Este artículo también está disponible en español.

Within the aftermath of yesterday’s Bitcoin crash, market individuals are intently analyzing whether or not the main cryptocurrency by market capitalization can rebound or if it faces the prospect of one other decline. In a put up shared on X as we speak, February 4, on-chain evaluation knowledge supplier Lookonchain supplied insights into 5 important indicators which will assist merchants and buyers assess Bitcoin’s present place.

“The value of Bitcoin skilled a serious crash yesterday! Will it proceed to rise or fall from the highest? Let’s use 5 indicators to see if BTC is at its peak now,” Lookonchain writes.

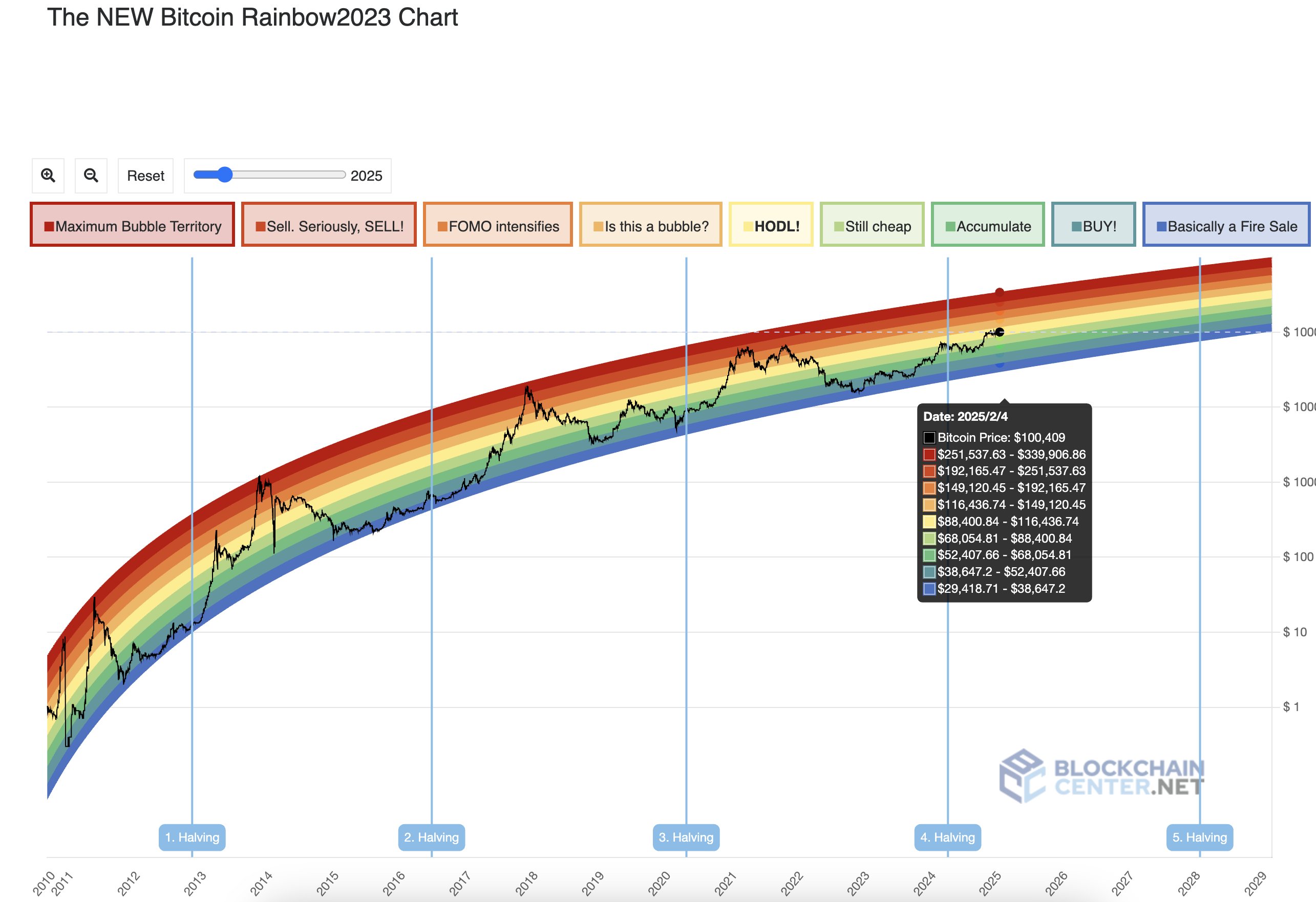

#1 Bitcoin Rainbow Chart

Described by Lookonchain as “a long-term valuation device that makes use of a logarithmic progress curve to forecast the potential future worth route of BTC,” the Rainbow Chart is commonly employed to gauge whether or not Bitcoin is likely to be undervalued, overvalued, or approaching a key turning level. “The NEW Bitcoin Rainbow2023 Chart exhibits you could nonetheless maintain BTC, and BTC will prime above $250K this cycle.”

Associated Studying

Whereas this chart suggests a bullish long-term trajectory, its forecasts are primarily based on historic worth patterns and will not account for unexpected market occasions. Nonetheless, Lookonchain’s knowledge signifies a view that Bitcoin has but to succeed in its cycle peak.

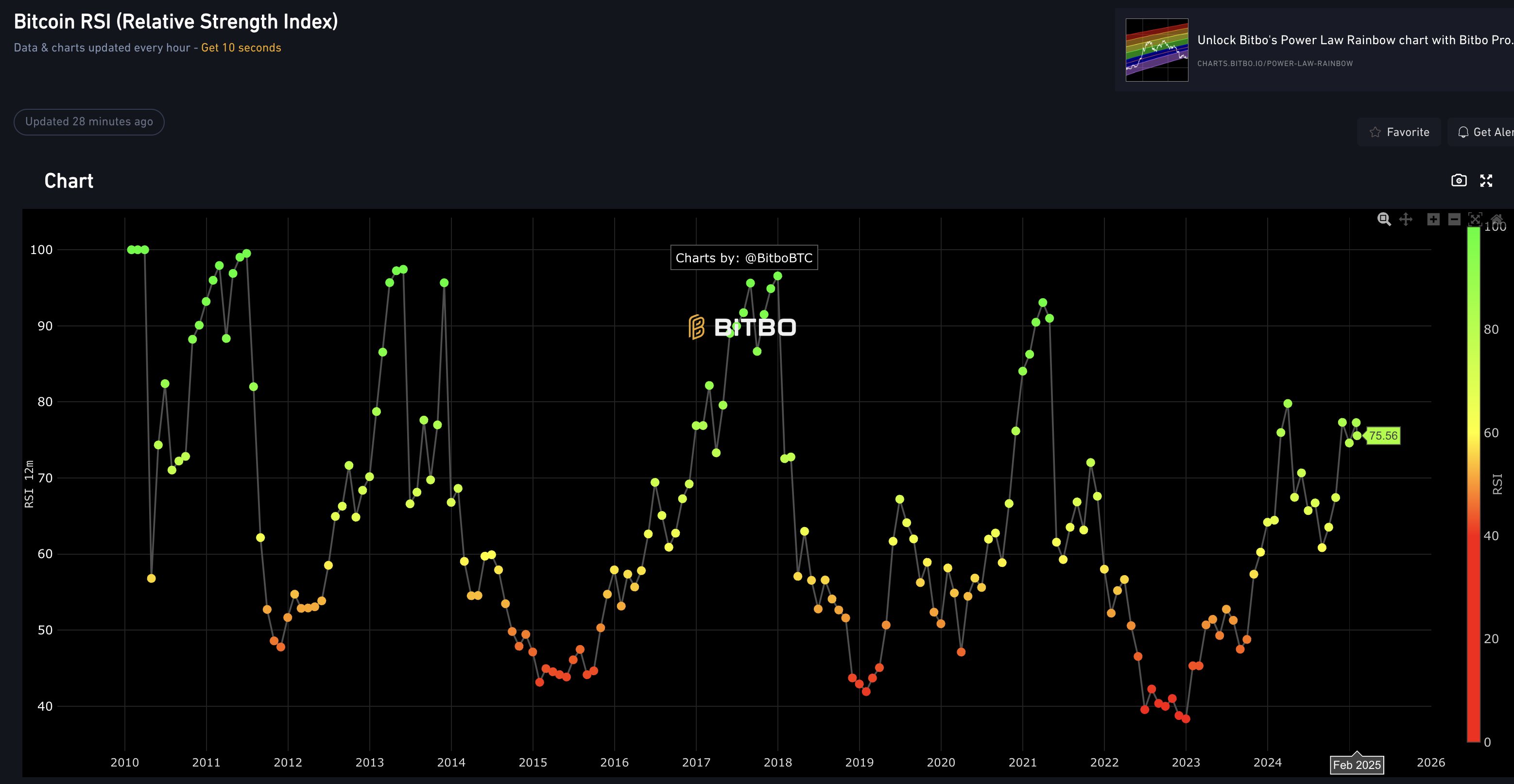

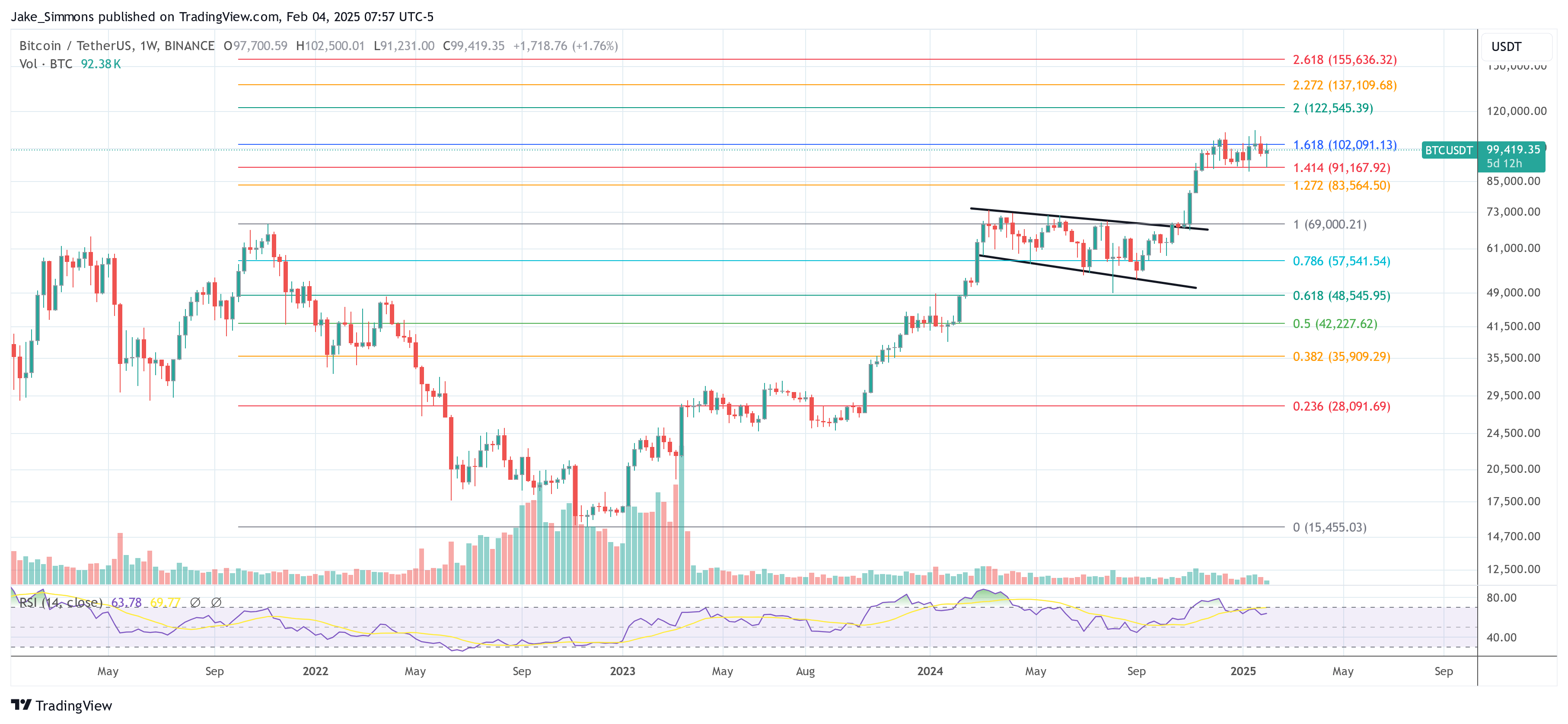

#2 Relative Energy Index (RSI)

The RSI is a technical indicator measuring the magnitude of current worth adjustments to judge overbought or oversold circumstances.“≥ 70: BTC is overbought and will quickly fall. ≤ 30: BTC is oversold and will quickly enhance. The present RSI is 75.56, in contrast with earlier knowledge, plainly BTC has not but reached its peak.”

An RSI studying above 70 usually raises issues {that a} correction could also be due. Nevertheless, Lookonchain’s statement underscores their view that regardless of the excessive RSI, historic knowledge doesn’t essentially verify a definitive market prime.

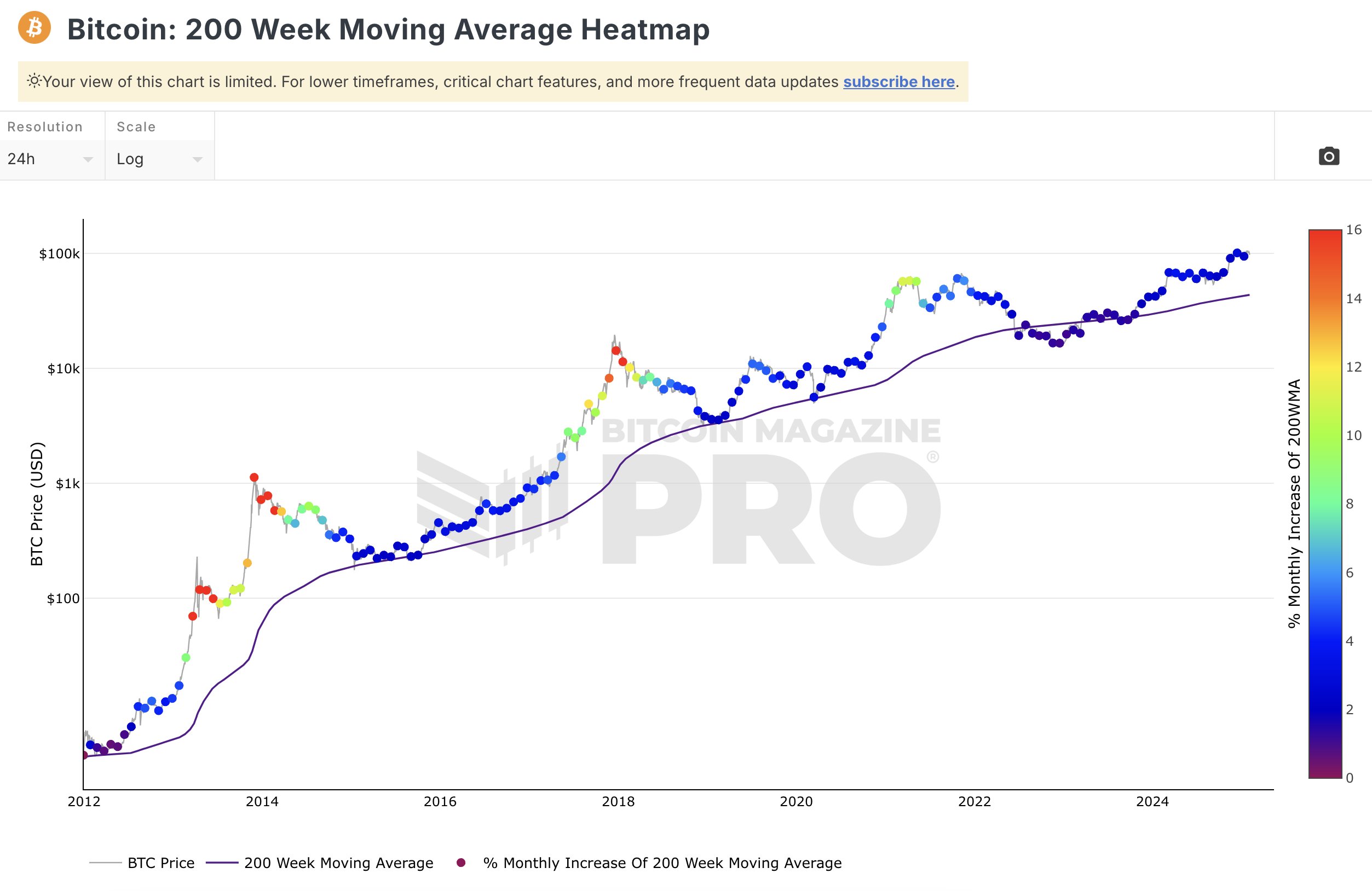

#3 200 Week Shifting Common (200W MA) Heatmap

Merchants typically reference the 200W MA as a foundational help or resistance stage. Its heatmap variation charts the broader momentum and potential inflection factors over a multi-year interval. “The 200 Week Shifting Common Heatmap exhibits that the present worth level is blue, which signifies that the value prime has not been reached but, and it’s time to maintain and purchase.”

Associated Studying

A “blue” studying on the heatmap implies the market has not displayed the height indicators noticed in prior cycles. Whereas some may view this as indicative of additional potential upside, others stay cautious given macroeconomic uncertainties.

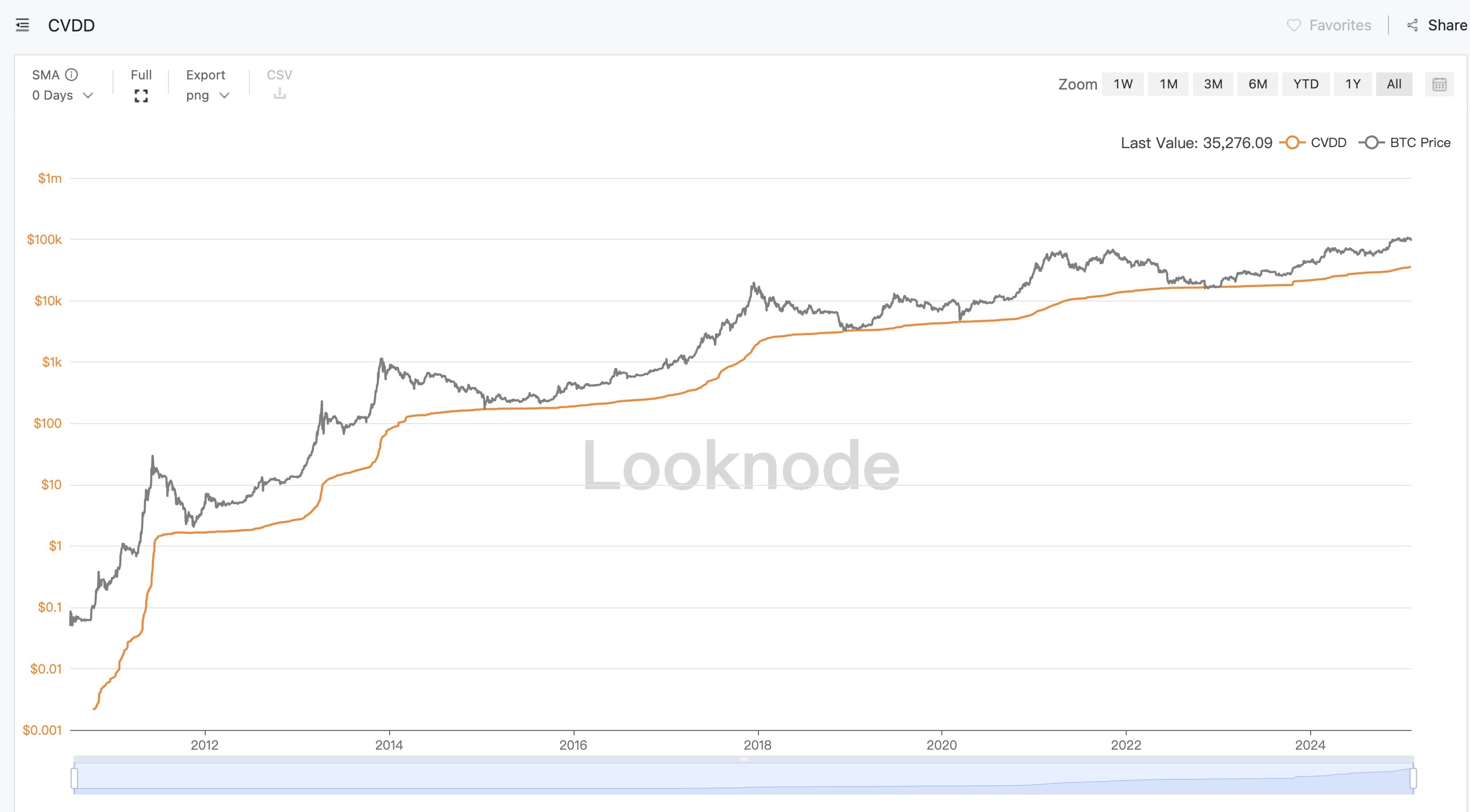

#4 Bitcoin Cumulative Worth Coin Days Destroyed (CVDD)

Coin Days Destroyed is a long-standing on-chain metric that focuses on how lengthy BTC has remained in a specific pockets earlier than being moved. CVDD aggregates this knowledge over time, aiming to pinpoint factors the place Bitcoin is likely to be undervalued or overvalued. “When the BTC worth touches the inexperienced line, the $BTC worth is undervalued and it’s a good shopping for alternative. The present CVDD exhibits that the highest of $BTC doesn’t appear to have been reached but.”

In response to Lookonchain, Bitcoin’s place relative to this metric implies that the market has not encountered the traditionally noticed prime circumstances, suggesting the potential of additional upward momentum.

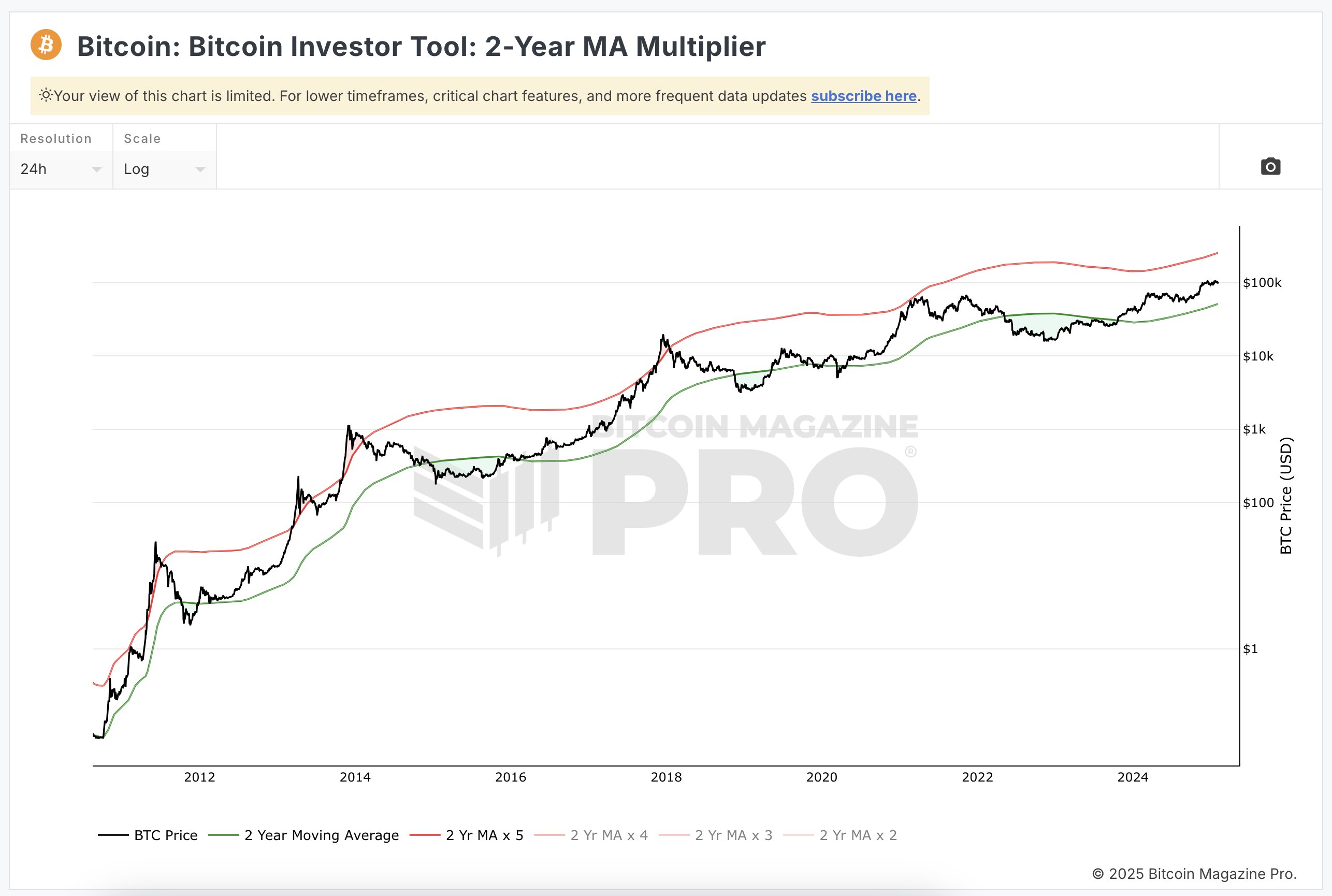

#5 2-12 months MA Multiplier

The two-12 months Shifting Common Multiplier is one other broadly referenced mannequin that compares Bitcoin’s present worth to its two-year shifting common. “The two-12 months MA Multiplier exhibits that the value of $BTC is in the course of the pink and inexperienced strains. It has not touched the pink line and the market has not reached the highest but.”

Traditionally, Bitcoin’s worth nearing or surpassing the higher pink line has typically coincided with cycle peaks. Since Bitcoin stays in a mid-range place, the information suggests {that a} prime could not have materialized but—although this doesn’t eradicate the chance of additional volatility.

Total, Lookonchain’s evaluation, primarily based on these 5 indicators, factors to a conclusion that the highest of Bitcoin’s present market cycle could stay undiscovered.

At press time, BTC traded at $99,419.

Featured picture created with DALL.E, chart from TradingView.com