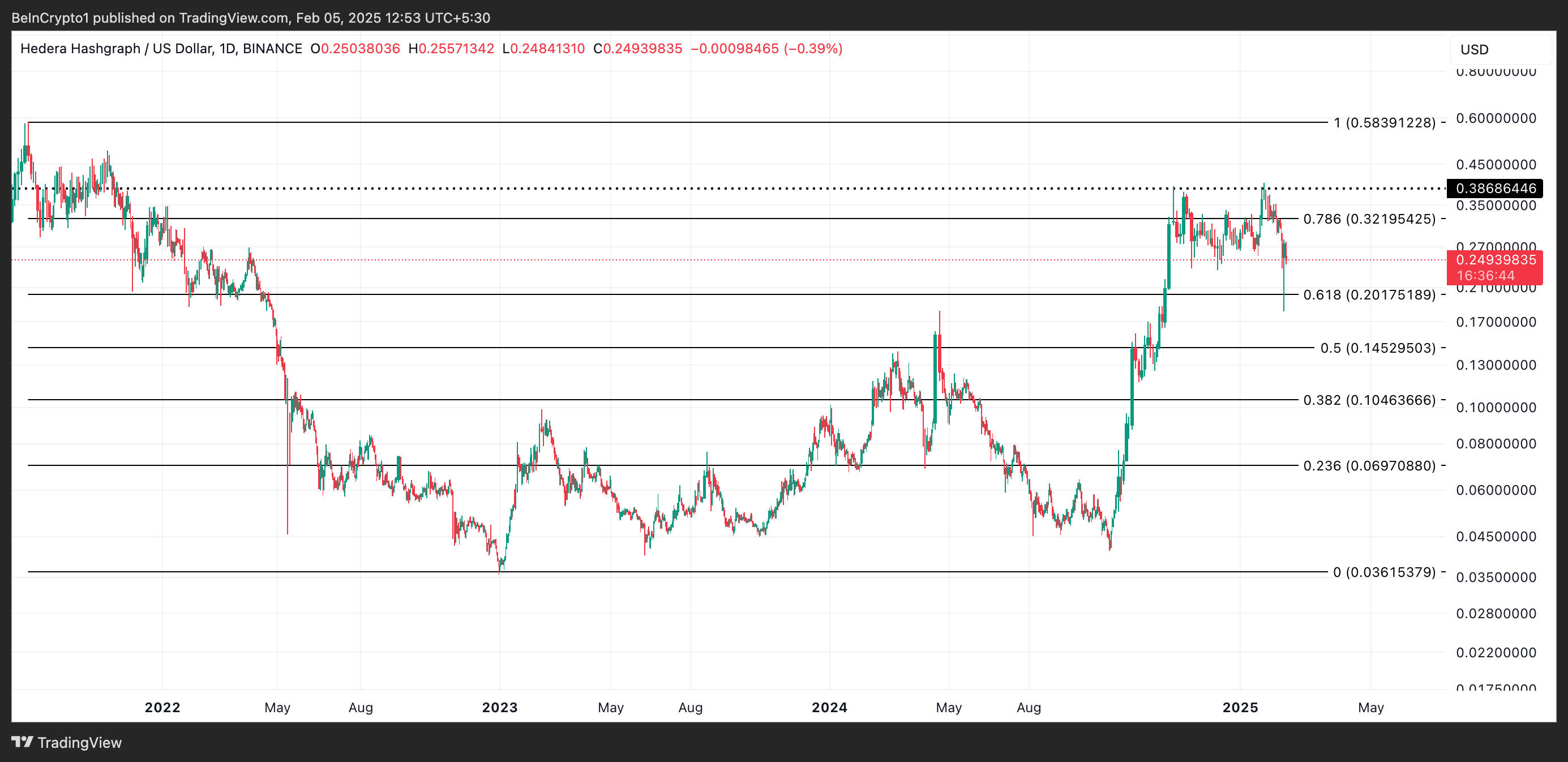

HBAR’s value has struggled to keep up momentum after reaching a four-year excessive of $0.41 on January 17. Since then, the token has been on a gentle downtrend, shedding 39% of its worth.

The altcoin dangers slipping under the important $0.20 mark as brief merchants dominate the futures market.

Hedera Quick Merchants Name the Pictures

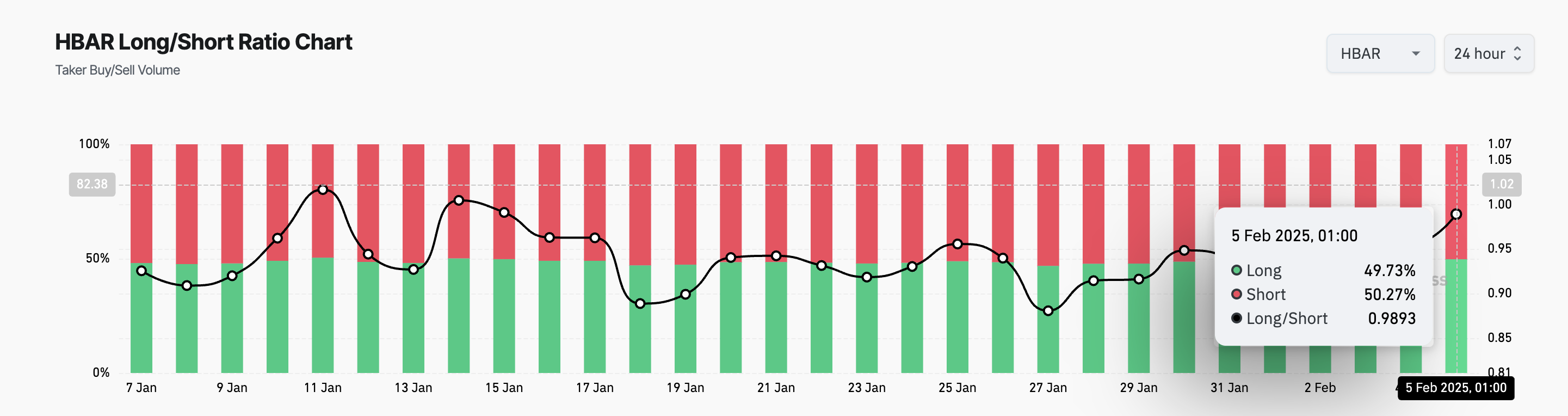

HBAR’s lengthy/brief ratio highlights the bearish bias towards the altcoin in its futures market. At press time, the metric stands under one at 0.98.

This ratio compares the variety of lengthy positions (bets that the worth will rise) to brief positions (bets that the worth will fall) in a market. When an asset’s lengthy/brief ratio is above 1, there are extra lengthy than brief positions, indicating that merchants are predominantly betting on a value enhance.

Conversely, as with HBAR, when the ratio is under one, extra merchants are betting on a value decline. This implies a powerful bearish sentiment available in the market, with expectations of additional draw back.

Notably, technical indicators reinforce this outlook. HBAR trades under its Ichimoku Cloud on the each day chart, indicating poor demand and downward momentum.

The Ichimoku Cloud tracks the momentum of an asset’s market developments and identifies potential help/resistance ranges. When an asset trades under this cloud, it displays the downtrend. On this state of affairs, the cloud acts as a dynamic resistance zone, reinforcing the probability of continued decline if the worth stays under it.

HBAR Value Prediction: Weak Shopping for Stress May Push It to $0.14

The setup of HBAR’s Shifting Common Convergence Divergence (MACD) confirms the low shopping for stress amongst its merchants. At press time, the MACD line (blue) rests under the sign (yellow) and nil strains.

An asset’s MACD indicator identifies developments and momentum in its value motion. It helps merchants spot potential purchase or promote alerts by crossovers between the MACD and sign strains. When arrange this manner, promoting exercise dominates the market, hinting at additional value drops.

If HBAR selloffs proceed, its value might drop to $0.20. If bearish stress positive factors momentum at this level, its worth might decline additional to $0.14, a low final reached in November.

However, if the bulls regain dominance and drive up the demand for the altcoin, HBAR’s value might climb to $0.32.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.