XRP value stays below stress, buying and selling inside a key vary as technical indicators sign potential draw back dangers. The latest 64-minute outage, which briefly halted transactions, has now been resolved, however it did little to spice up investor confidence.

In the meantime, XRP’s CMF stays constructive however has weakened. Additionally, the community’s lively addresses have dropped almost 50% from its December peak. With a doable demise cross forming on its EMA traces, XRP may check decrease help ranges until renewed hype and shopping for stress push it again above key resistance zones.

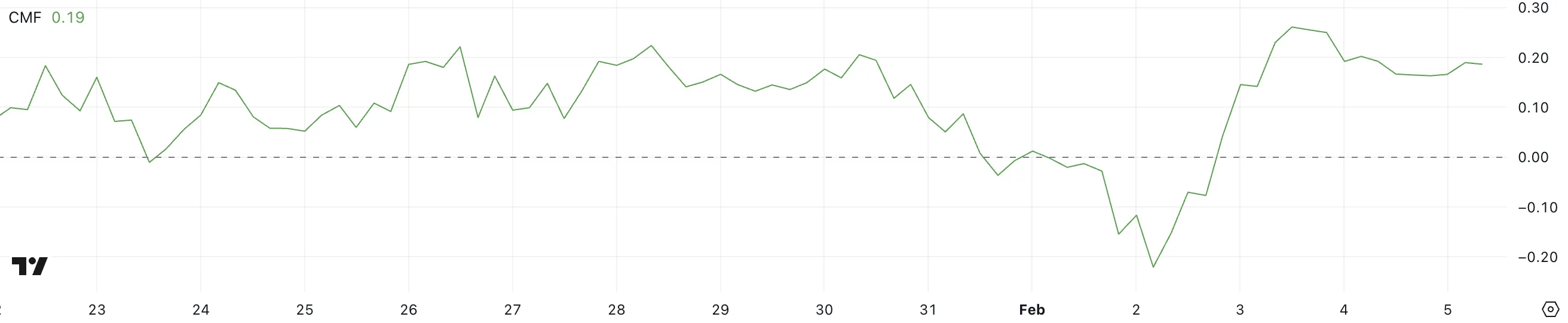

XRP CMF Is Nonetheless Very Optimistic, However Consolidating

XRP Chaikin Cash Circulate (CMF) is at the moment at 0.19, down from 0.26 two days in the past, after briefly dipping to -0.22 three days in the past. This decline suggests that purchasing stress has weakened, however the indicator has now stabilized round 0.19 and 0.20.

The earlier drop into unfavourable territory signaled sturdy promoting, however the fast restoration above zero reveals that consumers have stepped in to help the worth. Nonetheless, with CMF decrease than its latest excessive, XRP’s bullish momentum has softened.

The CMF is a volume-weighted indicator that tracks the stream of cash into or out of an asset. A constructive CMF signifies shopping for dominance, whereas a unfavourable studying suggests promoting stress. With XRP’s CMF stabilizing round 0.19 after dropping from 0.26, capital inflows stay constructive however have slowed.

If it stays on this vary, XRP value may consolidate, however a transfer under 0.15 might point out growing weak spot, whereas a restoration above 0.25 may sign renewed shopping for energy.

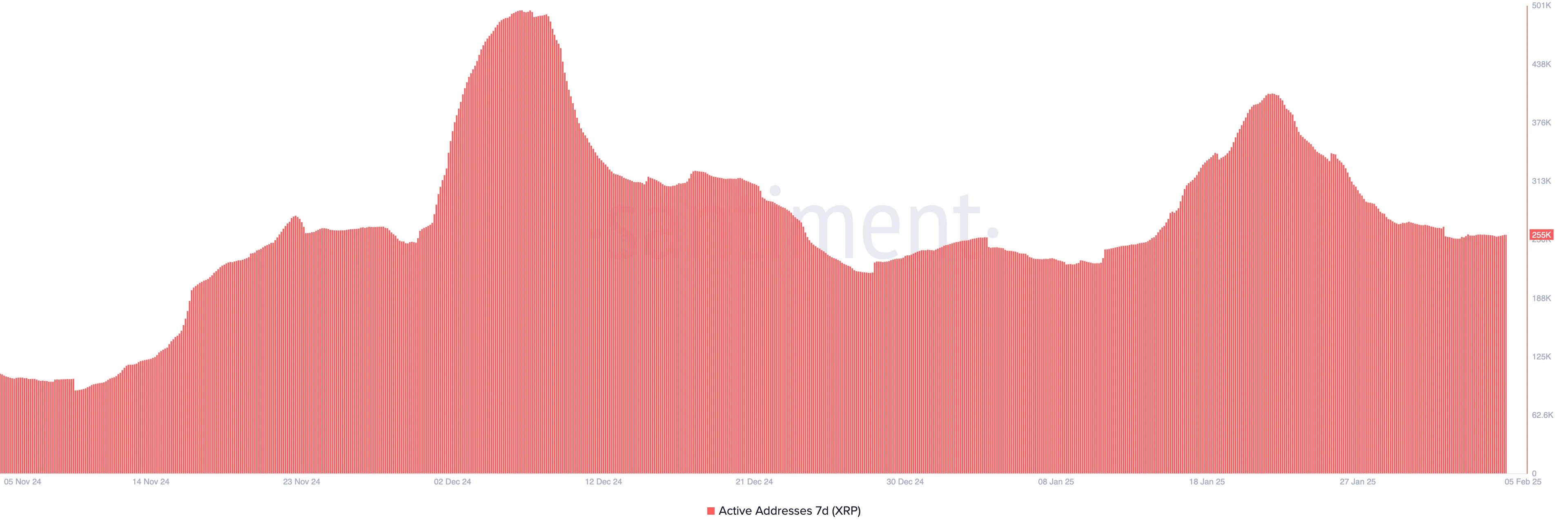

XRP Energetic Addresses Are Nonetheless Excessive, However Down 50% From Its Peak In December

The variety of 7-day XRP lively addresses is at the moment round 256,000, down from 407,000 almost two weeks in the past, marking a 37% decline. Whereas this stays a comparatively excessive worth in comparison with most of 2024, it’s nonetheless almost 50% decrease than the height reached in early December.

This drop suggests a slowdown in community exercise, which may point out lowered demand or decrease transaction volumes. If lively addresses proceed to say no, it could mirror waning curiosity or participation in XRP transactions.

Monitoring lively addresses is essential as a result of it measures actual consumer engagement and transaction exercise on the community. A better variety of lively addresses usually alerts sturdy adoption and demand, whereas a decline might point out lowered community utilization.

Though XRP present rely stays elevated in comparison with most of final yr, the sharp lower from December and January suggests fading momentum.

If this development persists, it may sign weaker market participation, however a rebound in lively addresses would possibly point out renewed investor and consumer curiosity.

XRP Worth Prediction: Can XRP Drop Beneath $2 Quickly?

XRP’s EMA traces point out {that a} new demise cross may type quickly, with a short-term line crossing under its longest-term line. If this bearish sign performs out, XRP value might check the help at $2.32, and if that stage is misplaced, it may drop additional to $2.20.

A continued decline in lively addresses and a weakening CMF may push XRP under $2, with the following key help at $1.99. This could verify a deeper bearish development, making restoration harder, particularly if new outages happen.

Then again, if the hype round XRP returns to ranges seen in latest months, it may break the $2.60 resistance. A powerful breakout above this stage may result in a check of $2.82, and if momentum builds, XRP may push above $3.

An additional rally may see it check $3.15 and even $3.40, reinforcing a bullish breakout and growing the probabilities of the XRP value reaching $4 in February. For this situation to play out, shopping for stress and community exercise would wish to enhance considerably.

Disclaimer

In keeping with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.