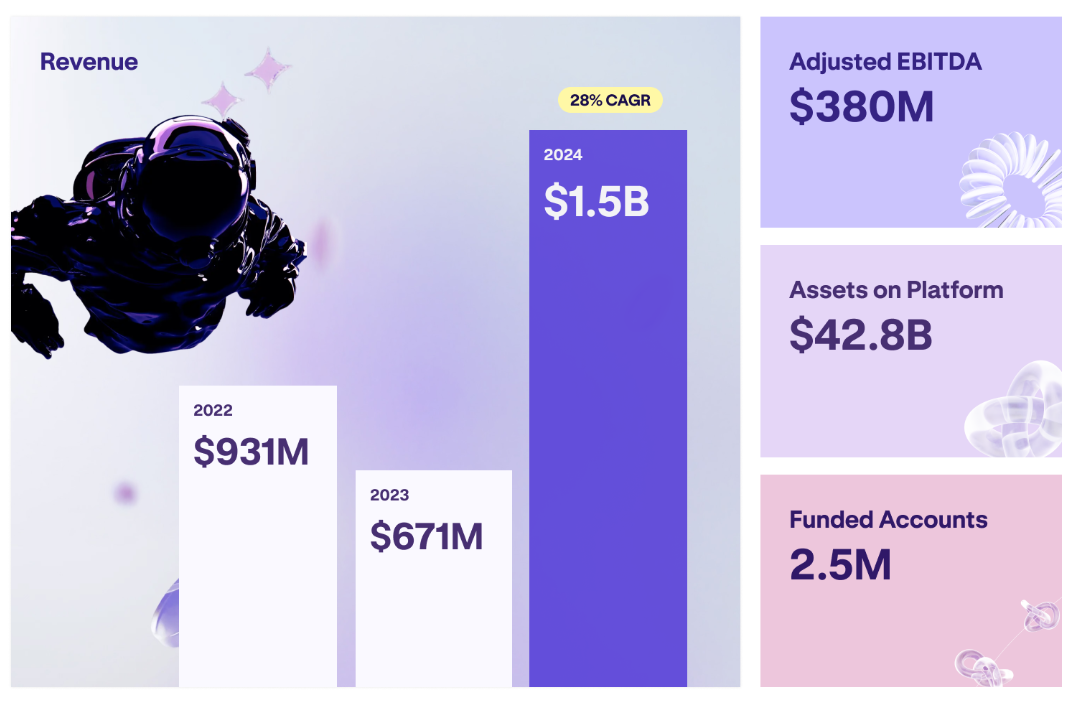

Kraken’s income surged considerably in 2024, reaching $1.5 billion—a rise of 128% yr over yr.

The US-based crypto trade’s monetary success aligns with a broader market upswing, which noticed Bitcoin and different digital property attain new all-time highs.

Kraken’s Buying and selling Quantity Hits $665 Billion

In 2024, the platform reported $380 million in earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA), fueled by $665 billion in buying and selling quantity.

On common, Kraken generated over $2,000 per buyer whereas holding roughly $42.8 billion in property. The platform additionally managed 2.5 million funded accounts, changing into the fifth-largest centralized trade by way of every day buying and selling quantity.

Kraken attributes its success to a long-term development technique reasonably than short-term market tendencies. This focus has helped it dominate the stable-to-fiat on-ramp sector. The trade managed over 40% of the worldwide stable-fiat quantity amongst main centralized exchanges.

The corporate additionally emphasised its dedication to seamless execution, reporting 2.5 billion trades since inception, 99.9% platform uptime, and sub-2ms round-trip latency.

Kraken Co-CEO Arjun Sethi reaffirmed the agency’s dedication to transparency whereas asserting plans to launch quarterly monetary experiences that would come with the trade of proof-of-reserves disclosures.

“At the moment’s monetary highlights are the primary of many as we proceed to prioritize transparency and accountability. We stay dedicated to publishing our Proof of Reserves recurrently, guaranteeing our purchasers’ highest stage of belief,” Sethi added.

Whereas hypothesis a couple of 2025 preliminary public providing (IPO) continues, Kraken has not confirmed any plans. As an alternative, the agency acknowledged that it maintains monetary independence, having raised solely $27 million in major funding since its launch in 2011.

Regulatory Hurdles Persist

Regardless of its sturdy monetary efficiency, Kraken continues to face vital regulatory hurdles within the US.

The trade settled with the SEC in 2023 over its staking companies, resulting in the suspension of the product. Nonetheless, it reintroduced staking for customers in 39 states earlier this week whereas asserting to close down its NFT market in February.

In the meantime, Kraken stays entangled in an SEC lawsuit, which alleges it has been working as an unregistered trade, dealer, and clearing company. The regulator claims Kraken facilitated illegal crypto securities transactions since 2018, producing vital income.

Nonetheless, a current court docket ruling allowed the trade to proceed with its “truthful discover” and “due course of” defenses, although its “main questions doctrine” argument was dismissed.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.