Solana (SOL) value has seen robust corrections over the previous week, dropping 17% and falling under the $100 billion market cap. The Ichimoku Cloud chart signifies that bearish momentum stays dominant, with SOL buying and selling under key development indicators and reflecting draw back stress.

In the meantime, the Directional Motion Index (DMI) means that the energy of the present downtrend remains to be intact, although promoting stress seems to be weakening. With technical indicators exhibiting combined indicators, SOL’s subsequent transfer will rely on whether or not it could regain momentum or proceed its decline towards decrease assist ranges.

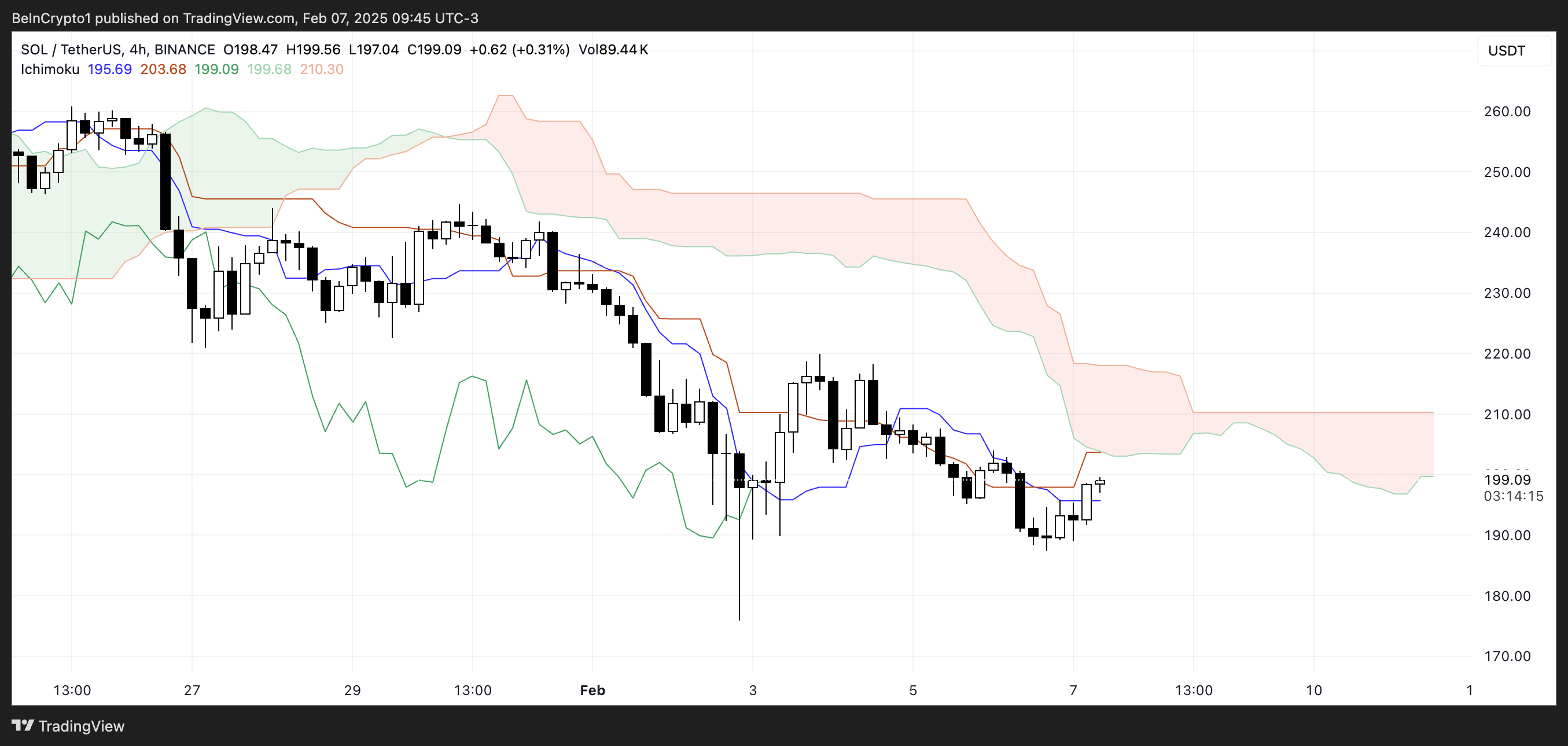

SOL Ichimoku Cloud Present the Bearish Momentum Is Nonetheless Right here

The Ichimoku Cloud chart for Solana reveals a predominantly bearish setup. The worth is buying and selling under the cloud, and the cloud itself is shaded crimson, indicating continued draw back stress.

The Kijun-sen (crimson line) stays above the value, reinforcing the bearish bias, whereas the Tenkan-sen (blue line) can be positioned under the cloud, suggesting that short-term momentum remains to be weak.

Moreover, the Senkou Span A (inexperienced cloud boundary) is trending under Senkou Span B (crimson cloud boundary), signaling that the broader development stays downward. The truth that the value is under each the conversion and base strains additional confirms that bears are in management.

Nonetheless, there are indicators of potential stabilization, as SOL has just lately tried to push larger and is testing the Tenkan-sen. If the value can maintain momentum above this degree, it could point out an early shift in sentiment.

The Lagging Span (inexperienced line) remains to be under the value motion, which means that no clear bullish affirmation is current but.

To ascertain a development reversal, SOL would want to interrupt above the cloud, which stays a key resistance zone. Till then, the prevailing Ichimoku construction means that the market remains to be in a corrective section, with the cloud appearing as a dynamic barrier to additional upside motion.

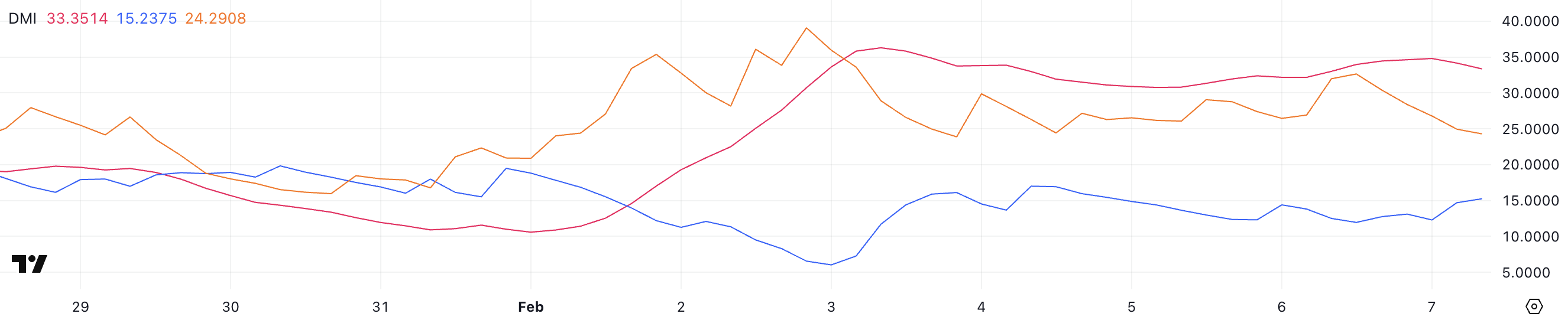

Solana DMI Reveals the Downtrend Might Be Easing

Solana Directional Motion Index (DMI) chart signifies that the Common Directional Index (ADX) is presently at 33.3 and has remained between 30 and 35 for the previous 4 days. The ADX measures development energy, with values above 25 usually indicating a robust development and values under 20 suggesting weak or range-bound value motion.

A studying between 30 and 35, as seen in SOL’s case, confirms that the continuing development – whether or not bullish or bearish – is holding agency.

Nonetheless, the path of the development is decided by the motion of the +DI and -DI strains, which signify shopping for and promoting stress, respectively.

Presently, Solana +DI stands at 15.2 and has been secure round this degree for the final three days, suggesting weak bullish momentum.

In the meantime, -DI has dropped to 24.2 after being as excessive as 32.6 only a day in the past, indicating that promoting stress is easing. Whereas SOL stays in a downtrend, the declining -DI means that bearish momentum could also be weakening.

If the +DI begins rising whereas -DI continues to drop, it may sign a possible development reversal. Nonetheless, so long as the ADX stays elevated and the -DI stays above the +DI, the downtrend stays dominant. SOL may nonetheless face additional draw back stress earlier than any significant restoration happens.

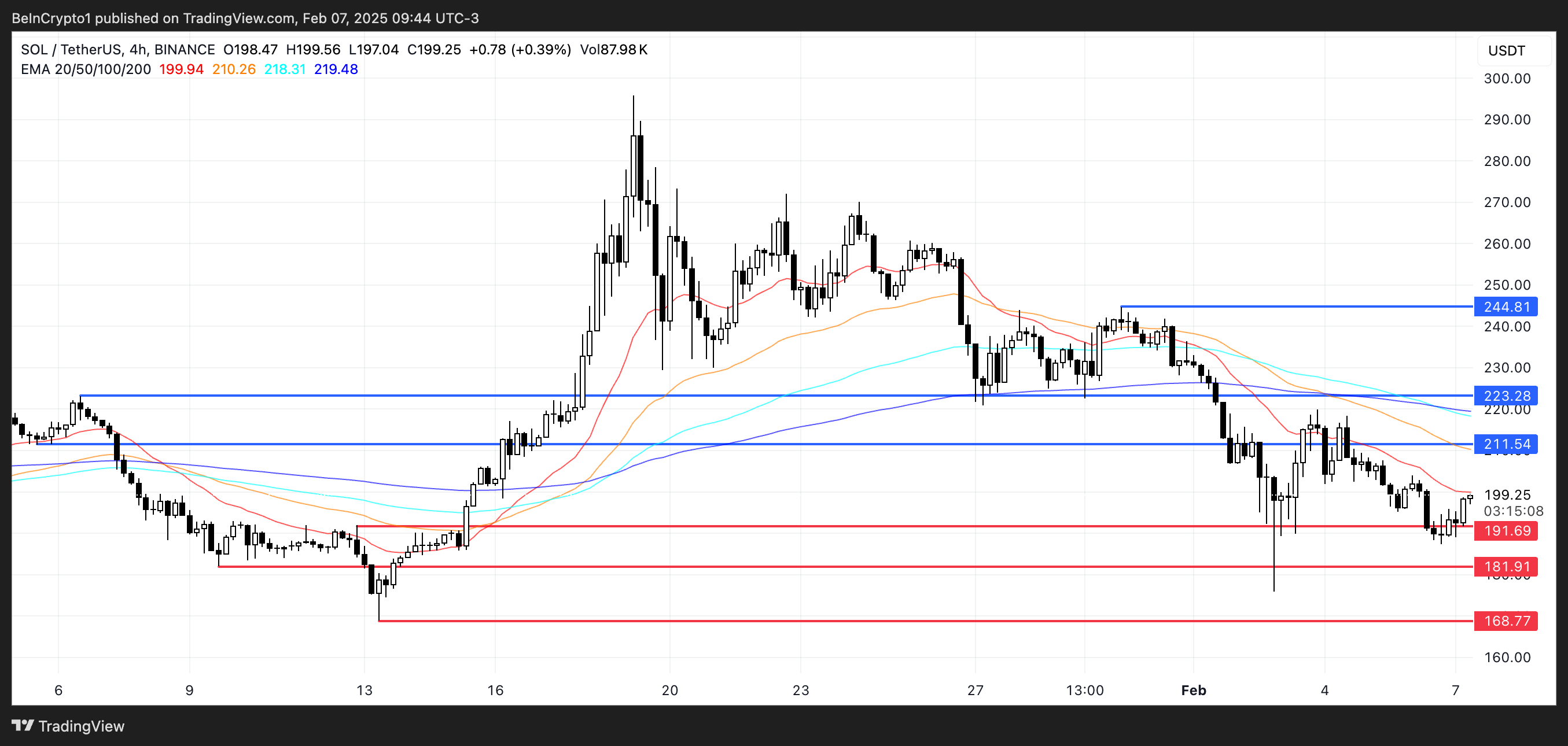

SOL Value Prediction: Will Solana Break Above $220 Quickly?

In recent days, Solana value has been hovering close to the $200 degree, consolidating inside a decent vary as market members assess its subsequent transfer.

If bullish momentum returns, SOL may take a look at the $211 resistance degree within the close to time period. A profitable breakout above this zone may open the door for additional positive aspects, with $223 as the following key goal.

Ought to shopping for stress strengthen, SOL value may even rally towards $244, marking a possible 22% upside from present ranges. Nonetheless, for this situation to play out, Solana wants sustained demand and a shift in momentum to beat the current bearish development.

On the draw back, if the present downtrend persists and promoting stress intensifies, SOL may quickly retest the $191 assist degree.

A breakdown under this crucial degree might speed up losses, probably sending the value towards $181 and even as little as $168, representing a 15% additional correction.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.