- XRP has rallied 30% after a latest market crash, however bearish on-chain knowledge and low open curiosity pose challenges to sustained restoration.

- Whale transactions and realized earnings hit historic highs through the crash, with $103 million in futures liquidations recorded over the previous 24 hours.

- XRP is eyeing a transfer previous $3.00, with potential upside towards $3.40 and $3.55 if key resistance ranges and trendlines are damaged.

Ripple’s XRP is making headlines after leaping 30% early Tuesday, with bulls exhibiting indicators of a possible restoration from the latest crypto market crash. Regardless of bearish on-chain knowledge, market watchers imagine that if momentum holds, XRP might push previous the essential $3.00 psychological barrier, setting the stage for additional positive factors.

On-Chain Information: Promoting Frenzy Throughout Market Crash

XRP’s latest rally follows a interval of intense market turbulence triggered by former President Trump’s announcement of latest tariffs on Canada, Mexico, and China. Over the past three days, XRP traders realized almost $2 billion in earnings—one of many largest spikes within the community’s historical past.

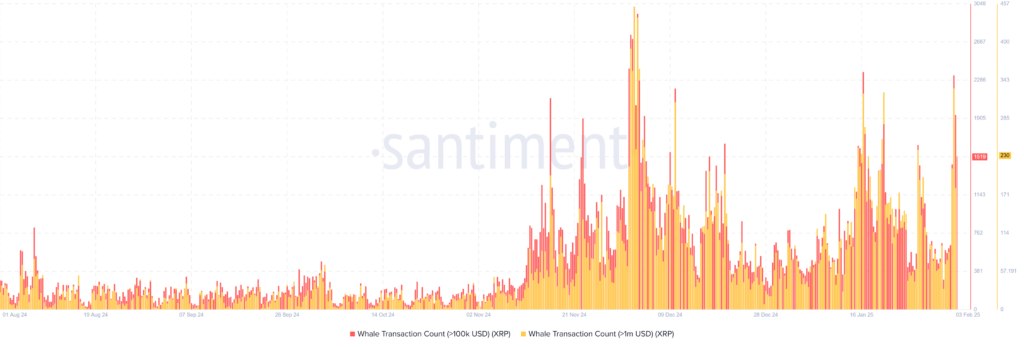

Whale exercise has been significantly pronounced. Massive transactions, each from long-term and short-term holders, surged through the crash, as seen by the rise in Dormant Circulation and whale transactions exceeding $100K and $1M.

In the meantime, Weighted Sentiment, a metric that displays social quantity versus optimistic and adverse sentiment, dropped to ranges final seen in November. Funding charges for XRP derivatives additionally hit lows not seen since August, based on Coinglass knowledge. Curiously, excessive adverse sentiment typically precedes worth reversals, which might clarify XRP’s 30% bounce-back.

supply: Sentiment

Bulls Face Hurdles Regardless of Momentum

Regardless of the sharp rally, XRP’s Open Curiosity—which tracks the variety of excellent by-product contracts—stays sluggish. It fell from 2.05 billion XRP to 1.50 billion, signaling that many traders are nonetheless hesitant to carry massive positions.

For XRP to maintain this restoration, bulls might want to re-enter the market in higher pressure. With out renewed curiosity and better open curiosity ranges, the rally might lose steam.

supply: Sentiment

Reclaiming $3.00: The Subsequent Main Goal

XRP’s worth briefly plummeted under the $2.00 degree on Monday, triggering over $103 million in futures liquidations—the best single-day liquidation occasion within the present market cycle. Of that, $74.67 million got here from liquidated lengthy positions, whereas $28.28 million got here from shorts.

Now, XRP is trying to interrupt again above $3.00. If profitable, the following goal is the seven-year excessive resistance degree of $3.40. Clearing this barrier would pave the best way for XRP to probably attain a brand new all-time excessive above $3.55.

Nonetheless, XRP faces a descending trendline resistance that has been energetic since January 16. Bulls might want to overcome this resistance, alongside the $3.40 mark, to proceed the rally.

Technical Indicators Level to Constructing Momentum

On the technical aspect, indicators are turning bullish. The Relative Energy Index (RSI) is transferring upward, indicating elevated shopping for stress. The Stochastic Oscillator (Stoch) has additionally crossed above its impartial degree, additional reinforcing the bullish outlook.

Nonetheless, warning is warranted. If XRP fails to keep up assist above $1.96, the bullish thesis might be invalidated, placing the token prone to additional declines. Merchants can be watching intently for a day by day candlestick shut to substantiate whether or not the present rally can maintain itself.