On-chain information reveals the Bitcoin buyers with no historical past of promoting are again to intense accumulation, an indication that might be bullish for BTC’s worth.

Bitcoin Accumulation Addresses Have Been Exhibiting Excessive Demand Lately

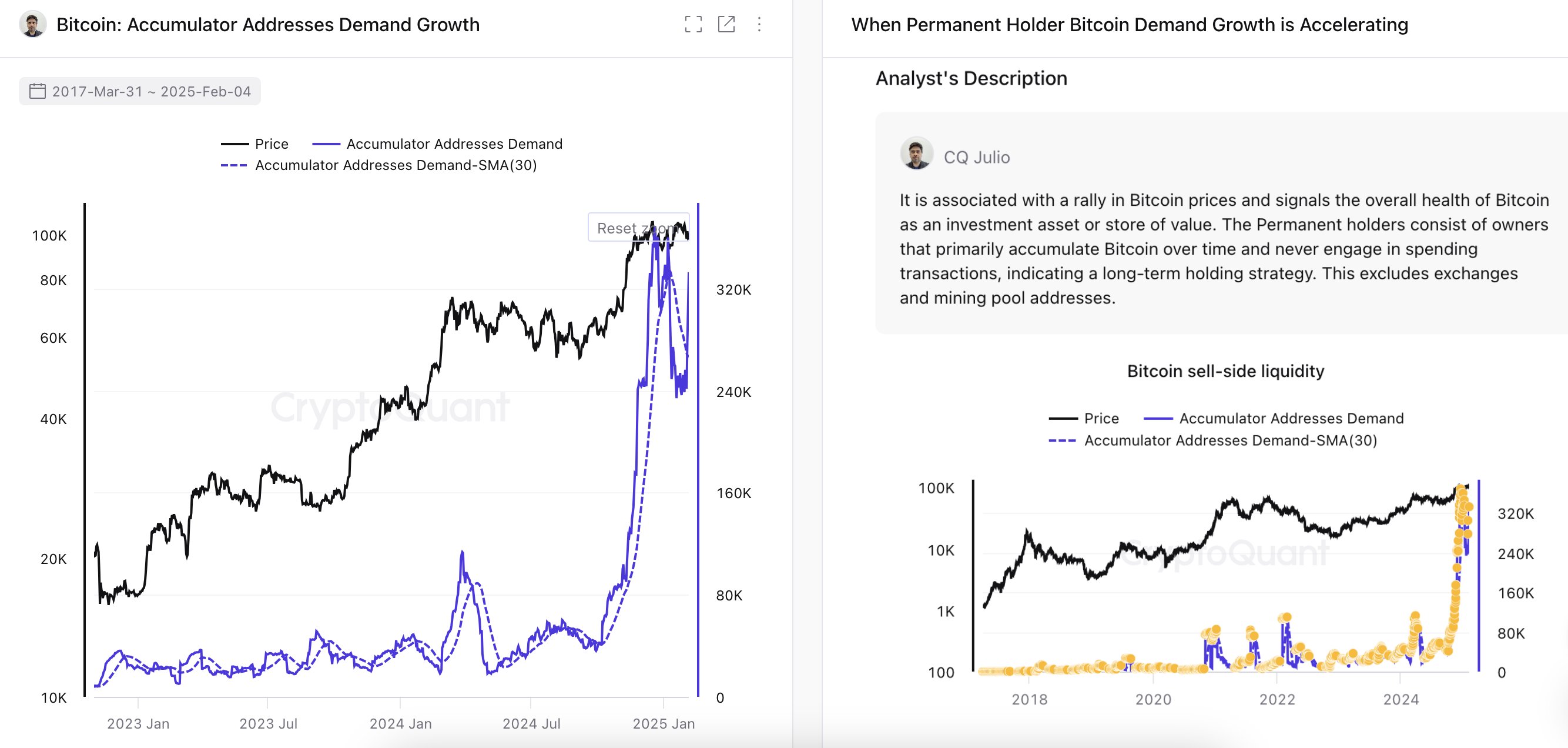

In a brand new submit on X, the on-chain analytics agency CryptoQuant has talked about how the demand is trying from the Everlasting Holders of Bitcoin. Everlasting Holders, also called Accumulation Addresses, consult with the BTC wallets which have by no means made an outflow transaction.

That’s, the Everlasting Holders are the buyers who solely have a historical past of shopping for and none of promoting. There are additionally a number of different restrictions on which addresses can fall inside this class, with a key one being that they shouldn’t be related to miners or exchanges.

The rationale behind that is that these two entities type of play the position of promoting strain out there. As such, the holdings hooked up to them may be checked out because the ‘promote provide’ of the cryptocurrency, which is the precise reverse of what the Accumulation Addresses characterize.

Now, right here is the chart shared by the analytics agency that reveals the pattern within the demand coming from these buyers during the last couple of years:

The worth of the metric seems to have been following a steep upwards trajectory in latest days | Supply: CryptoQuant on X

As displayed within the above graph, the Bitcoin Accumulation Addresses had been going by means of a shopping for spree over the past couple of months of 2024, however in January of this 12 months, they noticed their demand sharply go down and drop under the 30-day easy transferring common (SMA).

Clearly, the buildup from this cohort was what supported the bull run and it going away was the possible cause behind the slowdown within the cryptocurrency’s worth that adopted.

In the previous few days, although, demand from the group has as soon as once more been exhibiting acceleration, which means that provide is consistently being locked within the arms of those HODLers.

The indicator has now additionally damaged again above the 30-day SMA in a pointy trend, just like the breakout of 2024. “Traditionally, this indicators robust confidence and infrequently precedes rallies,” notes CryptoQuant.

The Everlasting Holders are literally not all going to be ‘everlasting,’ as someday at the very least part of this group would promote to reap the earnings of their persistence. Nonetheless, buyers who haven’t any historical past of promoting are prone to maintain it for at the very least some size of time, which is why shopping for from Accumulation Addresses is taken into account bullish.

The cohort can now be to keep watch over within the close to future, as the place their demand traits might find yourself being essential for Bitcoin. Naturally, a continuation of the upwards trajectory could be a optimistic signal, whereas a slowdown might result in flat motion within the asset.

BTC Worth

Bitcoin has been unable to determine a path in the previous few days as its worth remains to be buying and selling across the $98,700 mark.

Seems like the worth of the coin has been transferring sideways just lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com