Ethereum has made a restoration to $2,800 throughout the previous day as on-chain knowledge exhibits the whales have been making huge withdrawals from exchanges.

Ethereum Alternate Outflows Spiked After Value Crash

In accordance with knowledge from the market intelligence platform IntoTheBlock, traders reacted to the newest crash within the Ethereum value by making outflows from exchanges.

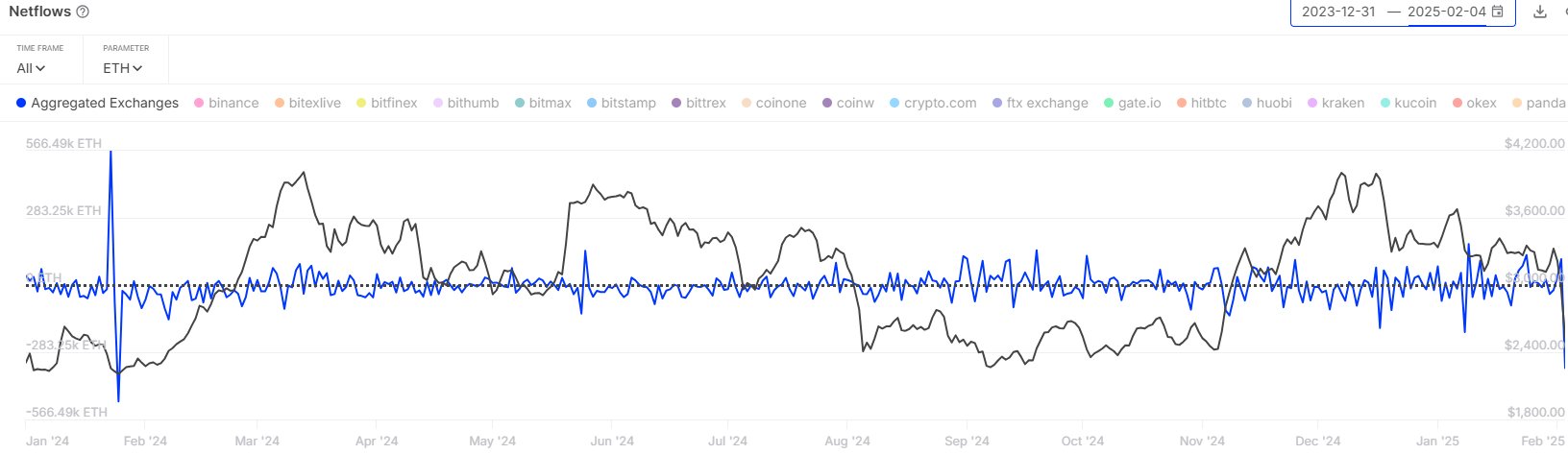

The on-chain indicator of relevance right here is the “Alternate Netflow,” which retains monitor of the online quantity of the cryptocurrency that’s getting into into or exiting the wallets related to all centralized exchanges.

When the worth of this metric is constructive, it means the holders are depositing a internet variety of cash into these platforms. As one of many principal the explanation why traders switch to the exchanges is for selling-related functions, this type of development is usually a bearish signal for the asset’s value.

However, the indicator being unfavourable suggests the outflows outweigh the inflows and a internet variety of tokens is shifting out of the exchanges. Such a development can point out that the traders are accumulating, which is one thing that may naturally be bullish for ETH.

Now, here’s a chart that exhibits the development within the Ethereum Alternate Netflow over the previous yr:

As is seen within the above graph, the Ethereum Alternate Netflow noticed a large unfavourable spike yesterday after the crash within the asset’s value happened.

In complete, the traders withdrew 350,000 ETH (price round $982 million on the present trade price of the token) from the exchanges on this outflow spree. “That is the very best quantity of internet trade withdrawals since January 2024!” notes the analytics agency.

Given the timing of the outflows, it will seem possible that they had been made by whales trying to purchase Ethereum at low-cost post-crash costs. The buildup from the traders has in flip helped the cryptocurrency attain a backside and make some restoration.

The Alternate Netflow might now be to regulate within the coming days, because the upcoming development in it may additionally affect the ETH value. Naturally, a continuation of the outflows can be a constructive signal, whereas a rise in inflows might spell a bearish final result.

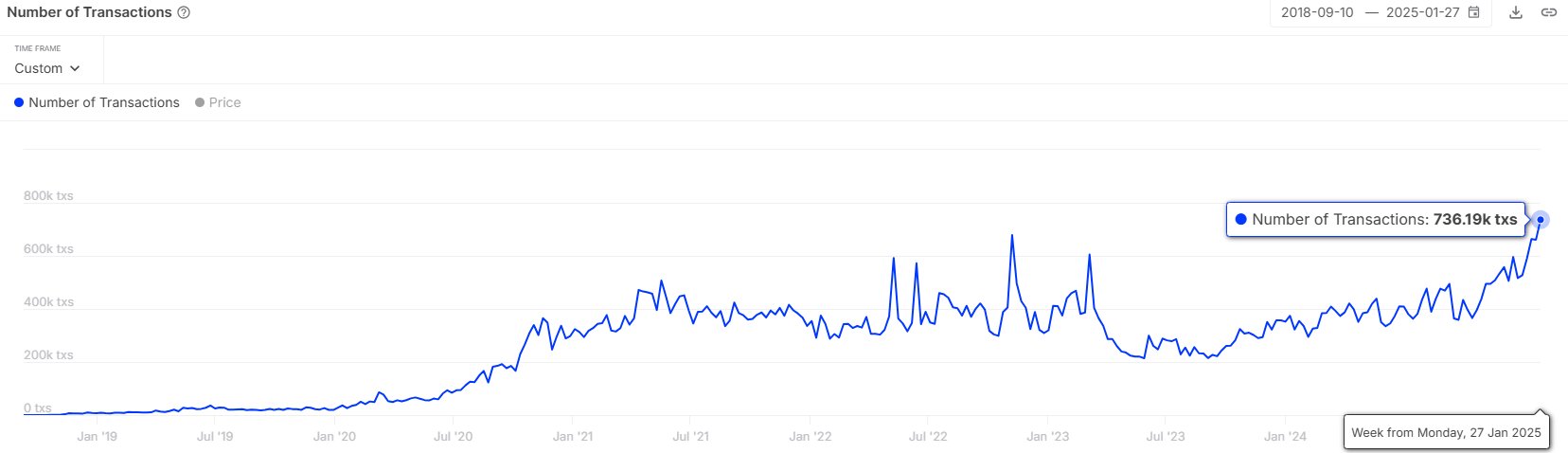

In another information, the quantity two stablecoin by market cap, USDC, has seen its transaction rely shoot up not too long ago, as IntoTheBlock has identified in one other X put up.

“USDC is changing into more and more common, with the variety of every day transactions growing by over 119% within the final yr!” says the analytics agency. Stablecoins can find yourself performing as gasoline for unstable property like Ethereum, so elevated exercise associated to them is usually a good signal for the market.

ETH Value

On the time of writing, Ethereum is floating round $2,800, down greater than 11% during the last seven days.