Este artículo también está disponible en español.

For the previous few months, stablecoins have yielded the highlight to their extra speculative counterparts, together with tokens impressed by politicians. Nevertheless, current on-chain information means that stablecoins are again and have surpassed the $200 billion market cap.

Associated Studying

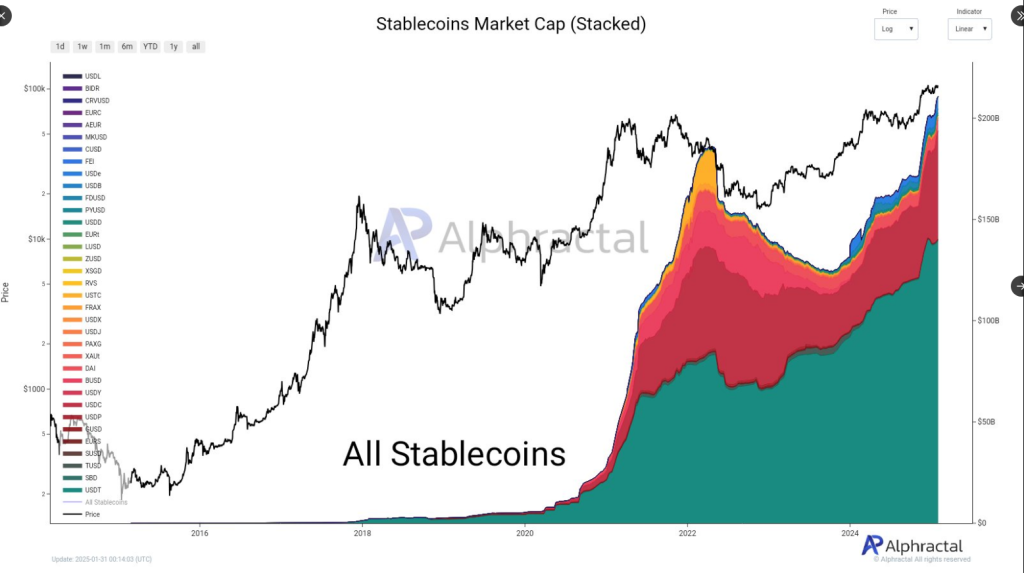

In keeping with the information shared by Alphractal, the phase’s capitalization has surged to $211 billion, a file excessive, due to months of secure progress, which began in mid-2023.

Stablecoins‘ market capitalization grew by 73% from its August 2023 worth of $121 billion, up to date information launched on January thirty first present. The first driver of this phase’s progress remains to be Tether’s USDT, nevertheless, USDC has been gaining floor lately, which is fascinating.

🚨 Stablecoin Market Cap Surpasses $211B – USDC Positive factors Momentum!

Since 2023, the stablecoin market has grown considerably, primarily pushed by USDT (Tether). Nevertheless, lately, USDC has been gaining an edge over different stablecoins.

This development is going on as a result of current drop in… pic.twitter.com/IRKrQErmCE

— Alphractal (@Alphractal) January 31, 2025

Tether’s USDT Stays Major Driver Of Development

Since 2023, the stablecoin market has grown regular, largely attributable to Tether’s USDT. As of now, stablecoins are price $223 billion, which is a 0.2% improve from yesterday.

Apparently, USDT and USDC are the current progress drivers of stablecoins. Aside from the numbers from each cash, the stablecoins group hasn’t modified a lot since 2023 and has proven regular and common values. Proper now, Tether’s USDT is valued at virtually $140 billion, and USDC is at $53 billion.

USDC Slowly Positive factors Floor On Different Cash

Alphractal’s publish on Twitter/X reveals that USDC has been gaining floor over different stablecoins out there. In keeping with the publish, that is occurring attributable to a drop in altcoin costs and since a considerable a part of the sell-offs have been swapped into USDC.

The publish additionally confirmed that USDC’s dominance on this phase has hit a key resistance stage, the identical quantity noticed in 2021. This was the beginning of the bear market in 2022 when Bitcoin’s value dropped to as little as $15,500. If this metric persists, it may well function the market’s bearish sign, impacting buyers’ shopping for choices. Nevertheless, if this metric declines, it may be USDC’s leaping board to assert new highs.

Associated Studying

What To Count on From The Stablecoins Phase In The Quick-Time period

Within the final bull run, USDC’s provide elevated in Might, then reached its excessive in March 2022. The stablecoin’s market cap elevated by 170% from April 2021 to March 2022. If the present coin provide continues to develop however value begins to dip, then the stablecoin market could hit its peak in a couple of months.

Historically, a rising market cap for stablecoins displays rising buyers’ confidence, which indicators a rise in capital inflows.

Quite the opposite, a rising stablecoin market cap is normally related to rising investor conviction, signaling the potential for boosted capital inflows. This implies that the bullish momentum might proceed for a couple of extra months.

Featured picture from Gemini Imagen, chart from TradingView