Este artículo también está disponible en español.

XRP has confronted vital promoting stress over the previous a number of hours, inflicting the value to dip to new native lows round $2.65. This decline comes after a interval of heightened volatility within the broader cryptocurrency market. Whereas the long-term outlook for XRP stays bullish, the current drop highlights dangers that buyers want to observe carefully.

Associated Studying

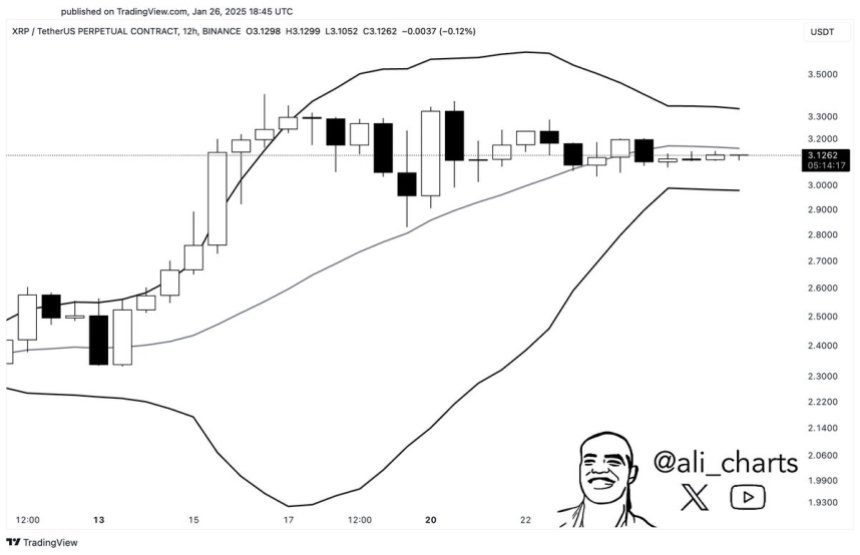

Prime analyst Ali Martinez shared insights on X, pointing to a essential growth on XRP’s day by day chart. He revealed that the Bollinger Bands, a well-liked technical evaluation indicator, have been tightening previous to the drop. This “squeezing” sample is usually a precursor to a major value motion, signaling a shift in market dynamics.

As XRP moved under key demand ranges, the breakdown has left merchants speculating concerning the subsequent potential transfer. Some see this as a short lived setback inside a bigger bullish pattern, whereas others warn that continued promoting stress might result in additional declines.

For now, XRP is at a pivotal juncture. Traders and analysts alike are carefully looking ahead to indicators of stabilization and a possible rebound, which can be essential for sustaining confidence within the token’s long-term trajectory. The approaching days will probably reveal whether or not XRP can regain momentum or proceed to face downward stress.

XRP Faces Intense Volatility Amid Hypothesis

XRP has been on the middle of market exercise, with large value swings dominating the previous few weeks. The cryptocurrency has confronted vital volatility, and analysts predict that the approaching days might carry much more aggressive actions. Regardless of the turbulence, many buyers view this as a strategic alternative, sustaining optimism about XRP’s long-term development potential.

Prime crypto analyst Ali Martinez lately shared a key technical perception on X, pointing to tightening Bollinger Bands on XRP’s day by day chart. This sample is usually related to intervals of diminished volatility adopted by sharp value actions. True to kind, the anticipated transfer materialized, resulting in a dramatic value drop of over 15% in only a few hours.

This steep decline has raised questions on XRP’s quick future. Whereas the long-term outlook stays optimistic for a lot of, the current drop has sparked considerations that XRP could also be coming into a deeper consolidation section. Such phases are sometimes obligatory for market recalibration however can check investor endurance and resilience.

Associated Studying

The market’s present temper is combined, with bullish buyers eyeing this era as a possible accumulation section. In the meantime, analysts proceed to observe key technical indicators to find out whether or not XRP is poised for a rebound or additional draw back. The approaching days can be essential in shaping XRP’s trajectory and whether or not it could possibly keep its repute as a resilient participant within the crypto area.

Indicators of Restoration Amid Current Volatility

XRP is buying and selling at $2.76 following a pointy drop into the $2.65 degree throughout current market turbulence. Regardless of the downturn, the value has demonstrated resilience, recovering roughly 5% prior to now few hours. This rebound has introduced a way of cautious optimism amongst buyers and merchants.

For bulls to reclaim momentum and steer XRP again towards bullish territory, holding above the essential $2.80 degree is crucial. This mark has emerged as a key threshold for sustaining upward stress and stopping additional draw back. A robust protection of this degree might set the stage for a broader restoration, attracting contemporary shopping for curiosity and enhancing market sentiment.

Associated Studying

Whereas XRP’s long-term outlook stays constructive, the present market atmosphere is marked by uncertainty and heightened volatility. Merchants are carefully looking ahead to affirmation of energy above the $2.80 degree, which might sign that bulls are regaining management. Failure to carry this mark might end in one other check of the current $2.65 lows, doubtlessly resulting in a deeper consolidation section.

Featured picture from Dall-E, chart from TradingView