of consideration.

Since hitting an ATH of $20.7 billion in December, although, the metric has witnessed an prolonged drawdown, implying exercise has waned on the community. At this time, the chain is processing simply $11.2 billion in inter-entity quantity, a lower of just about 46% from the height.

Transaction exercise from the traders is what supplies the gas for rallies to be sustainable, which can be why the slowdown within the cryptocurrency’s value has come after the drawdown within the quantity.

That mentioned, whereas the newest quantity is considerably decrease than the ATH, it’s really nonetheless actually excessive when in comparison with historical past. As Glassnode has highlighted within the chart, there have solely been 67 days in BTC’s lifetime the place the community has seen a better quantity of transaction exercise.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $105,300, up nearly 3% within the final seven days.

Appears to be like like the value of the coin has been shifting sideways over the previous couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com