Bitcoin (BTC) has recorded large volatility during the last a number of weeks, rising previous the $100,000 milestone solely to retrace to the $90,000 vary. This has sparked debate over whether or not the crypto market has topped, drawing opinions from numerous analysts and merchants.

Regardless of market fluctuations, many stay optimistic concerning the future trajectory of Bitcoin and altcoins, whereas others warning in opposition to unchecked bullish sentiment.

Optimism for Q1 and Bitcoin’s Bullish Development

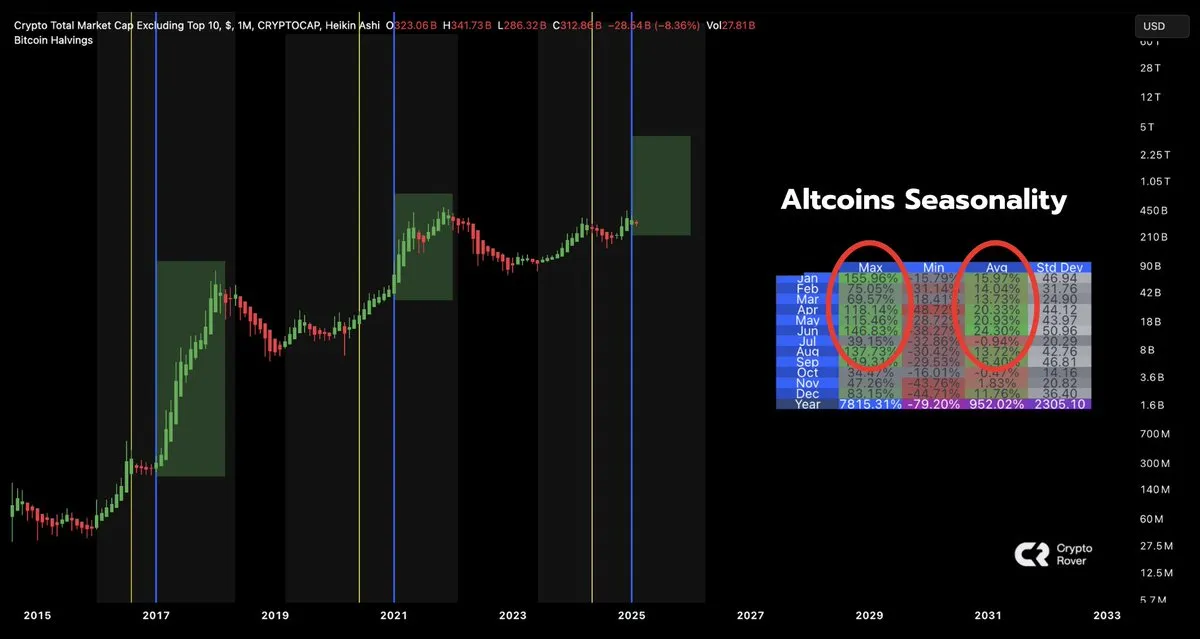

Crypto Rover stays assured that historical past will repeat itself, sustaining that Bitcoin’s worth goal stays steadfast at $175,000. In accordance with the famend analyst, a bullish breakout is imminent.

“Q1 is at all times bullish for altcoins. This time won’t be any completely different. I belief historical past,” Rover remarked.

In the meantime, some analysts urge traders to shift their focus away from short-term market tops. As a substitute, they need to consider figuring out robust communities with longevity, citing a “battle of attrition” within the crypto area.

HODL Protocol reinforces that momentum ought to information decision-making slightly than an obsession with whether or not the market has peaked. Their recommendation is to remain adaptable and concentrate on long-term features.

In the identical tone, Crypto Nova, a seasoned investor, cautions in opposition to making an attempt to time market tops. As a substitute, she recommends taking earnings progressively, no matter whether or not the market continues to rise. This technique, she argues, will in the end outperform most merchants.

“Hear it from somebody that has been right here for fairly some time: Don’t ever attempt to time to the highest on something. Not on Bitcoin, not in your favourite alts, not on something. Ultimately, the purpose is to take earnings earlier than the highest of the market occurs. Regardless if it retains operating or not. Try this and also you’ll outperform nearly anybody on this total area,” the analyst quipped.

Trump’s Affect on Bitcoin and the Crypto Market

Elsewhere, analyst Crypthoem presents an intriguing principle concerning the Trump household’s affect on the crypto market. He means that strategic bulletins concerning tariffs and liquidity occasions have been used to depress altcoin costs, making Ethereum (ETH) a beautiful purchase for main traders.

“Launch TRUMP Sucks liquidity out of all alts, permits world liberty fi to purchase low-cost ETH. Launch MELANIA Dumps all alts, permits world liberty fi to purchase low-cost ETH. Saying tariffs causes a liquidation cascade in an already weak altcoin market, permitting the world liberty fi to purchase low-cost ETH. Calls of tariffs baggage have been stuffed,” Hoem wrote.

This principle implies that these occasions create shakeouts that in the end profit well-positioned gamers.

Nachi, a high dealer on Binance, sees a sample in Trump’s market affect. He suggests the latest tariff information was a deliberate political maneuver to create a disaster, shake out merchants, and permit main traders to build up Ethereum at decrease costs. He believes this cycle will repeat with China, resulting in additional shakeouts earlier than one other main worth rally.

Ran Neuner, founding father of Crypto Banter, reiterates this allusion, referencing Eric Trump’s tweet suggesting, “It’s a good time so as to add ETH.” The tweet was later edited, main analysts like Duo 9 to take a position about potential insider information.

“The Trumps are the final word KOL,” Neuner remarked.

Nonetheless, The DeFi Investor counters this view, arguing that Trump’s DeFi venture had already bought over $100 million price of Ethereum earlier than Trump’s tariff announcement. This implies their holdings additionally suffered.

Warning Amid Market Uncertainty

Regardless of the optimism, some analysts are urging warning. Andrew Kang believes the latest rally was an enormous mechanical bounce and advises merchants to take earnings whereas they will.

“Huge mechanical bounce immediately. In case you made good earnings, IMO it’s a great spot to safe them. Simple mode is over for alts. Imply reversion consumers flip into imply reversion sellers. There shall be extra nice shopping for alternatives in February/March,” Kang suggested.

In the identical tone, Binaso advises merchants to money out earnings into their financial institution accounts as an alternative of stablecoins or different crypto belongings. The analyst encourages a disciplined method to securing features. Others add to the skepticism, highlighting extreme leverage available in the market as merchants have been front-running Bitcoin’s rise since $15,000. However, with open curiosity nonetheless at excessive ranges, probabilities of a correction stay excessive.

Sachin Sharma, a market analyst, refutes the notion of an imminent crash. He factors out that true market tops are usually marked by extreme hypothesis and unsustainable valuations, which, in his view, haven’t but materialized. He additionally argues that AI-driven improvements usually tend to gasoline progress than trigger a downturn.

“Market tops close to when IPO and speculative progress tech goes up with no income to again. As a sector, tech monetary metrics are nonetheless inside 1-sigma to imply. And BTW the entire AI saga which is main the market to dip immediately comes with a promise that you should utilize AI to enhance productiveness, merchandise, money cycle, decrease prices, and better revenues,” the analyst challenged.

Nonetheless, Evanss6 takes a agency stance, estimating a 90-95% likelihood the cycle has topped.

As the talk over whether or not the crypto market has topped stays extremely contentious, merchants should navigate the market cautiously. Balancing optimism with danger administration methods to maximise features in the end, however traders should additionally conduct their very own analysis.

BeInCrypto knowledge exhibits BTC was buying and selling for $98,900 as of this writing, up by over 5% since Tuesday’s session opened.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.