- Tron surpassed Ethereum’s community price income, pushed by low-cost transactions and rising stablecoin exercise.

- TRX confronted resistance at $0.2467 however might rally towards $0.30 if adoption and transaction quantity proceed rising.

TRON[TRX] has overtaken Ethereum’s[ETH] community price income, signaling a big shift in blockchain exercise.

This growth highlights TRON’s rising adoption for transactions, notably in stablecoin transfers and DeFi purposes.

However how does TRON’s TVL examine with Ethereum’s, and what does it imply for TRX’s worth pattern?

TRON’s community price income outpaces Ethereum

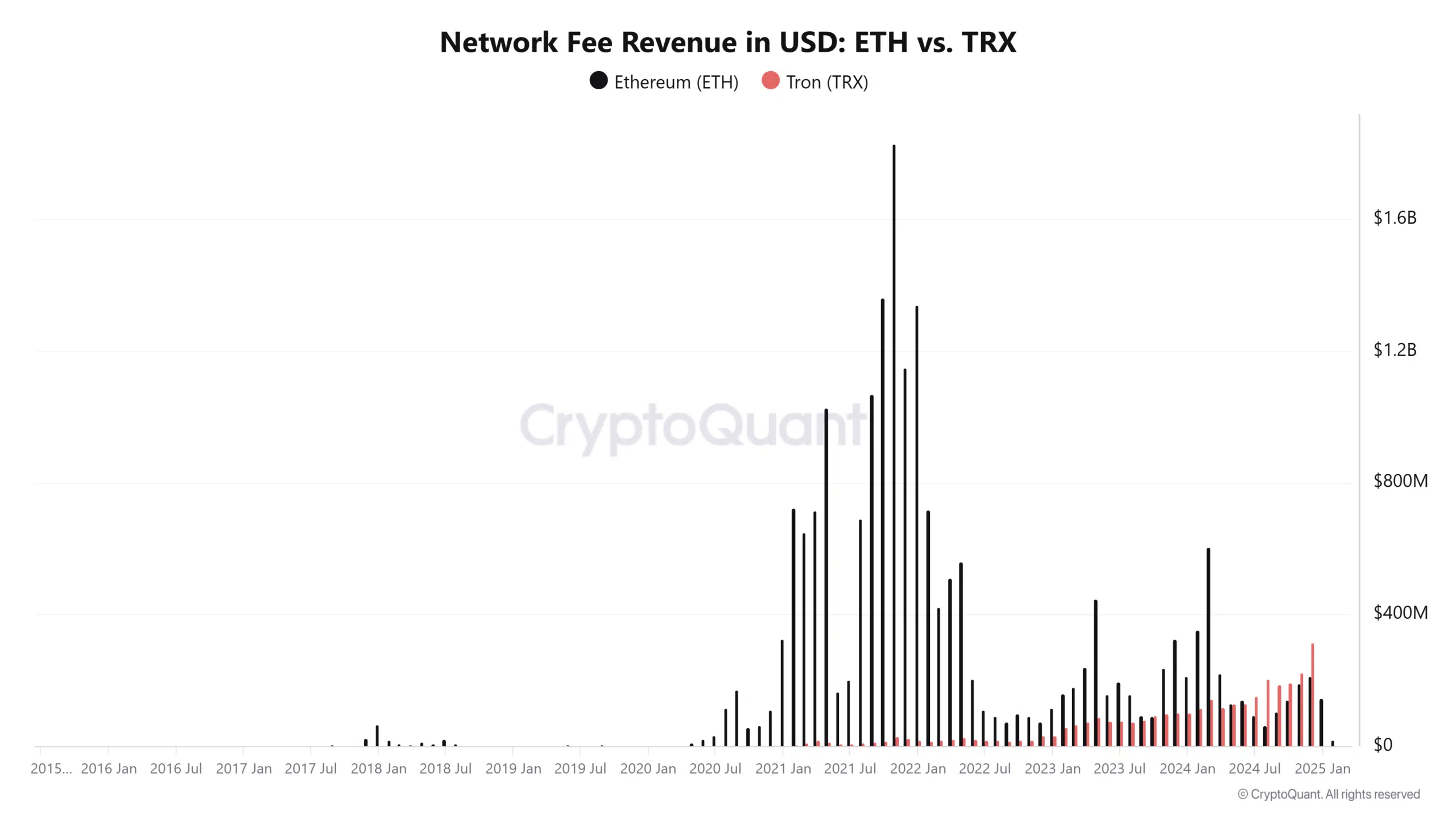

Latest knowledge from CryptoQuant revealed that TRON has surpassed Ethereum in community price income, a pattern that displays its rising dominance in blockchain transactions.

Traditionally, Ethereum has had extra community charges, however excessive fuel prices have pushed customers to low-fee options like TRON.

Supply: CryptoQuant

Evaluation reveals that Ethereum’s community price income peaked at over $1.6 billion through the 2021 bull run, whereas TRON’s price income remained comparatively low.

Nevertheless, latest months have seen TRON’s charges steadily improve, overtaking Ethereum in early 2025. This surge means that extra customers and purposes are leveraging TRON’s community for cost-efficient transactions.

Evaluating TRON and Ethereum TVL

Regardless of TRON’s rising community income, Ethereum nonetheless leads in Complete Worth Locked (TVL). Knowledge from DeFiLlama reveals that Ethereum’s TVL is at the moment round $60 billion, considerably increased than TRON’s $6 billion.

Whereas TRON’s TVL has grown steadily, Ethereum’s ecosystem stays the go-to selection for high-value DeFi purposes, institutional investments, and sophisticated good contracts.

One of many causes for this discrepancy is that TRON’s community exercise is basically pushed by stablecoin transactions, notably USDT transfers, relatively than high-value DeFi protocols.

This distinction highlights Ethereum’s power as a DeFi powerhouse, whereas TRON advantages from widespread transaction effectivity.

Can it maintain momentum?

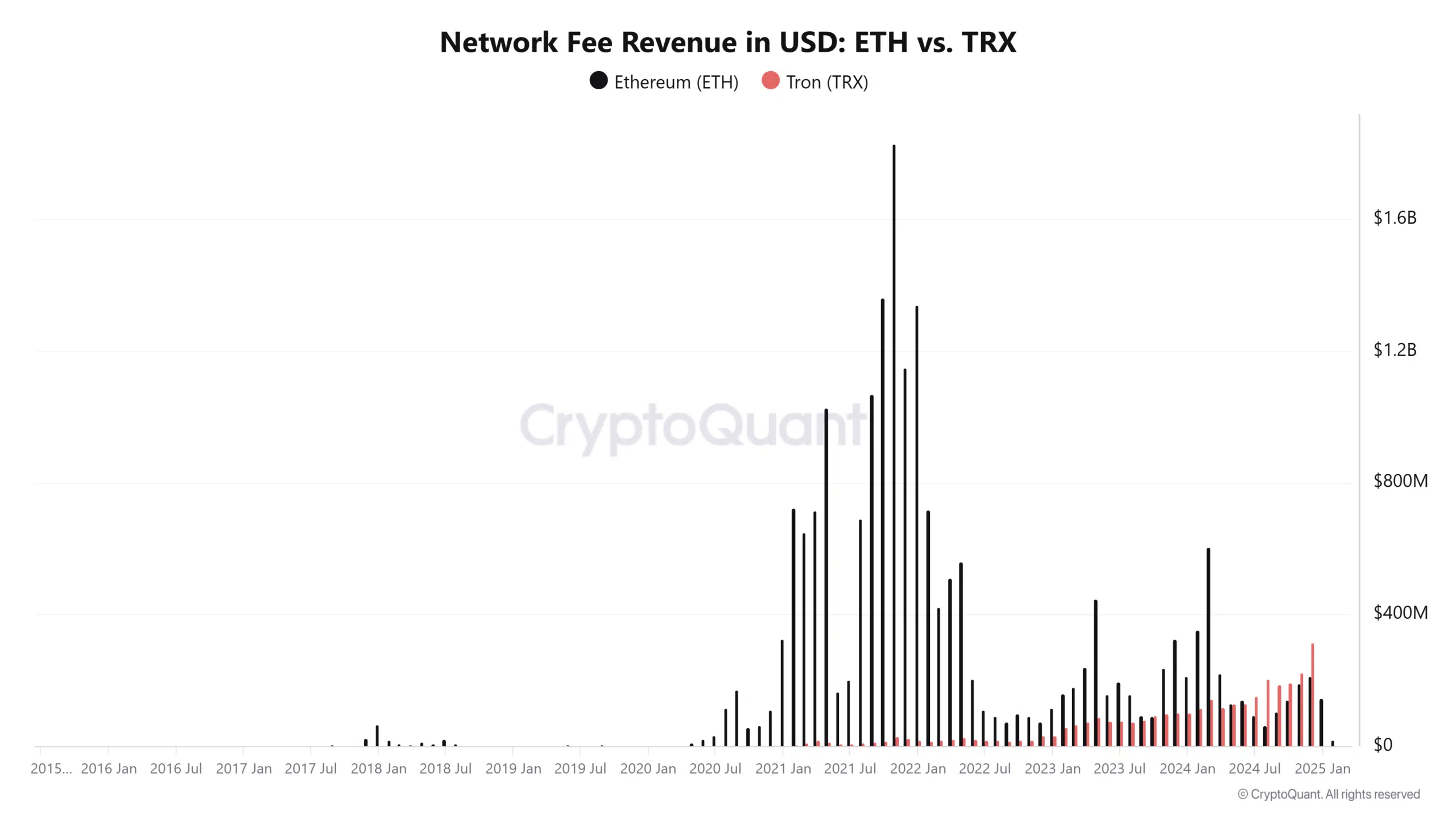

At press time, TRX was buying and selling at $0.2300, reflecting a 3.37% every day achieve. The 50-day Transferring Common (MA) at $0.2467 presents a important resistance degree.

If TRX breaks above this threshold, it might rally towards $0.28-$0.30, marking a possible breakout zone.

Supply: TradingView

The 200-day MA at $0.1920 stays a robust help degree, that means any draw back correction might discover shopping for curiosity round this space. If TRX holds above $0.22, bullish momentum might construct, reinforcing its place for additional good points.

What’s subsequent for TRON?

TRON’s capacity to surpass Ethereum’s community price income indicators robust adoption and consumer development. Nevertheless, for TRON to problem Ethereum’s dominance within the DeFi house, it might want to improve TVL and entice institutional gamers.

From a worth perspective, TRX should preserve help above $0.22 and break resistance at $0.25 to verify a sustainable uptrend. TRX might goal $0.30 and past if adoption continues rising, supported by robust transaction volumes and on-chain exercise.

– Is your portfolio inexperienced? Take a look at the TRON Revenue Calculator

General, TRON’s rising price income highlights its rising position in crypto transactions, however Ethereum’s robust DeFi ecosystem retains it forward in TVL.

The following few months will decide whether or not TRON can maintain this development and additional strengthen its market place.