Este artículo también está disponible en español.

Bitcoin is buying and selling beneath the $100K mark after enduring a risky and turbulent week. The cryptocurrency confronted excessive promoting strain final Sunday, dropping over 9% in lower than 24 hours. Though Bitcoin managed a slight restoration on Monday, the promoting strain has persevered, leaving the market in a state of uncertainty.

Associated Studying

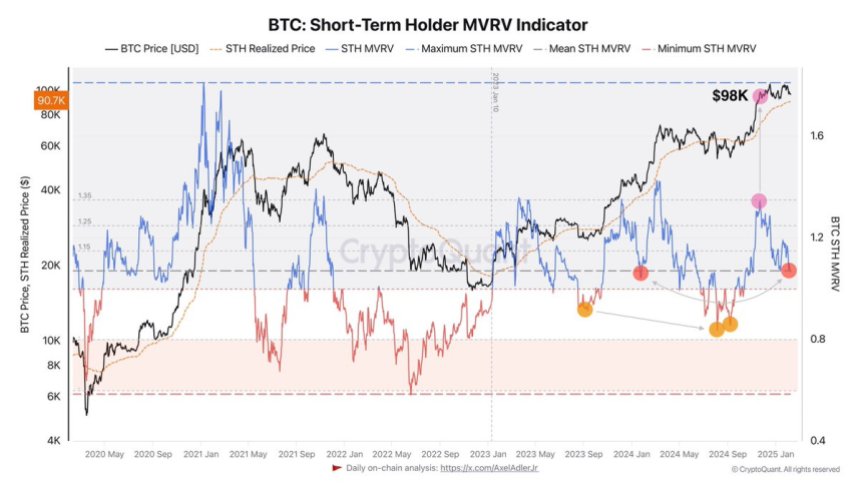

Key metrics shared by Axel Adler on X make clear the present state of Bitcoin’s worth motion. Based on Adler, the Bitcoin Brief-Time period Holder (STH) MVRV indicator has declined from $98K and a worth of 1.35 to common ranges. This drop means that short-term holders have been actively taking income throughout this era of heightened volatility.

The STH MVRV is a important indicator for assessing market sentiment amongst short-term members. Traditionally, values above 1.30–1.35 sign an overheated market, usually resulting in sell-offs. The latest decline within the indicator signifies that some short-term holders have exited their positions, doubtlessly marking the tip of a neighborhood overheated section.

As Bitcoin consolidates beneath $100K, market members are protecting a detailed eye on key help and resistance ranges, hoping to determine the subsequent massive transfer on this unpredictable market surroundings. For now, profit-taking and volatility dominate the narrative.

Bitcoin Faces Persistent Promoting Strain As Brief-Time period Holders Exit Positions

Bitcoin has been grappling with heightened volatility and promoting strain because the begin of February, a development that has negatively impacted altcoins and meme cash, resulting in bearish worth motion throughout the market. Analysts are more and more calling for a correction as bulls present indicators of fatigue and worth actions counsel additional declines may very well be on the horizon.

Key insights from CryptoQuant, shared by Axel Adler on X, reveal an essential shift in market dynamics. The Bitcoin Brief-Time period Holder (STH) MVRV indicator, a important instrument for gauging short-term holder habits, has declined from $98K and 1.35 to common ranges. This drop signifies that short-term holders have been taking income amid the latest market volatility.

Traditionally, an STH MVRV above 1.30–1.35 indicators an overheated market, usually previous vital sell-offs. The present decline within the indicator suggests {that a} portion of short-term holders have exited their positions, relieving some strain available on the market. A return to common ranges usually marks the tip of a neighborhood overheated section.

Associated Studying

If demand stays robust, Bitcoin is prone to enter a consolidation or sideways buying and selling section following this era of profit-taking. Nonetheless, a drop within the STH MVRV beneath 1.0 would sign the formation of a neighborhood backside, doubtlessly setting the stage for a future rally. Because the market navigates this era of uncertainty, monitoring these key metrics can be essential in anticipating Bitcoin’s subsequent transfer.

Worth Struggles to Discover Course Beneath $100K

Bitcoin is buying and selling at $96,700 after a number of days of sideways motion inside a decent vary between $100,000 and $95,600. The value has been unable to ascertain a transparent course, with bulls dropping management after failing to carry the $100K mark final Tuesday. This lack of momentum has created an environment of uncertainty out there, leaving merchants on edge as Bitcoin hovers close to key help ranges.

The short-term outlook for Bitcoin stays unclear, as neither bulls nor bears have managed to take decisive management. If Bitcoin fails to carry above the important $95K help degree, a deeper decline into the $90K demand zone might observe. Such a transfer would sign elevated promoting strain, doubtlessly dampening sentiment additional and increasing the present consolidation section.

Associated Studying

However, reclaiming the $100K degree is essential for bulls to regain management and push the worth greater. Nonetheless, with no robust push above this psychological resistance, Bitcoin’s worth motion is prone to stay uneven and unsure. Market members are watching intently for any indicators of a breakout or breakdown, as the subsequent transfer might outline Bitcoin’s trajectory within the coming weeks. For now, warning stays the prevailing sentiment.

Featured picture from Dall-E, chart from TradingView