Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has confronted persistent struggles all year long.

Regardless of a number of makes an attempt to reclaim momentum, Ethereum has fallen under $3,000 every so often, reflecting an incapacity to maintain restoration. This lack of upward motion has triggered investor warning, main many to promote their holdings to safe income.

Ethereum Traders Run Out Of Endurance

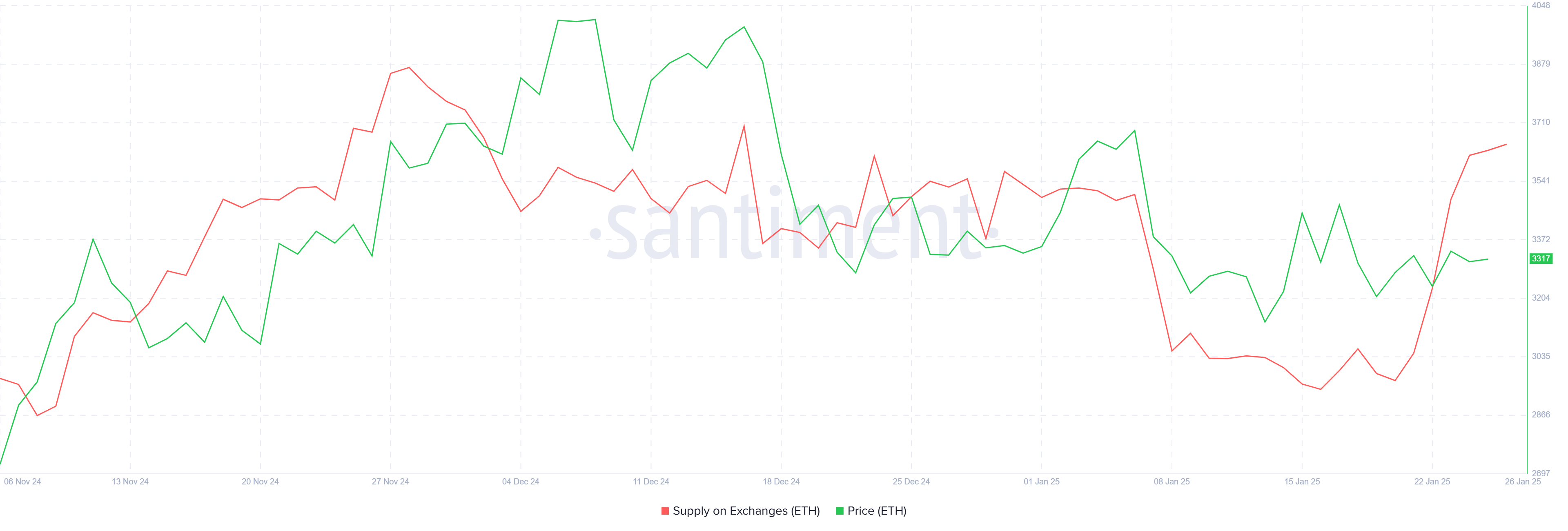

Investor sentiment surrounding Ethereum has shifted notably, with holders shifting to dump their property amid rising skepticism. Over the previous week, greater than 410,000 ETH, price over $1.3 billion, has been bought. This spike in sell-offs is clear within the elevated ETH provide on exchanges, a transparent sign that buyers are capitalizing on current value motion slightly than holding for long-term features.

This rise in promoting stress highlights the waning confidence amongst market individuals, who seem unconvinced of Ethereum’s capacity to maintain a significant restoration. The absence of sturdy upward value motion has additional fueled uncertainty, resulting in a shift towards profit-taking conduct.

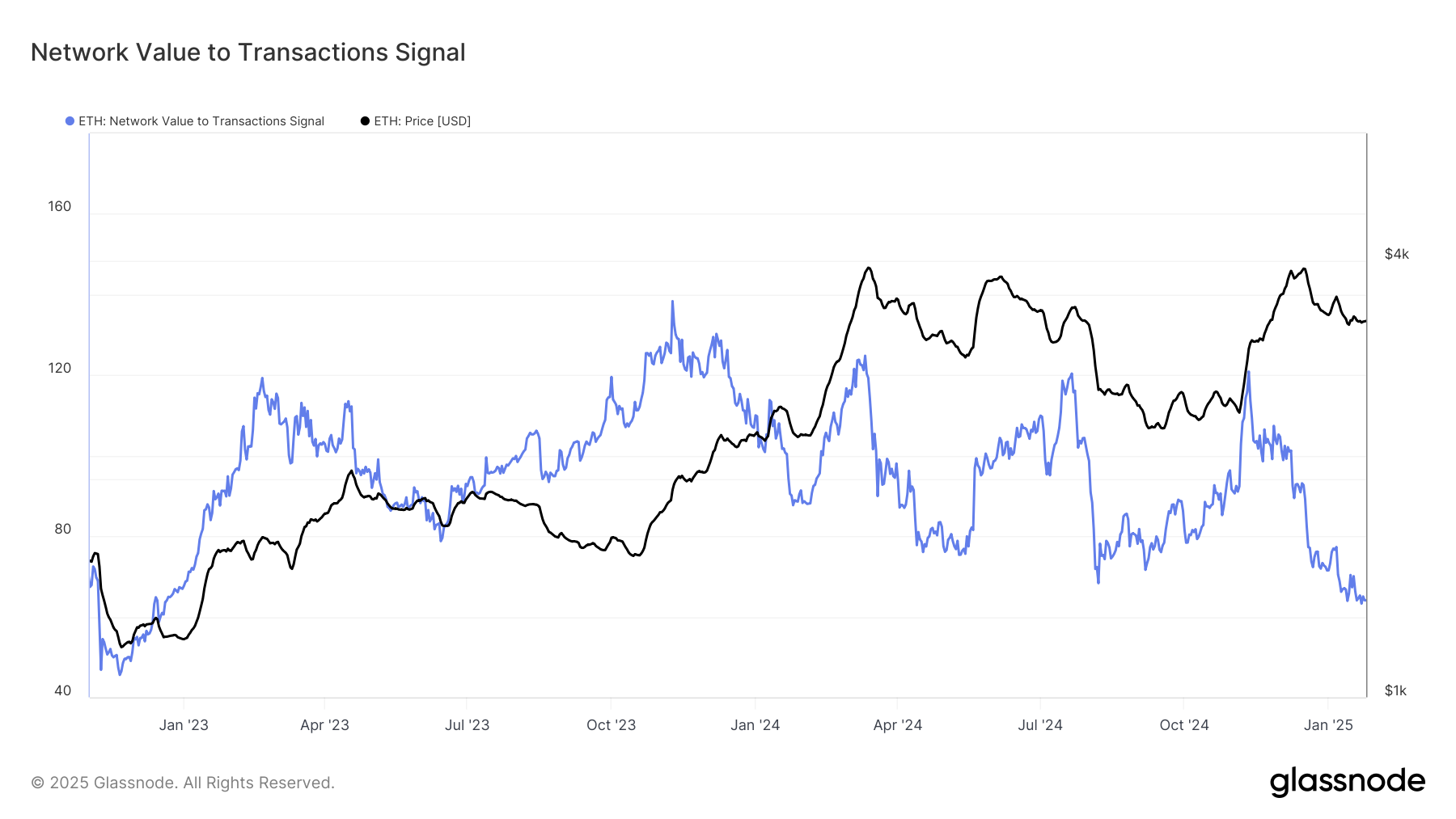

Ethereum’s macro momentum presents a blended outlook. The Community Worth to Transaction (NVT) sign, a key metric for assessing valuation, has dropped to a 25-month low. This implies that Ethereum is at present undervalued, which traditionally signifies a possible for restoration and a rally within the medium to long run.

The undervaluation proven by the NVT sign may stop Ethereum from experiencing sharp corrections, providing some hope for a reversal in sentiment. If this undervalued standing attracts renewed curiosity, ETH might have an opportunity to stabilize and push past its present boundaries.

ETH Worth Prediction: Invalidating Obstacles

Ethereum’s value is at present holding above the assist stage at $3,303, following a failed try and breach the $3,530 barrier. Final week, the cryptocurrency dipped to $3,131, highlighting its ongoing battle to take care of bullish momentum.

Given the present situations, Ethereum is prone to proceed consolidating underneath the $3,530 resistance stage. A failure to reclaim this vital barrier may see ETH falling again to $3,131, additional weakening market confidence.

Then again, a profitable breach of $3,530 may mark a turning level for Ethereum. Such a transfer would seemingly push the value towards $3,711, restoring investor confidence and invalidating the bearish outlook. Nevertheless, sustained shopping for stress and favorable market situations shall be vital for this state of affairs to unfold.

Disclaimer

According to the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.