The SEC has postponed its determination on approving choices buying and selling for Ethereum exchange-traded funds (ETFs).

The regulator has prolonged its overview interval by 60 days, setting April 9 as the brand new deadline.

SEC Delays Ethereum ETF Choices Approval for the Third Time

On February 7, the SEC introduced one other delay in figuring out whether or not Ethereum ETFs can commerce choices.

This marks the third extension after earlier deferrals in September and November 2024. The company cited that it wants extra time to evaluate the potential influence available on the market and collect public enter, opening a 21-day window for feedback.

“The Fee is extending the time interval for approving or disapproving the proposed rule change for a further 60 days. The Fee finds it acceptable to designate an extended interval inside which to challenge an order approving or disapproving the proposed rule change in order that it has adequate time to think about the proposed rule change and the problems raised therein,” the SEC acknowledged.

The delay impacts functions from a number of main companies, together with Bitwise, Grayscale, Ethereum Mini Belief, and BlackRock. The SEC emphasised that the extension permits for a extra complete overview earlier than making a closing determination.

This determination follows the regulator’s earlier request for public feedback on a proposal by Cboe BZX Trade Inc., which was submitted on behalf of Constancy. The proposal seeks approval to record and commerce choices tied to Constancy’s spot Ethereum ETF.

Choices contracts present merchants with the precise—however not the duty—to purchase or promote an asset at a particular worth inside a set timeframe. These monetary devices play an important function in threat administration and worth hypothesis.

Analysts imagine that the introduction of Ethereum ETF choices might speed up institutional adoption and improve market effectivity. Notably, an analogous regulatory framework already applies to Bitcoin ETFs and commodity-backed belongings like gold.

In the meantime, Bloomberg ETF analyst Eric Balchunas has urged that whereas approval appears probably, the delay could also be linked to ongoing management modifications on the SEC.

“SEC punting on spot Ether ETF choices. I wouldn’t learn an excessive amount of into it, can’t think about they don’t get authorised ultimately, probably ready till Atkins is confirmed earlier than transferring on stuff,” Balchunas acknowledged.

Former Commissioner Paul Atkins, nominated by Donald Trump to switch Gary Gensler, is awaiting Senate affirmation. His appointment is extensively considered as a possible shift towards a extra crypto-friendly regulatory strategy.

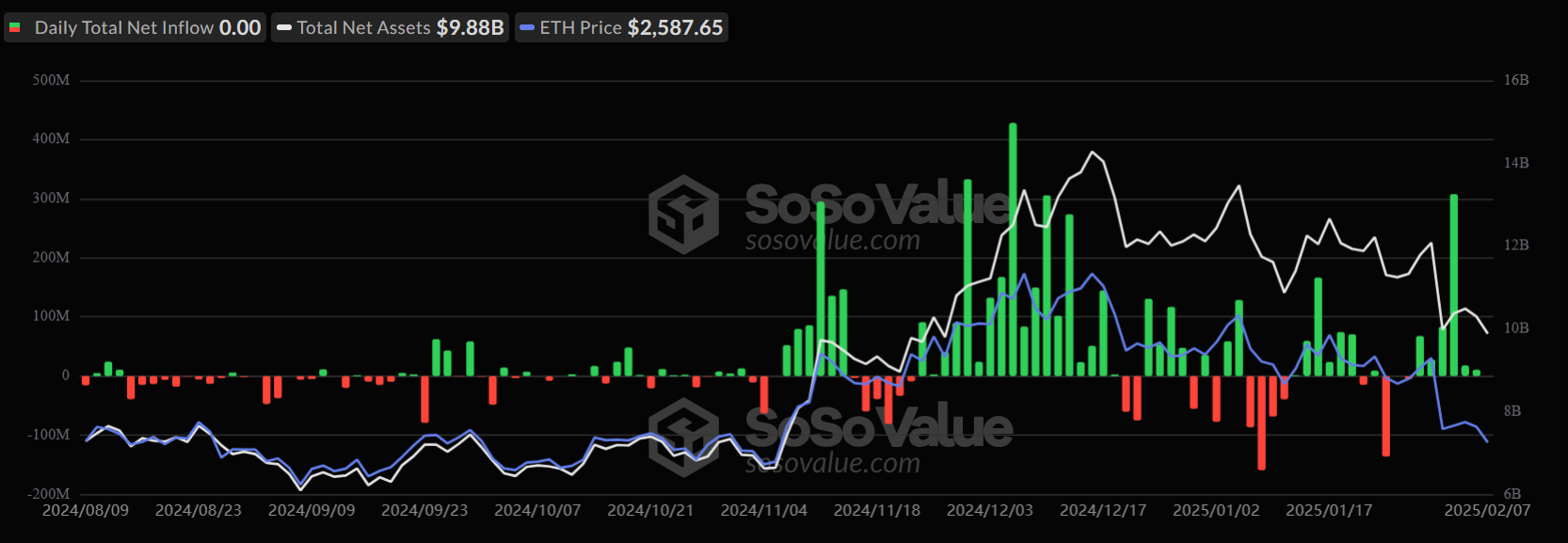

Regardless of ongoing uncertainty, demand for spot Ethereum ETFs continues to develop. Information from SoSo Worth signifies that these funds have skilled 5 consecutive days of internet inflows, pushing complete investments past $3 billion since their introduction.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.