Grayscale has filed with the SEC to launch Litecoin and Solana ETFs, alongside different crypto-related merchandise.

A number of corporations, together with Grayscale, VanEck, 21Shares, Bitwise and Canary Capital, are additionally pursuing spot Solana ETFs, with the SEC’s preliminary selections anticipated by late January 2025.

Nate Geraci, president of the ETF Retailer, shares optimism in regards to the timeline, reflecting broader market sentiment.

Many within the trade speculate that potential shifts within the U.S. administration and SEC management may foster a extra favorable regulatory local weather for crypto ETFs.

Polymarkets at the moment estimate a 77% probability of Solana ETF approval in 2025, sparking enthusiasm amongst buyers. Approval is predicted to behave as a significant worth catalyst, with some arguing the impression isn’t but totally mirrored in Solana’s market valuation.

Attainable Solana worth breakout

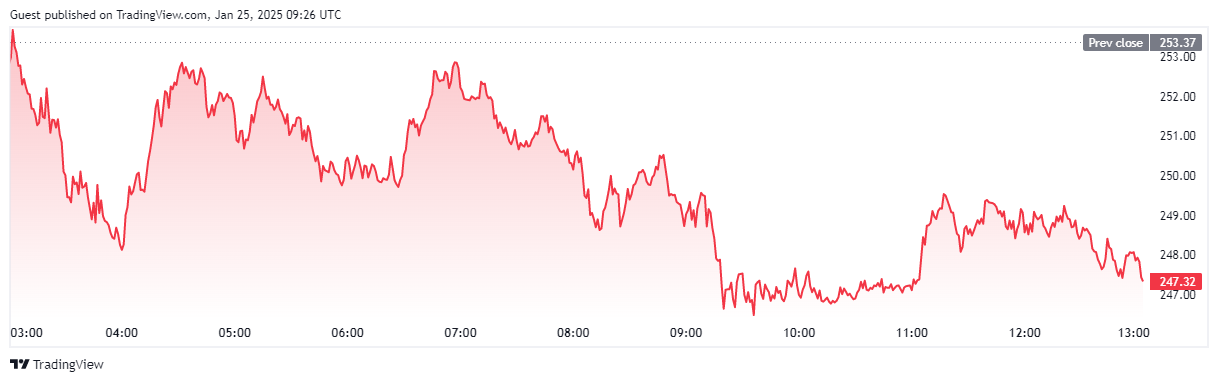

Solana (SOL) has regained bullish momentum after approaching the $230 help degree. Presently buying and selling at $240.60, SOL has skilled a 6.11% decline up to now 24 hours, with market quantity dropping by 35.4% to $13.48 billion.

Regardless of current declines, analysts stay optimistic about Solana’s restoration. Continued curiosity and rising confidence within the coin may doubtlessly drive costs upward, mirroring its resilience over current days.

Disclaimer: The opinions expressed by our writers are their

personal and don’t signify the views of U.Immediately. The monetary and market data

supplied on U.Immediately is meant for informational functions solely. U.Immediately isn’t

chargeable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct

your personal analysis by contacting monetary consultants earlier than making any funding

selections. We consider that every one content material is correct as of the date of publication,

however sure provides talked about could now not be out there.