The arrival of DeepSeek in the marketplace has profoundly shaken the Western technological and monetary sector, producing important losses for US shares similar to Nvidia, Alphabet, Microsoft, and Meta.

The Chinese language synthetic intelligence mannequin has triggered a wave of deep uncertainty amongst buyers, who now query the sovereignty of the USA on the planet of chips.

How will this occasion have an effect on the way forward for Nvidia and what would be the penalties on the crypto AI area of interest?

Let’s see all the main points on this article.

The appearance of DeepSeek shakes the US tech markets: Nvidia, Alphabet, Microsoft, and Meta shares in deep crimson

Yesterday, all the US inventory market crashed downwards after the Chinese language AI mannequin DeepSeek went viral worldwide.

Main know-how firms within the USA similar to Nvidia, Alphabet, Microsoft, and Meta have recorded important losses already in pre-market, following the discharge of this profitable software.

Extra particularly, what appears to have precipitated turbulence within the American inventory markets was the debut of the DeepSeek-R1 chatbot (much like ChatGPT).

This product has gained notoriety in document time, bringing the DeepSeek cellular app to the #1 rating within the listing of essentially the most downloaded apps on Apple’s App Retailer.

Essentially the most stunning factor is that this synthetic intelligence mannequin was created in simply 2 months, with solely 10 million {dollars} in funding.

Compared, OpenAI has invested billions of {dollars} in years of analysis and growth to create an answer much like the Chinese language competitor.

Moreover, it appears that evidently DeepSeek requires 95% much less GPU computing energy in comparison with different rivals, providing the identical kind of outcome.

The technological competitors between the USA and China, already intensified lately, has reached a brand new stage of complexity with the introduction of DeepSeek.

Traders have liquidated giant positions from Western tech shares, frightened by how the Chinese language novelty may have challenged the USA dominance.

Specifically, Nvidia shares have been essentially the most affected by the state of affairs, contemplating the damaging implications on the gross sales of their video playing cards.

The Chinese language AI mannequin, requiring much less computational energy, successfully threatens Nvidia’s GPU market and their gross sales.

This local weather of uncertainty has had a strongly damaging impression on all the universe of Wall Avenue, with the index Nasdaq 100 E-MINI dropping by 3% yesterday.

As we speak, the USA markets appear to be in slight restoration.

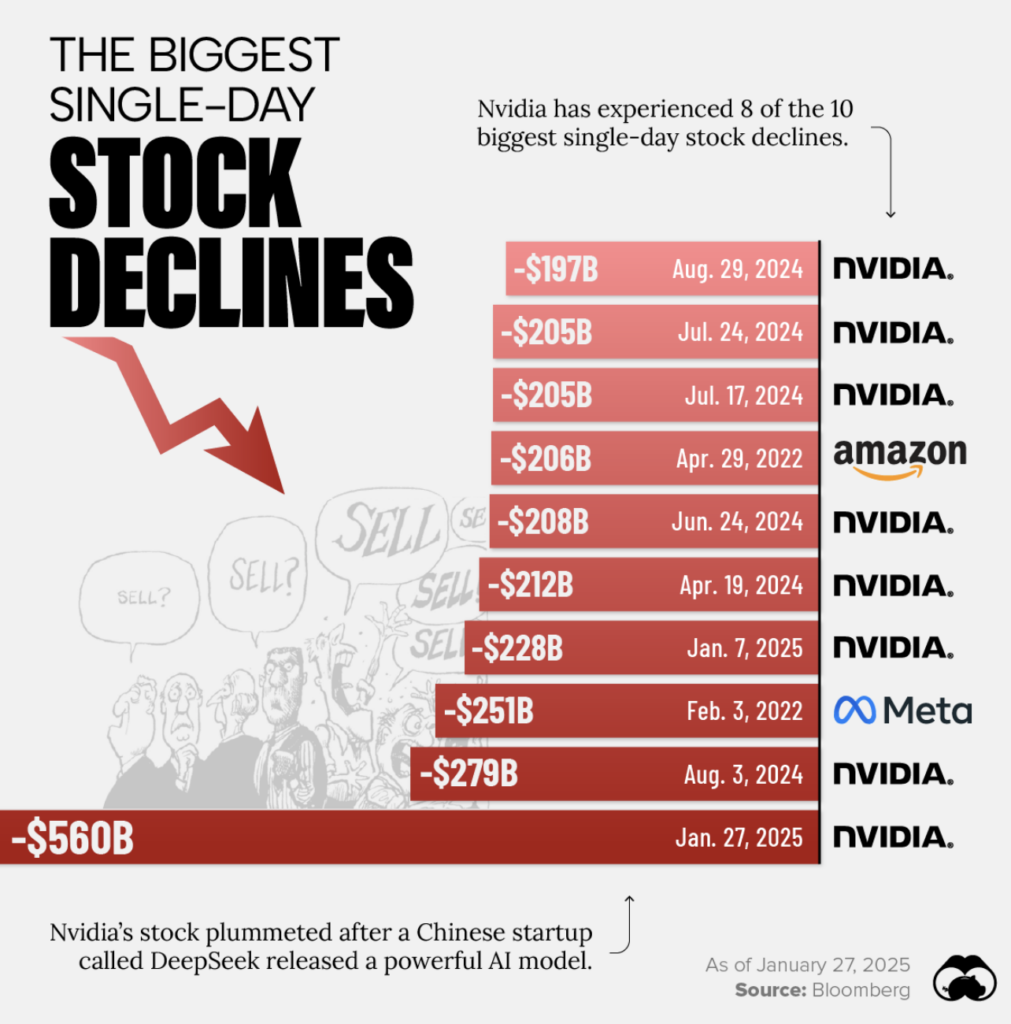

Nvidia inventory value evaluation: collapse of 560 billion {dollars}

As talked about, Nvidia’s shares have been essentially the most affected by the debut of DeepSeek, which has generated important considerations relating to the American firm’s potential to keep up its dominant place.

In a single day, the enormous of video playing cards noticed as a lot as 560 billion {dollars} in market capitalization evaporate.

That is the biggest day by day collapse in historical past for an American inventory: attention-grabbing to notice how Nvidia seems 8 instances within the 10 instances of best decline.

The final drawdown of this magnitude occurred on August 3, 2024, when the Santa Clara firm misplaced 279 billion {dollars}.

Total, Nvidia shares misplaced 16.97% yesterday, creating a big hole within the chart between day by day closing and opening costs.

The gross sales, accompanied by volumes of 800 million shares, have introduced the costs effectively under the EMA 50, thus worsening the technical construction.

Already on Friday, January 24, Nvidia had proven weak point by dropping 3 share factors: with the most recent plunge, nevertheless, the chance is that of going through a bear market.

Will probably be essential to see how the American firm will react to DeepSeek’s assault, and if it is going to handle to regain floor on the speculative entrance.

For the second, it appears that there’s stable help from the demand round 110 {dollars}, the place new bear incursions may very well be repelled.

Regardless of the collapse, a number of analysts argue that the inventory can nonetheless recuperate, particularly if Nvidia manages to innovate and adapt rapidly to the brand new market dynamics.

As we speak the premarket quotes point out a price of 123.62 {dollars} for NVDA, up by 5.34%.

Crypto market AI in transformation with DeepSeek: what to anticipate now?

The arrival of DeepSeek has not solely impacted the shares of know-how firms like Nvidia, however has additionally had important repercussions on the world of AI crypto tokens.

Yesterday, Bitcoin dropped sharply together with all the US tech sector, quickly falling under $100,000.

In a single day, the quintessential crypto asset recorded a drop of 5.2%, negatively affecting all the altcoin sector.

The AI tokens haven’t gained constructive traction from the appearance of a brand new Chinese language mannequin, however they too have accompanied the bear motion.

Regardless of this, buyers are betting that yesterday’s crash could also be solely linked to the correlation with the American inventory market and that there might quickly be a restoration.

It’s not but clear how and to what extent DeepSeeker can affect the worth and performance of AI crypto tokens, however it’s doubtless that its introduction will entice new consideration from a speculative spectrum.

The flexibility of this AI mannequin to course of monumental quantities of information may enhance the efficiency of tokens, making them extra environment friendly and dependable. Moreover, the adoption of DeepSeek may stimulate the creation of latest tokens and platforms, opening new bull alternatives for funding.

It is very important remember the fact that there are important considerations relating to the centralization of technological energy associated to this new Chinese language frontier.

There may be certainly discuss of censorship, of information seize similar to IP handle, keystroke sequences, and details about the system used.

Some customers additionally report (there are not any official sources) that the Chinese language startup might have lied in regards to the manufacturing prices of DeepSeek and the low demand for GPU.

Regardless of the path of DeepSeek from right here on, it’s doubtless that the USA will quickly reply with a brand new AI product, fueling this technological arms race.

It will doubtless shake the market as soon as once more, bringing new volatility to US shares and new stimuli on the crypto entrance.

The tokens which can be linked to the world of synthetic intelligence may benefit from this stimulus by coming into into a brand new constructive momentum.

We nonetheless anticipate very attention-grabbing months for the crypto AI sector.