Este artículo también está disponible en español.

Bitcoin is now retesting the psychological $100,000 worth degree once more after a 2.22% decline prior to now 24 hours. Notably, Bitcoin lately rebounded round an order block at $99,200 prior to now 24 hours because it continues to commerce with intense volatility.

In the meantime, crypto analyst Ali Martinez has pointed to $97,190 as a key assist degree, stressing that Bitcoin should keep above it to keep up its bullish trajectory. This perception comes amidst sharp worth swings which have examined investor sentiment, however optimism stays robust as knowledge signifies many merchants proceed to wager on Bitcoin’s upward trajectory.

Bitcoin’s Key Assist Stage Recognized At $97,190

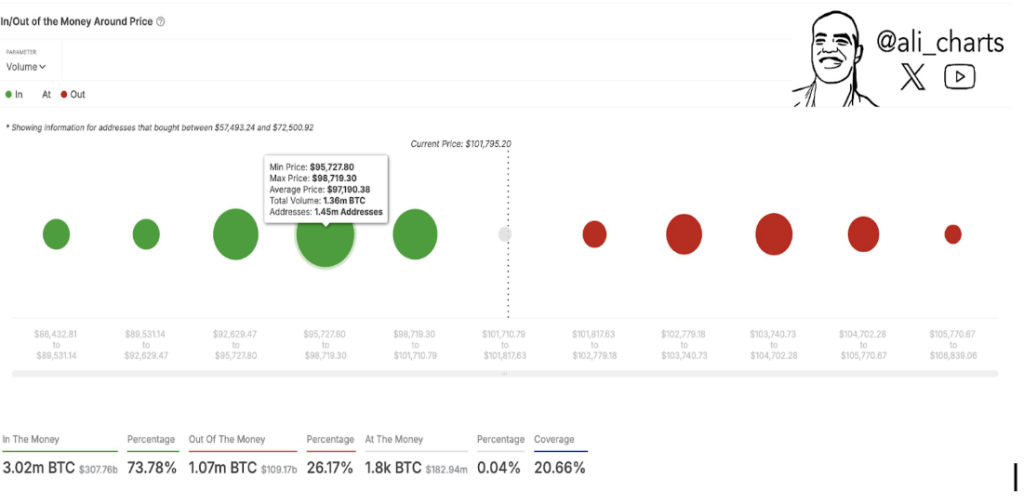

As Martinez famous, $97,190 is without doubt one of the most crucial assist ranges for Bitcoin, and holding above it’s essential to sustaining the bull market. This perception is backed by knowledge from on-chain analytics platform IntoTheBlock. Significantly, the information is revealed by means of the In/Out Of Cash Round Worth metric from IntoTheBlock, which tracks the variety of addresses making or dropping cash on the present worth of a crypto asset.

Associated Studying

Within the case of Bitcoin, about 73% of addresses that purchased Bitcoin on the present buying and selling vary are in revenue. A good portion of those, roughly 1.45 million addresses, purchased Bitcoin between $95,727 and $98,719 at a mean worth of $97,190. These addresses collectively maintain about 1.36 million BTC round this degree, making it some of the densely concentrated areas of holdings within the present cycle.

Given this focus of holdings, Bitcoin should preserve its place above $97,190 to protect its bullish momentum and maintain sentiment constructive amongst merchants. A break under this degree may push many of those holders towards break-even, growing the probability of panic promoting. This might, in flip, set off additional draw back stress and create a cascading impact on the Bitcoin worth.

Picture From X: Ali_charts

Binance Futures Information Reveals Sturdy Bullish Sentiment

Regardless of considerations surrounding Bitcoin’s means to keep up its assist, market sentiment amongst merchants stays largely optimistic. Notably, open positions on Binance, the world’s largest crypto change, present {that a} important majority of merchants proceed to wager on additional upside.

In line with knowledge from Coinglass, 60.94% of merchants on Binance, the most important crypto change, with open Bitcoin futures positions are betting on the upside.

Additional reinforcing the bullish outlook, Martinez additionally pointed to a purchase sign from the TD Sequential indicator, which has appeared on Bitcoin’s four-hour chart. This technical software has been instrumental in figuring out development reversals all through this cycle, usually previous notable worth recoveries.

Associated Studying

If the sample holds true once more, Bitcoin may expertise renewed shopping for stress within the coming days, doubtlessly setting the stage for a retest of the $106,000 degree.

On the time of writing, Bitcoin is buying and selling at $99,403, down by 2.35% prior to now 24 hours.

Featured picture from Neon Desires, chart from TradingView