Raydium’s (RAY) value has rebounded greater than 10% after the Monday morning crash, pushing its market cap near $2 billion. Technical indicators at the moment are exhibiting indicators of a possible bullish continuation.

RAY’s income and buying and selling quantity stay among the many highest, reinforcing its place as a number one Web3 protocol. Whether or not RAY can maintain this momentum or face one other downturn will rely on its potential to carry key help ranges and make sure an uptrend.

Raydium Is One in every of The Largest Blockchain Purposes In The Market

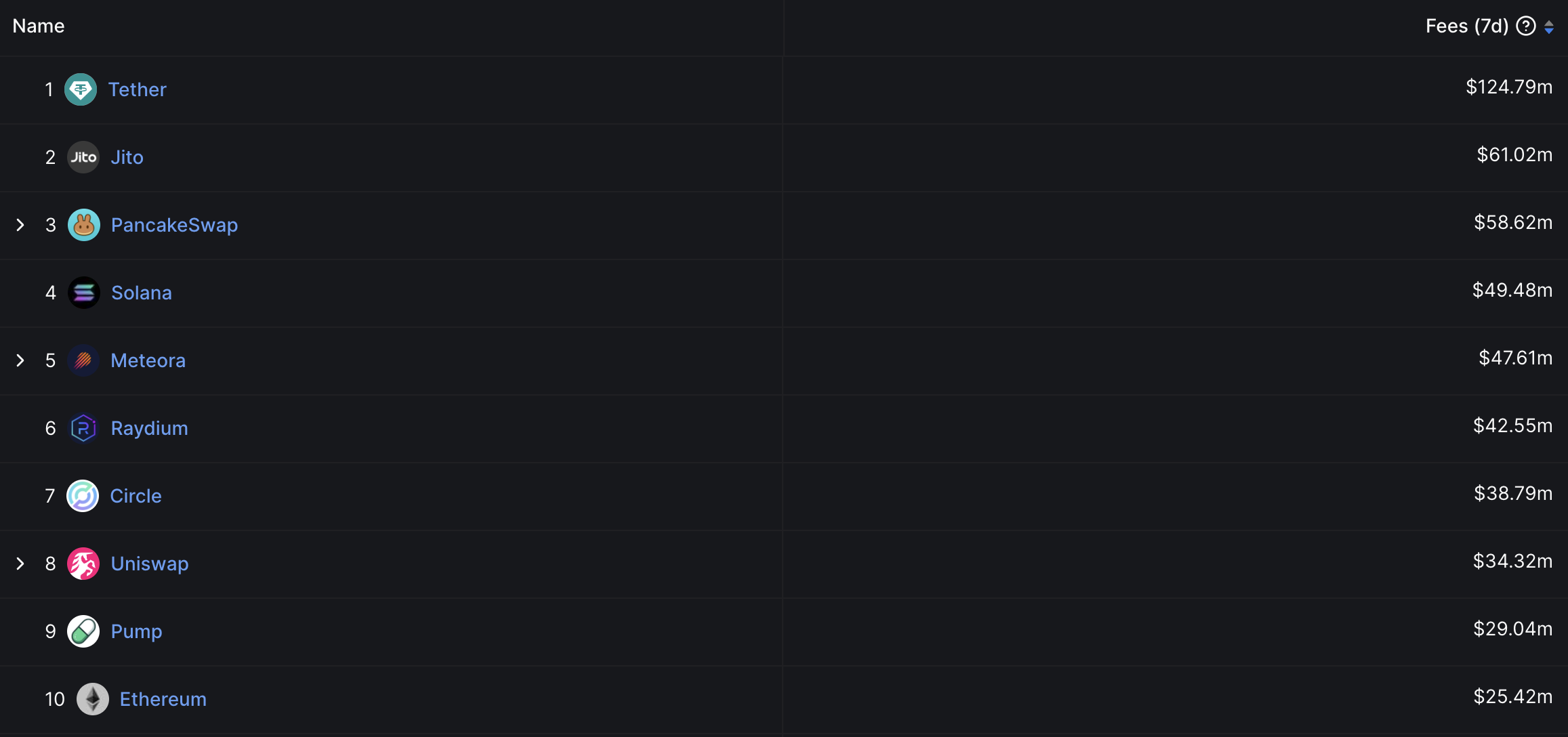

Raydium has emerged as one of many high revenue-generating blockchain protocols, bringing in over $42 million within the final seven days. This places it forward of main gamers like Circle, Uniswap, and even Ethereum by way of earnings.

Over the previous yr, Raydium has generated practically $1 billion in income, coming remarkably near Solana’s $965 million.

When it comes to buying and selling quantity, Raydium has dealt with round $3.4 billion within the final 24 hours and $21 billion over the previous week, solidifying its place as probably the most used Web3 tasks ever.

RAY RSI Is Recovering After Hitting Oversold Ranges

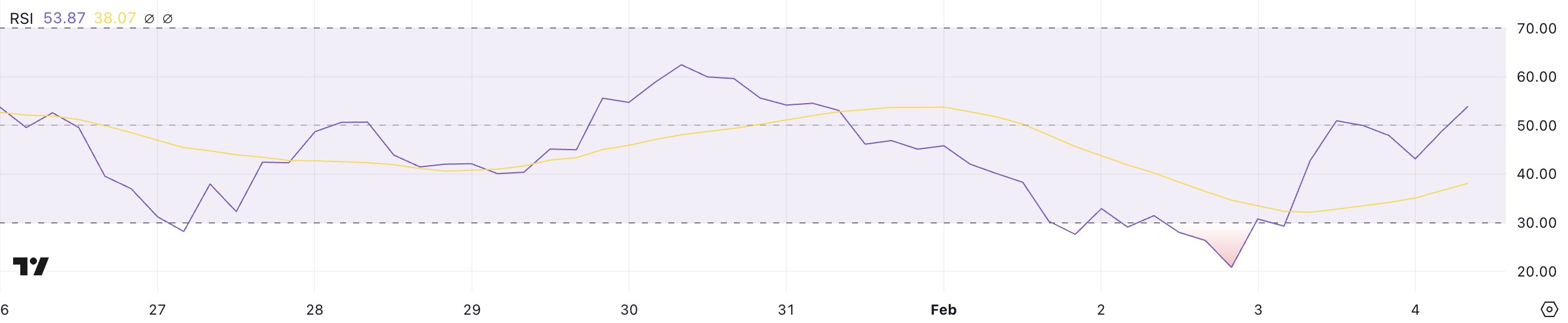

Raydium’s RSI is at the moment at 53.87, rising sharply from 20.8 simply two days in the past. The Relative Power Index (RSI) measures momentum by monitoring current value actions, with values under 30 indicating oversold circumstances and above 70 signaling overbought ranges.

The current bounce suggests that purchasing stress has elevated, bringing Raydium out of oversold territory and right into a extra impartial vary.

At 53.87, Raydium’s RSI is neither strongly bullish nor bearish, leaving room for additional value motion in both route. Notably, RAY hasn’t touched the 70 ranges, which might point out overbought circumstances, since January 19.

This implies that whereas the asset has seen renewed energy, it hasn’t but entered a powerful bullish section. The subsequent pattern affirmation will rely on whether or not the RSI continues to rise or stall at present ranges.

RAY Worth Prediction: A Additional 33% Upside?

Raydium’s value just lately corrected by 34% between January 30 and February 3 however has since rebounded practically 30%. Its EMA strains counsel {that a} golden cross, the place the shortest-term shifting common crosses above the longer-term ones, might be forming quickly.

If this occurs, RAY value may proceed its restoration, with a powerful uptrend probably pushing it to retest $7.92. A breakout above that stage may result in additional beneficial properties, with $8.7 as the subsequent main goal, representing a attainable 33% upside.

Nonetheless, if RAY fails to take care of its momentum, it may check help at $5.85, with a breakdown resulting in $5.36. A deeper sell-off may see it drop additional to $4.71 and even $4.14, marking its lowest stage since January 13.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.