The Bitcoin market has lengthy been outlined by its seemingly immutable four-year cycle, a sample of three years of surging costs adopted by a pointy correction. Nonetheless, a seismic shift in coverage from Washington, led by former President Donald Trump, could shatter this cycle and usher in a brand new period of extended progress for the cryptocurrency trade.

Matt Hougan, Chief Funding Officer at Bitwise Asset Administration, lately posed an intriguing query: Can Trump’s Govt Order break crypto’s four-year cycle? His reply, although nuanced, leans in direction of an emphatic sure.

The 4-12 months Cycle: A Recap

Hougan clarifies his private perception that the four-year Bitcoin market cycle will not be pushed by Bitcoin’s halving occasions. He states, “Individuals attempt to hyperlink it to bitcoin’s quadrennial ‘halving,’ however these halvings are misaligned with the cycle, having occurred in 2016, 2020, and 2024.”

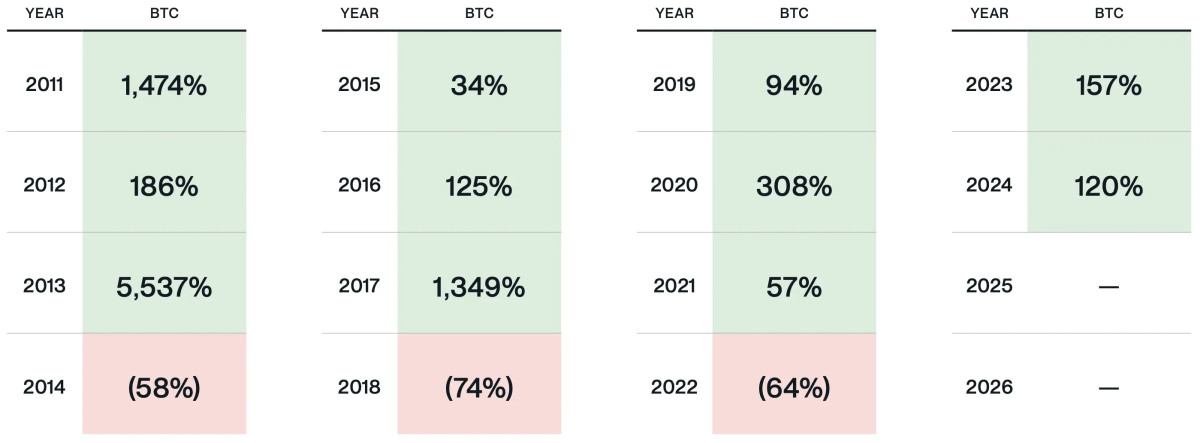

Bitcoin’s four-year cycle has been traditionally pushed by a mixture of investor sentiment, technological breakthroughs, and market dynamics. Usually, a bull run emerges following a major catalyst—be it infrastructure enhancements or institutional adoption—which attracts new capital and fuels hypothesis. Over time, leverage accumulates, excesses emerge, and a significant occasion—resembling regulatory crackdowns or monetary fraud—triggers a brutal correction.

This sample has performed out repeatedly: from the early days of Mt. Gox’s implosion in 2014 to the ICO increase and bust of 2017-2018, and most lately, the deleveraging disaster of 2022 with the collapse of FTX and Three Arrows Capital. But, each winter has been adopted by an excellent stronger resurgence, culminating in Bitcoin’s newest bull run spurred by the mainstream adoption of Bitcoin ETFs in 2024.

Associated: Nasdaq Proposes In-Type Redemptions for BlackRock’s Bitcoin ETF

The Govt Order: A Recreation Changer

The basic query Hougan explores is whether or not Trump’s current Govt Order, which prioritizes the event of the digital asset ecosystem within the U.S., will disrupt the established cycle. The order, which outlines a transparent regulatory framework and even envisions a nationwide digital asset stockpile, represents probably the most bullish stance on Bitcoin from any sitting or former U.S. president.

The implications are profound:

- Regulatory Readability: By eliminating authorized uncertainty, the EO paves the best way for institutional capital to circulate into Bitcoin at an unprecedented scale.

- Wall Road Integration: With the SEC and monetary regulators now pro-crypto, main banks can enter the area, providing Bitcoin custody, lending, and structured merchandise to their shoppers.

- Authorities Adoption: The idea of a nationwide digital asset stockpile hints at a future the place the U.S. Treasury may maintain Bitcoin as a reserve asset, solidifying its standing as digital gold.

These developments is not going to play out in a single day, however their cumulative impact may essentially alter Bitcoin’s market dynamics. In contrast to earlier cycles that had been pushed by speculative retail euphoria, this shift is underpinned by institutional adoption and regulatory endorsement—a much more steady basis.

Associated: Why A whole lot of Corporations Will Purchase Bitcoin in 2025

The Finish of Crypto Winters?

If historical past had been to repeat itself, Bitcoin would proceed its ascent via 2025 earlier than going through a major pullback in 2026. Nonetheless, Hougan suggests this time could also be totally different. Whereas he acknowledges the chance of speculative extra and leverage-driven bubbles, he argues that the sheer scale of institutional adoption will forestall the type of extended bear markets seen previously.

This can be a essential distinction. In earlier cycles, Bitcoin lacked a powerful base of value-oriented buyers. At present, with ETFs making it simpler for pensions, hedge funds, and sovereign wealth funds to allocate to Bitcoin, the asset is not solely depending on retail enthusiasm. The end result? Corrections should happen, however they’ll probably be shallower and shorter-lived.

What Comes Subsequent?

Bitcoin has already crossed the $100,000 mark, and projections from trade leaders, together with BlackRock CEO Larry Fink, counsel it may attain $700,000 within the coming years. If Trump’s insurance policies speed up institutional adoption, the standard four-year sample may very well be changed by a extra conventional asset-class progress trajectory—akin to how gold responded to the top of the gold commonplace within the Nineteen Seventies.

Associated: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Worth Amid Inflation Worries

Whereas dangers stay—together with unexpected regulatory reversals and extreme leverage—the path of journey is obvious: Bitcoin is turning into a mainstream monetary asset. If the four-year cycle was pushed by Bitcoin’s infancy and speculative nature, its maturation could render such cycles out of date.

Conclusion

For over a decade, buyers have used the four-year cycle as a roadmap for Bitcoin’s market actions. However Trump’s Govt Order may very well be the defining second that disrupts this sample, changing it with a extra sustained and institutionally-driven progress section. As Wall Road, firms, and even governments more and more embrace Bitcoin, the query is not if crypto winter will are available in 2026—however somewhat if it is going to come in any respect.

Disclaimer: This text is meant for informational functions solely and doesn’t represent monetary recommendation. Readers are inspired to conduct thorough unbiased analysis earlier than making funding choices.