- Bitcoin-backed loans provide liquidity whereas preserving publicity to Bitcoin’s long-term worth development

- The “purchase, borrow, die” technique helps traders unlock worth, with out triggering tax occasions

An growing variety of Bitcoin [BTC] holders are discovering methods to entry liquidity with out promoting their property or triggering tax occasions. Bitcoin-backed loans are on the forefront of this shift, permitting traders to borrow in opposition to their BTC whereas retaining possession.

Actually, market analyst Mark Harvey is amongst those that have emphasised the “purchase, borrow, die” technique as a sustainable method to wealth administration. This gives long-term revenue streams, whereas preserving publicity to Bitcoin’s future worth development.

This modern technique is shortly gaining traction amongst traders trying to maximize the utility of their digital property, whereas minimizing tax implications.

Unlocking Bitcoin’s worth with out promoting

Harvey’s newest proposal suggests utilizing Bitcoin as collateral to safe loans, enabling holders to entry liquidity whereas retaining publicity to Bitcoin’s worth development.

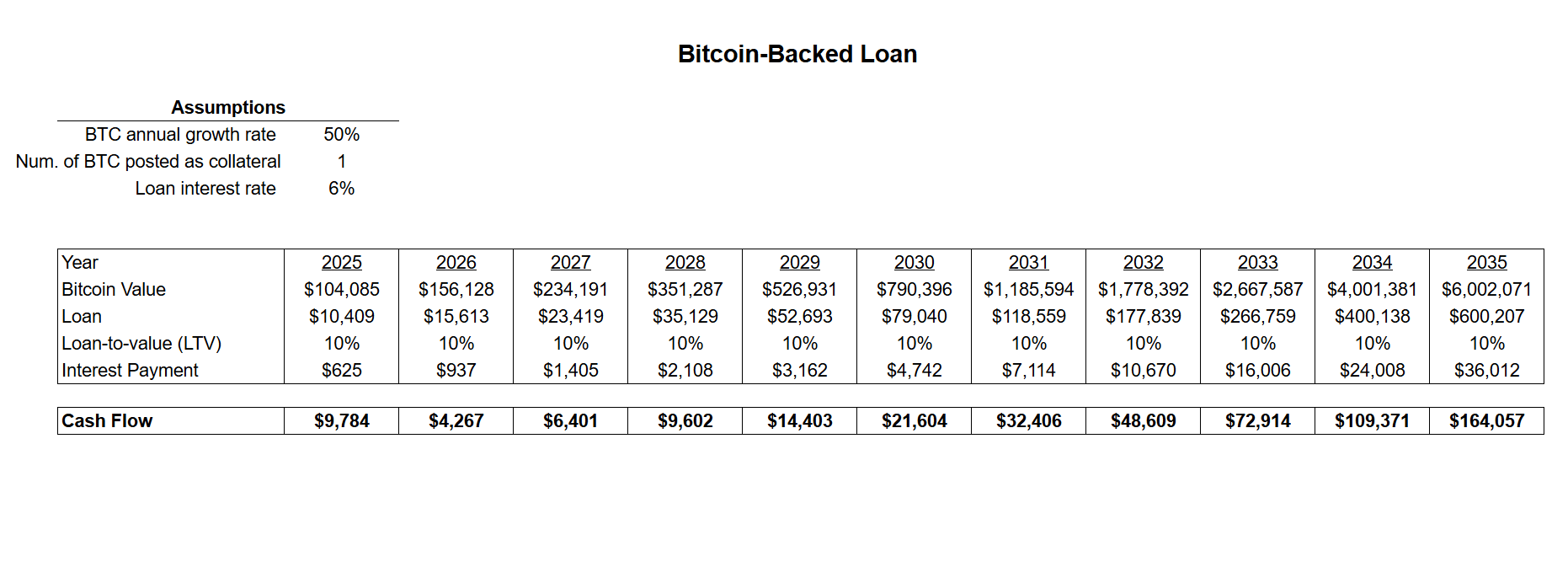

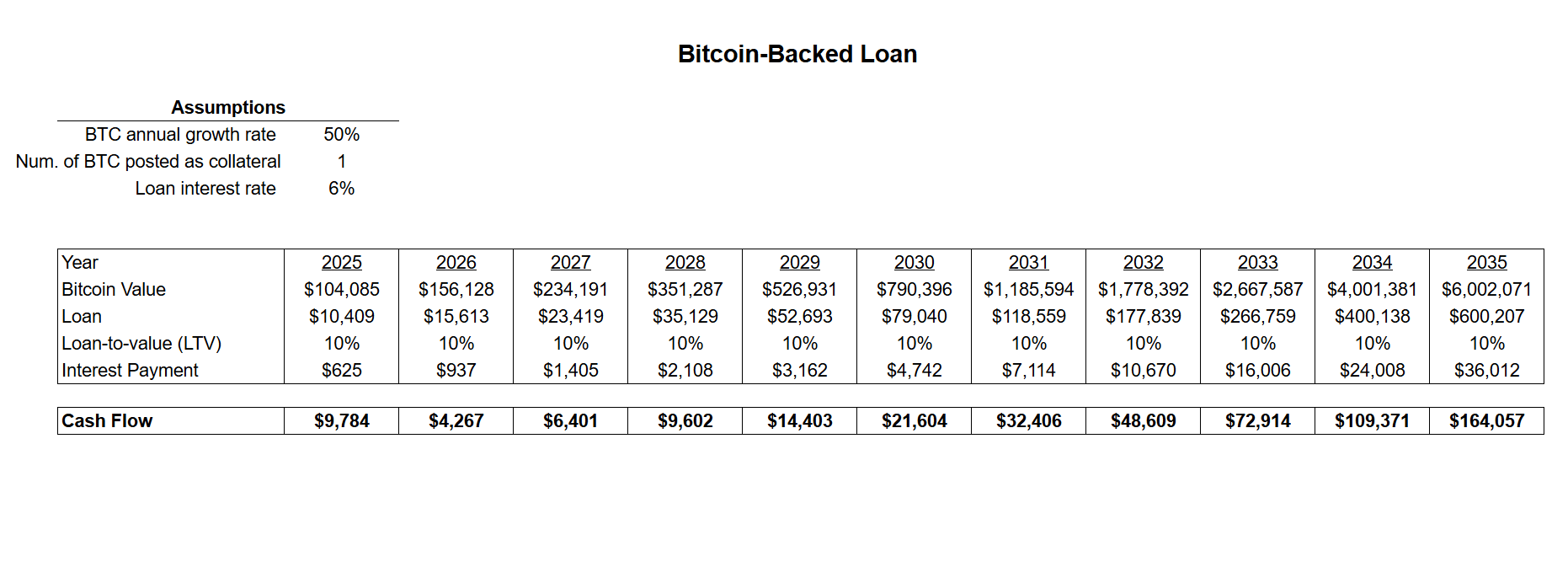

With a ten% loan-to-value (LTV) ratio, 1 BTC as collateral can unlock growing mortgage quantities yearly, assuming Bitcoin appreciates by 50% per 12 months. Debtors roll over loans into bigger quantities annually, accessing extra capital with out triggering taxable occasions.

This technique permits traders to learn from Bitcoin’s long-term worth development, whereas producing spendable revenue by way of mortgage proceeds – Eliminating the necessity to promote their Bitcoin.

Bitcoin loans – Money stream advantages

Supply: X

The Bitcoin-backed mortgage technique gives important money stream benefits. Initially, with a single Bitcoin valued at roughly $104,085, an investor can borrow $10,409 and generate a money stream of $9,784 after paying curiosity.

As Bitcoin appreciates, each the mortgage quantity and money stream develop. By 2035, with BTC projected to be price over $6 million, the mortgage quantity reaches $600,207, yielding a formidable $164,057 in annual money stream.

This method transforms Bitcoin from a passive asset into an income-generating device, permitting traders to maintain their life or reinvest funds with out promoting their holdings. The power to roll over loans yearly ensures steady entry to liquidity, making this a strong technique for long-term monetary safety.

Wealth era – The ‘purchase, borrow, die’ technique

The ‘purchase, borrow, die’ technique leverages Bitcoin-backed loans for wealth preservation and tax effectivity. Buyers borrow in opposition to Bitcoin’s appreciating worth, deferring capital positive factors taxes indefinitely.

Mortgage proceeds stay untaxed, and heirs inherit Bitcoin at a stepped-up price foundation, doubtlessly eliminating taxes. By rolling loans into bigger quantities, this method ensures liquidity, maximizes Bitcoin’s development potential, and secures a tax-efficient monetary legacy.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

Criticism and dangers

Whereas the thought of Bitcoin-backed loans sounds promising, not everybody agrees. Critics argue that this mannequin depends an excessive amount of on hypothesis and elements outdoors of an investor’s management.

One Twitter consumer warned,

“This at all times seems to be wonderful on paper, in actuality (from private expertise cough BlockFi) it doesn’t work this fashion.”

The collapse of lending platforms like BlockFi has made some skeptical of over-leveraging BTC. Others problem the belief that Bitcoin will recognize by 50% yearly, with one consumer mentioning,

“If it will go up 50% after simply 10 years BTC worth needs to be like 5 million {dollars}… your 50% should cease sooner or later mathematically talking.”

There’s additionally concern over whether or not the preliminary mortgage quantities justify the danger, as one other critic famous,

“In 2025, $10,409 doesn’t purchase a lot. Appears not well worth the threat.”

These counterpoints spotlight that whereas Bitcoin-backed loans provide potential, additionally they carry dangers tied to BTC’s volatility, lender stability, and market unpredictability.