Robinhood CEO Vlad Tenev is doubling on crypto’s potential to revolutionize investing in personal markets. In a current put up on X, Tenev emphasised that the US is making strides in crypto adoption and may additional increase its understanding of what’s potential.

His advocacy facilities on real-world asset (RWA) tokenization, a transformative method that would unlock private-market investments for on a regular basis buyers.

Vlad Tenev Makes a Case for Tokenization

In an opinion piece printed in The Washington Submit, Tenev highlighted the stark funding hole in personal markets, citing firms like OpenAI ($157 billion valuation), SpaceX ($350 billion), Canva, Revolut, Stripe, and Anthropic. In keeping with Tenev, these companies stay privately held, with early-stage investments restricted to a small elite of accredited buyers.

Present rules, such because the “accredited investor” rule, exclude roughly 80% of US households from these profitable alternatives. In keeping with Tenev, tokenization presents an answer.

“Lastly, the US is making up for misplaced time and taking crypto critically. So many promising strides ahead. It’s time to even additional increase our understanding of what’s potential,” Tenev shared on X.

Blockchain know-how permits for the creation of digital tokens representing possession stakes in real-world property, making them tradable on decentralized platforms. This method would allow retail buyers to entry personal firm shares earlier than they go public, doubtlessly benefiting from large early-stage progress.

“Tokenizing private-company inventory would allow retail buyers to spend money on main firms early of their life cycles earlier than they doubtlessly go public at valuations of greater than $100 billion,” an excerpt within the put up learn.

Furthermore, it might present personal firms with a brand new avenue to boost capital with out the burdens of a conventional IPO.

Regulatory Roadblocks and the Want for Reform

Regardless of the technological feasibility of tokenization, regulatory challenges stay. The Securities and Alternate Fee (SEC) oversees private-company inventory and securities buying and selling within the US. Nevertheless, present legal guidelines don’t account for blockchain know-how. Equally, the dearth of readability has hindered the event of tokenized securities platforms.

In the meantime, different areas, together with the European Union, Hong Kong, Singapore, and Abu Dhabi, are main in regulatory frameworks for safety token choices. Tenev argues for 3 key regulatory adjustments:

- Reforming Accredited Investor Guidelines – Shifting qualification standards from wealth-based metrics to knowledge-based assessments or self-certification

- Establishing a Safety Token Registration Framework – Permitting US buyers entry to tokenized securities whereas offering firms with a streamlined different to IPOs

- Offering Clear Tips for Dealer-Sellers and Exchanges – Guaranteeing that US-based platforms can legally and safely checklist and commerce safety tokens

Tenev’s push for tokenization aligns with broader business tendencies. As BeInCrypto reported, the Coinbase Layer-2 community, Base, is contemplating bringing tokenized Coinbase (COIN) shares to its platform. This transfer highlights the rising curiosity in tokenized equities. It additionally means that main gamers are exploring methods to bridge conventional finance with blockchain.

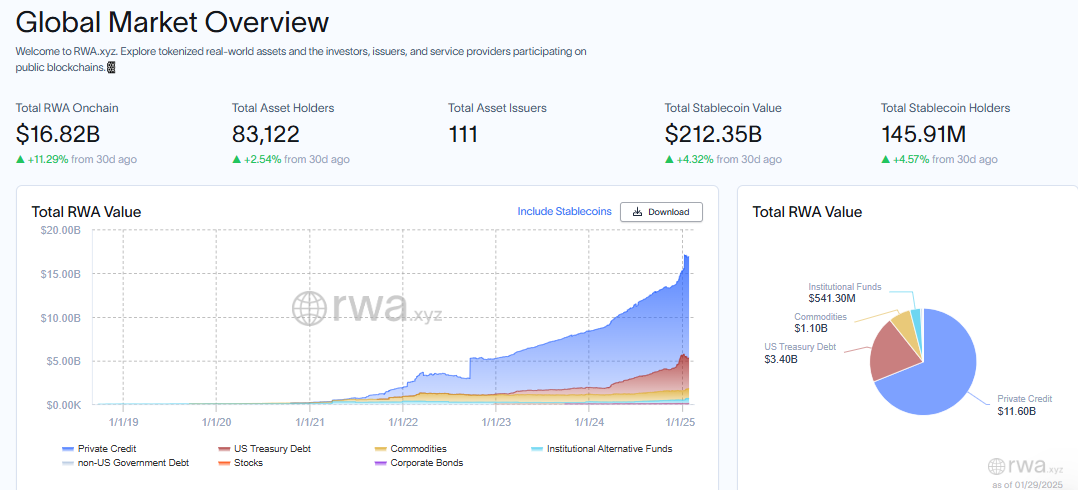

Because the RWA tokenization market grows, extra establishments are anticipated to discover digital asset-backed securities. Such an final result would enhance accessibility and liquidity for buyers worldwide.

Whereas advocating for monetary inclusion by way of tokenization, Robinhood has confronted regulatory scrutiny. The corporate not too long ago agreed to pay the SEC a $45 million settlement over regulatory failures. This highlights the compliance hurdles crypto-focused platforms should navigate.

Regardless of these challenges, Robinhood has seen sturdy monetary efficiency, buoyed by Bitcoin’s current rally. Alongside Coinbase, the platform skilled important year-end features, reflecting renewed investor curiosity in crypto markets.

Tenev’s imaginative and prescient for tokenization represents a paradigm shift in monetary markets. Leveraging blockchain know-how may make personal investments extra accessible, liquid, and world. Nevertheless, regulatory reforms are important to realizing this potential.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.