- MicroStrategy, now rebranded as “Technique,” has dubbed itself the primary “Bitcoin Treasury Firm” with 471K BTC in its stash.

- It’s a dangerous guess that would repay huge if Bitcoin continues its bullish run.

Bitcoin [BTC] and MicroStrategy [MSTR] have turn out to be an influence duo – one can’t thrive with out the opposite. However what occurs if both one falls aside?

Technique’s This autumn report below the highlight

MicroStrategy rebranded as “Technique” forward of its This autumn earnings report, dubbing itself the primary “Bitcoin Treasury Firm.” The identify appears becoming with 471,107 BTC in its stash, together with a whopping 194,180 purchased in This autumn alone.

This autumn was an enormous bullish section for Bitcoin, with billions flowing in through the election. MicroStrategy didn’t waste the chance, making three huge Bitcoin buys costing $11.5 billion in simply three transactions.

The corporate has launched its This autumn financials, revealing a 74.3% BTC yield for 2024, all from its 447,470 BTC stashes, with a mean value per Bitcoin of $62,503.

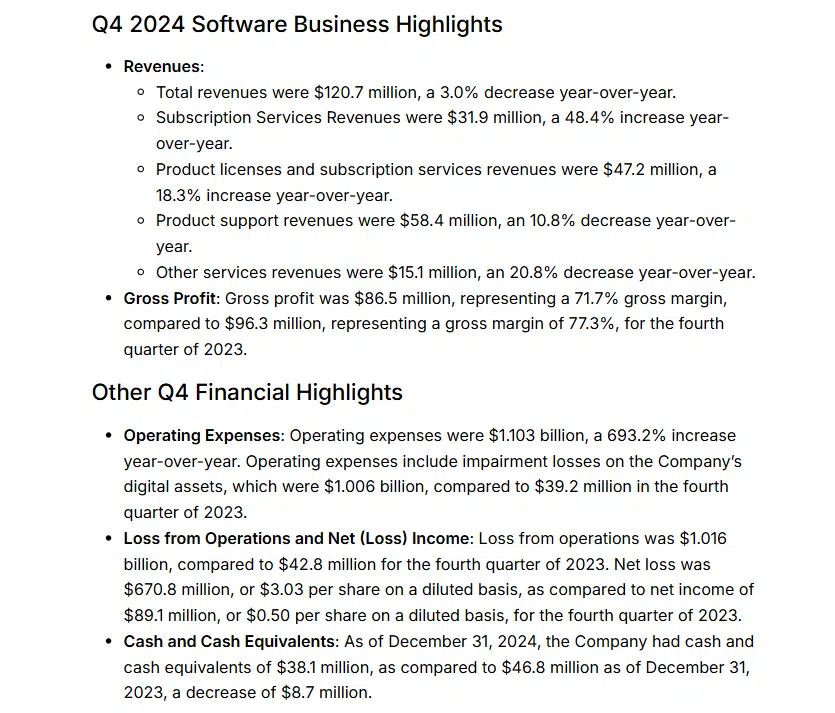

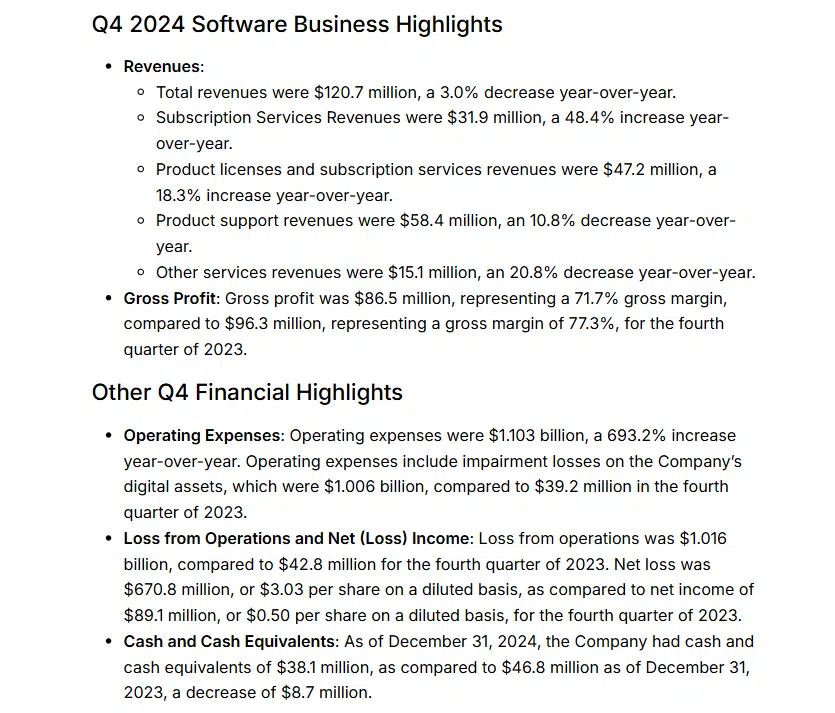

Nonetheless, that’s one a part of the story. MicroStrategy’s bills shot as much as $1.103 billion, principally because of a $1.006 billion loss on their digital property, leading to a internet lack of $670.8 million or $3.03 per share.

Supply: Technique

Bitcoin’s sudden dip from $108K to $92K – triggered by the Fed’s cautious stance on rates of interest – value MicroStrategy billions.

Its gross revenue took a success, dropping to $86.5 million from $96.3 million final yr.

What does this imply for Bitcoin and Microstrategy’ future?

MicroStrategy and Bitcoin are actually inseparable, however Bitcoin’s efficiency is essential. With 2025 trying risky, the continued commerce struggle would possibly simply be the start.

In such a local weather, predicting Bitcoin’s subsequent prime or backside is anybody’s guess, leaving MicroStrategy in a tough spot. The probabilities of two fee cuts this yr are shrinking quick.

Regardless of MicroStrategy’s $2.543 billion Bitcoin buys in January, Bitcoin’s value has solely risen 4% for the reason that begin of the yr, even dipping under $93K twice.

Nonetheless, MicroStrategy is aiming excessive, concentrating on a $10 billion BTC achieve for 2025—a major bounce from the 140,538 BTC achieve in 2024.

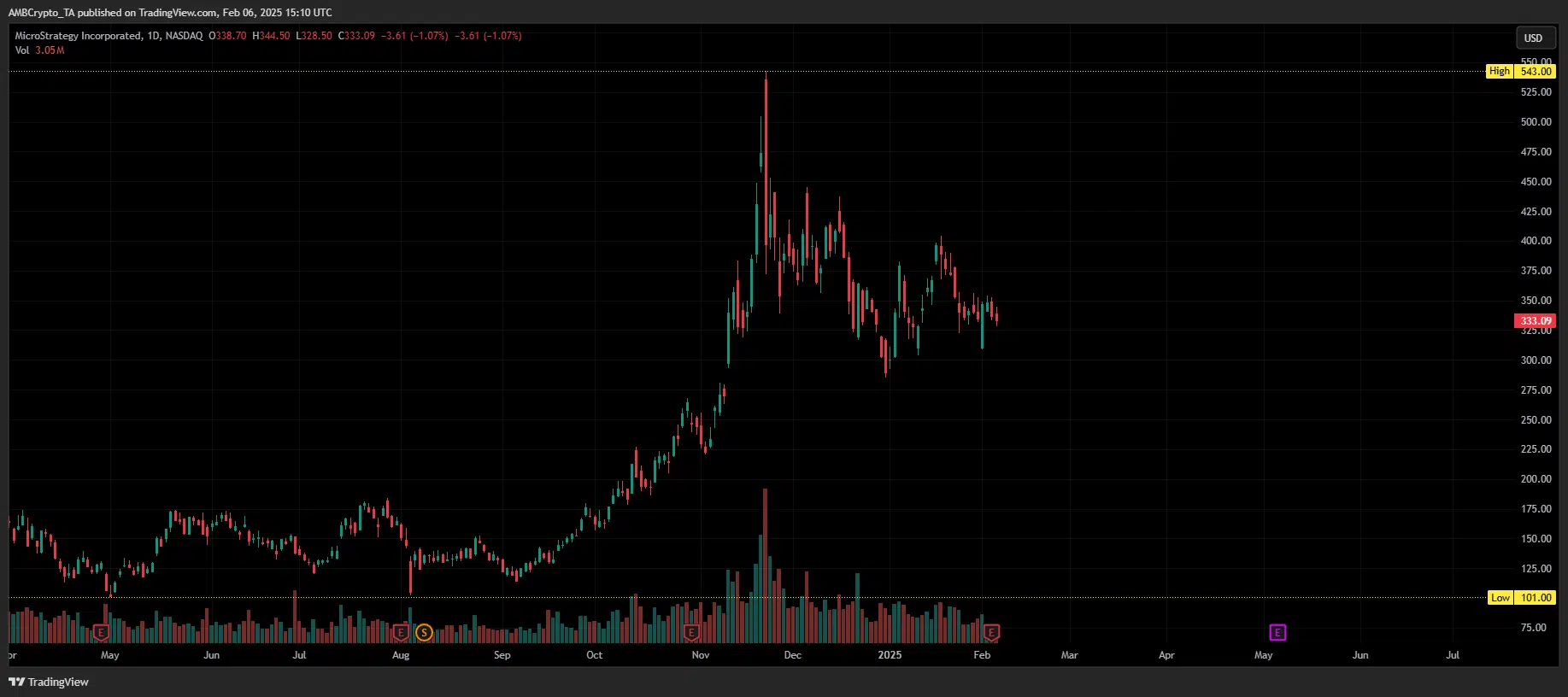

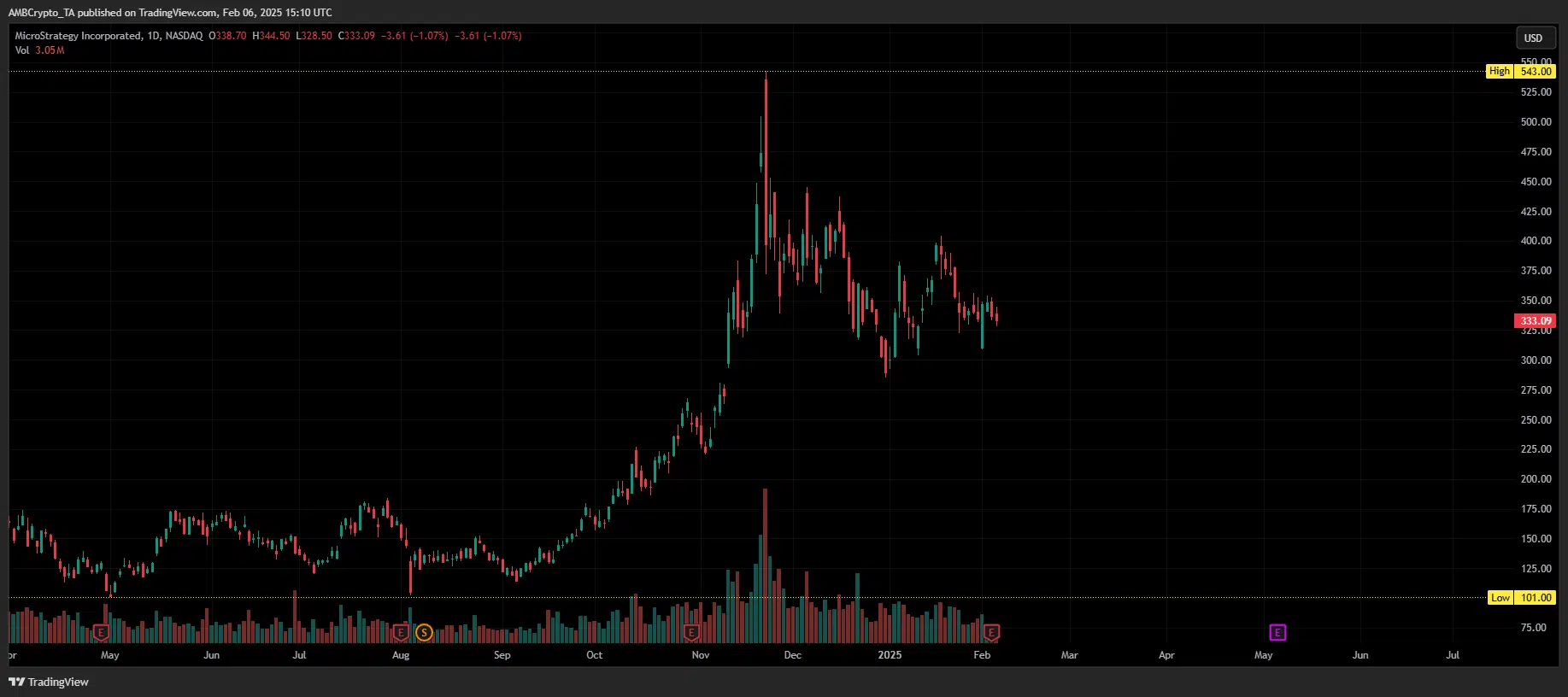

Nonetheless, its inventory has taken a success, with a 15.26% decline in market cap from its all-time excessive of $8.71 trillion in mid-December final yr, simply earlier than the FOMC assembly.

Supply: TradingView (MSTR)

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

As MicroStrategy turns to debt for future Bitcoin buys, the robust economic system, unpredictable inventory costs, and mounting losses put the corporate in danger.

If issues don’t go as deliberate, it’d really feel the affect first, placing Bitcoin’s rally in severe jeopardy.