Bitcoin (BTC) value has been unstable, gaining 9% within the final 30 days however dropping 3% previously week, with its market cap hovering round $2 trillion. Regardless of the latest draw back, BTC seems to be consolidating, as its EMA strains commerce intently collectively, and its DMI chart alerts weak pattern power.

In the meantime, the variety of BTC whales has dropped to its lowest degree in a yr, suggesting some massive holders have been offloading their cash. With key assist at $101,300 and resistance at $105,700, BTC’s subsequent transfer shall be essential in figuring out whether or not it continues consolidating or makes an attempt a push towards $110,000.

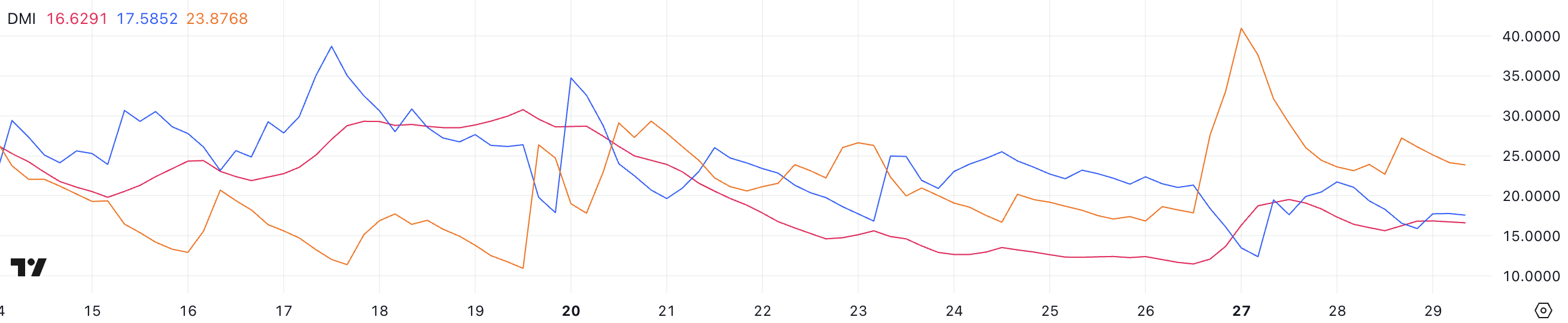

Bitcoin DMI Indicators Uncertainty

Bitcoin DMI chart exhibits its ADX at 16.6, fluctuating between 15 and 19 over the previous two days, signaling weak pattern power. ADX measures the power of a pattern, with values beneath 20 indicating consolidation and above 25 suggesting a stronger pattern. Proper now, BTC lacks clear momentum in both path.

The DMI chart additionally exhibits +DI at 17.5 and -DI dropping to 23.8 from 27.2. Notably, -DI peaked at 40.9 two days in the past when BTC fell from $105,000 to $98,600 in a couple of hours. This implies bearish strain has eased, and BTC is now consolidating.

If +DI crosses above -DI with a rising ADX, an uptrend may type. In any other case, BTC value could keep range-bound or proceed its earlier downtrend.

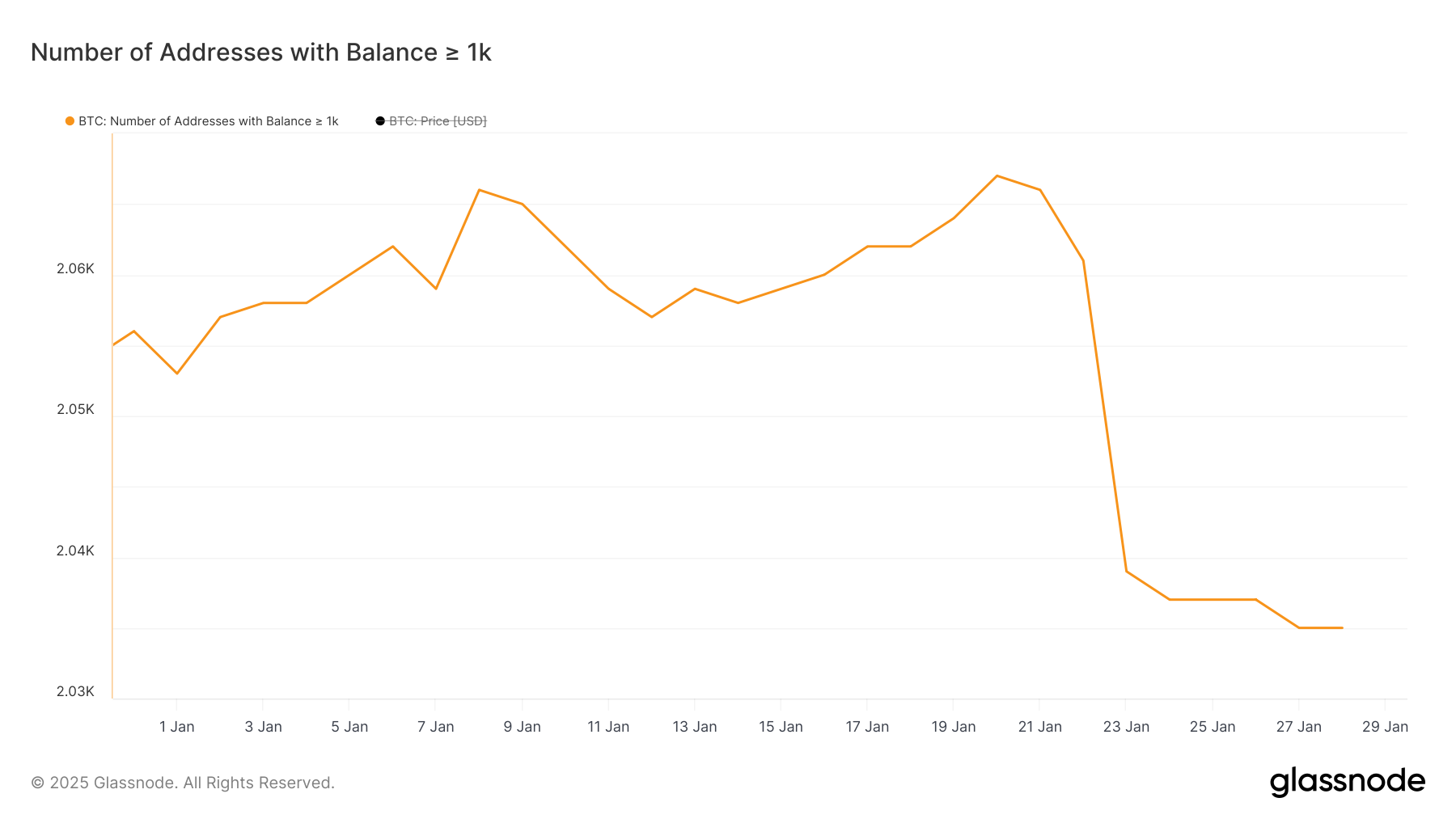

Bitcoin Whales Drop to Lowest Degree in a 12 months

The variety of BTC whales — addresses holding a minimum of 1,000 BTC — has dropped to 2,035, the bottom degree since January 2024. A big decline occurred between January 20 and January 24, when the depend fell from 2,067 to 2,037.

This sharp drop means that some massive holders have been offloading their BTC, doubtlessly rotating into different cash or holding their cash ready for brand new actions.

Monitoring BTC whales is vital as a result of they maintain a big share of Bitcoin’s provide and might affect market traits. A decline in whale addresses could point out distribution, which means massive holders are promoting reasonably than accumulating.

With whale numbers at a one-year low, BTC value may face elevated promoting strain, making it tougher for the worth to maintain sturdy upward momentum. Nonetheless, if new accumulation begins, it may present assist and assist stabilize the market.

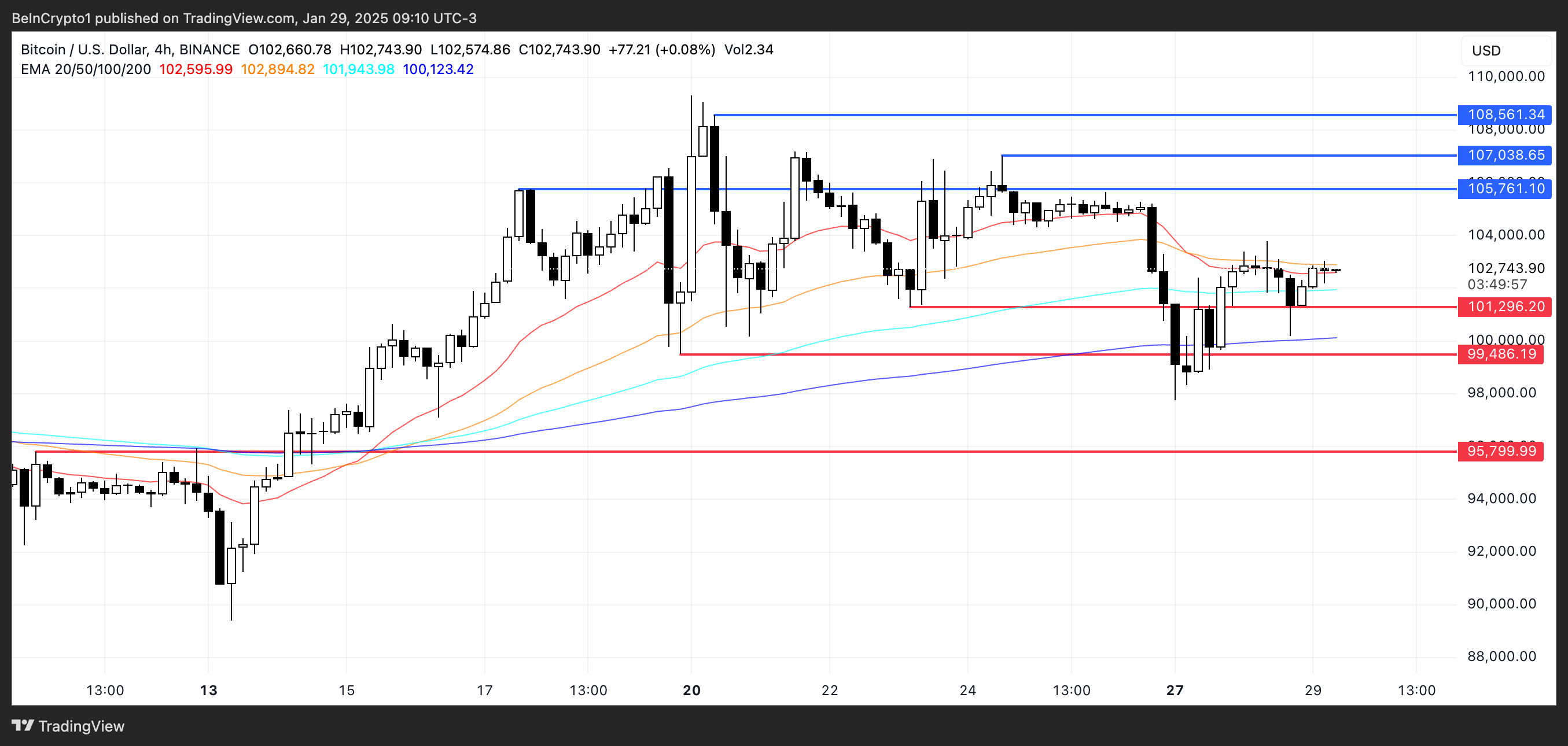

BTC Value Prediction: Will It Lastly Attain $110,000 In February?

Bitcoin’s EMA strains point out a consolidation part, as they’re buying and selling intently collectively. The present assist degree is round $101,300, which has been held thus far.

Nonetheless, if Bitcoin value checks and loses this assist, it may drop additional to $99,400, with a deeper decline presumably reaching $95,800.

On the upside, if BTC positive aspects momentum, it may check resistance at $105,700. A breakout above this degree could push BTC value towards $107,000 and $108,500, doubtlessly paving the best way for a transfer to $110,000 for the primary time.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.