The worth of Litecoin (LTC) has dropped 7% within the final 24 hours, bringing its market cap to $9.33 billion. Regardless of this decline, technical indicators present combined indicators. The RSI sits in a impartial zone, whereas Ichimoku Cloud suggests uncertainty across the altcoin’s subsequent transfer.

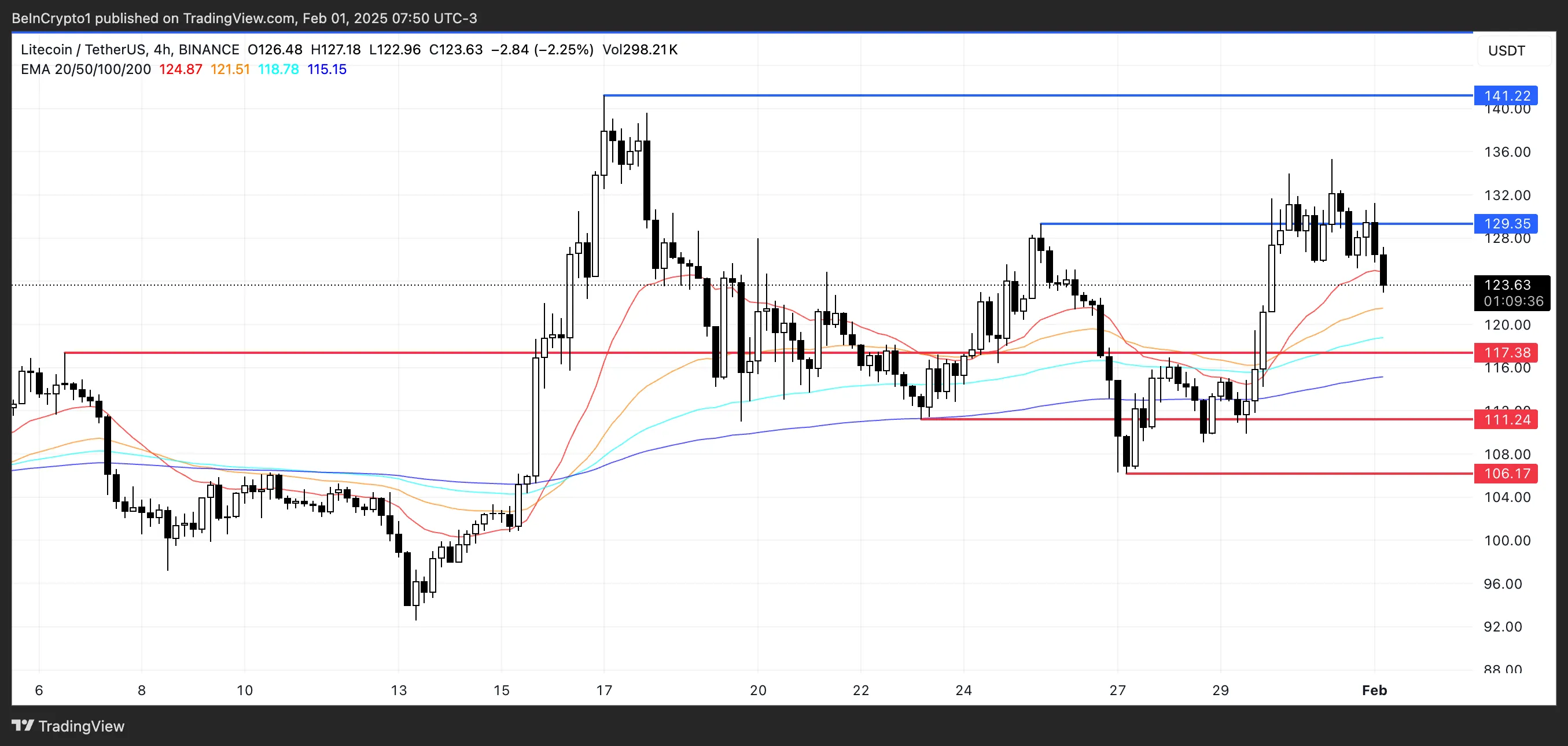

The EMA construction for Litecoin stays bullish total, however the shortest-term EMA is sloping downward. If the development continues, this might result in a demise cross. With LTC at a important level, a breakout might see it acquire 14% to $141, whereas additional weak point might push it down 14% to $106.

Litecoin RSI Is At present Impartial

Litecoin RSI is at the moment at 49.5, down from 69.6 simply two days in the past. This means a shift in momentum as the value dropped 7% within the final 24 hours, even after latest optimistic developments in its ETF functions.

The Relative Power Index (RSI) is a momentum indicator that measures value power on a scale of 0 to 100. Ranges above 70 point out overbought situations, and under 30 counsel oversold situations.

A studying between 40 and 60 usually indicators market consolidation, the place neither patrons nor sellers have clear management.

With LTC now at 49.5 RSI, it sits in a impartial zone, suggesting neither robust bullish nor bearish momentum.

Nevertheless, the sharp drop from near-overbought ranges signifies weakening shopping for stress. If the RSI developments decrease towards 40, this might result in additional declines.

If it stabilizes or strikes again above 50, it could sign renewed shopping for curiosity and potential value restoration.

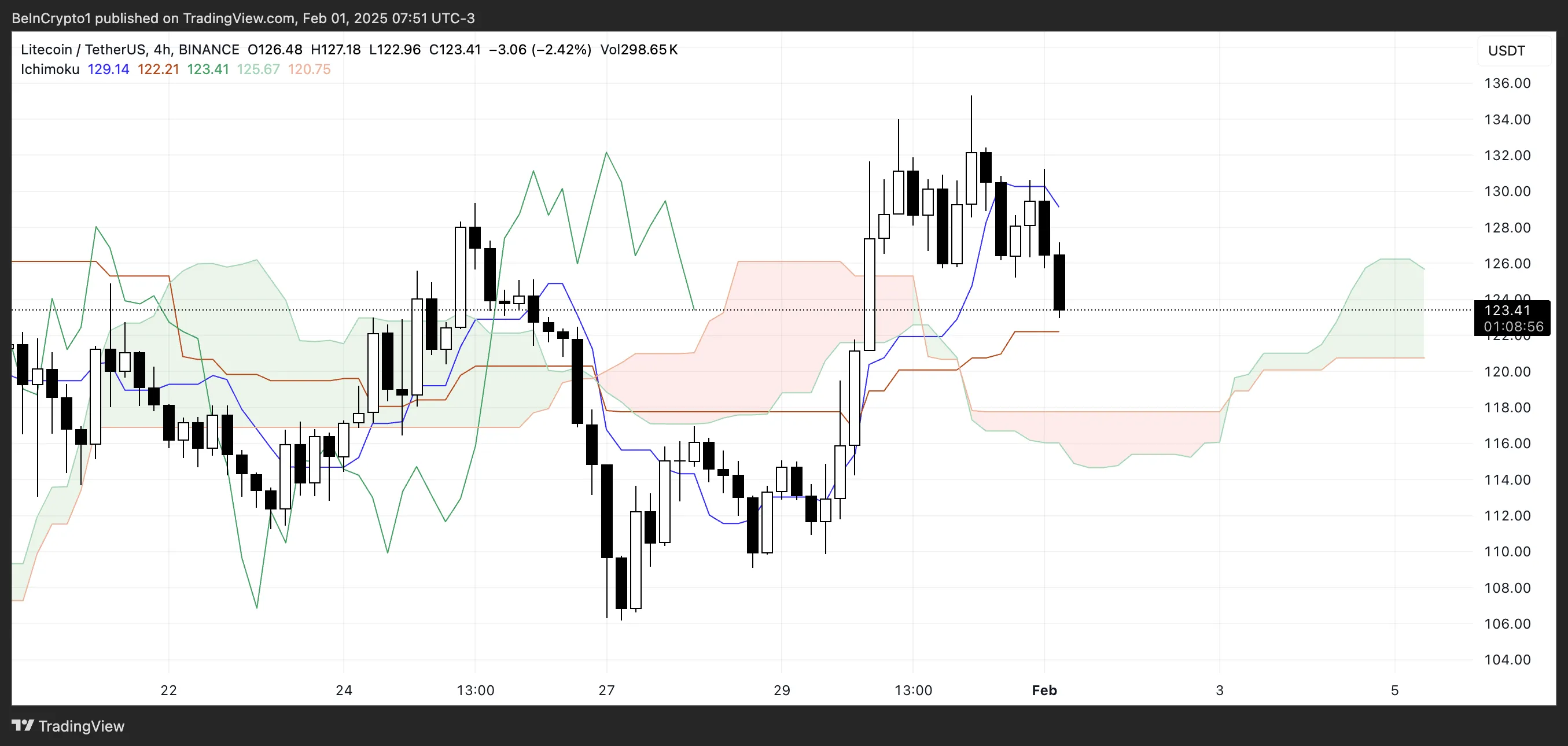

LTC Ichimoku Cloud Exhibits Combined Alerts

LTC value is at the moment transferring downward after failing to carry above the Tenkan-sen (conversion line), which is now sloping downward, indicating a weakening short-term development. The Kijun-sen (final analysis) is comparatively flat, suggesting that value equilibrium is being examined, and a stronger directional transfer could develop quickly.

The worth is approaching the Kumo (cloud), which serves as an vital space for development affirmation. Staying above it will point out continued bullish momentum, whereas breaking under it might sign elevated weak point.

The cloud (Kumo) forward is inexperienced, suggesting that the broader development stays optimistic, however the present value motion close to the cloud’s edge indicators uncertainty. If the Litecoin value finds help close to the cloud, which is between $120 and $126, it might stabilize and try and regain power.

Nevertheless, if it strikes into or under the cloud, it will point out a lack of momentum and potential development reversal. That occurs as a result of value motion contained in the Kumo usually represents consolidation or indecision.

LTC Value Prediction: A 14% Upside or Draw back?

Litecoin’s EMA traces stay bullish, with short-term EMAs nonetheless positioned above the long-term ones. Nevertheless, the shortest-term EMA is beginning to slope downward, signaling weakening momentum.

If it crosses under the longer-term EMAs, it’s going to kind a demise cross, a bearish sign that might result in additional draw back. In that case, the LTC value could take a look at help at $117.

If that stage fails to carry, the value might lengthen its decline to $111 and even $106, marking a possible 14% drop from present ranges.

Alternatively, RSI and the Ichimoku Cloud point out that the general bullish construction continues to be intact, that means Litecoin might nonetheless get well its momentum.

If shopping for stress will increase and the EMAs keep their bullish positioning, LTC might climb towards the $129 resistance stage. A profitable breakout above that stage might push the value increased to $141, representing a possible 14% acquire if momentum strengthens.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.