Solana has skilled a pointy drawdown, dropping beneath the $200 mark earlier this week. The decline comes amid broader market volatility, leaving traders unsure concerning the altcoin’s subsequent transfer.

Nevertheless, the latest downturn could current a bullish alternative, offered market individuals shift their stance and capitalize on the dip.

Solana Buyers Are Unsure

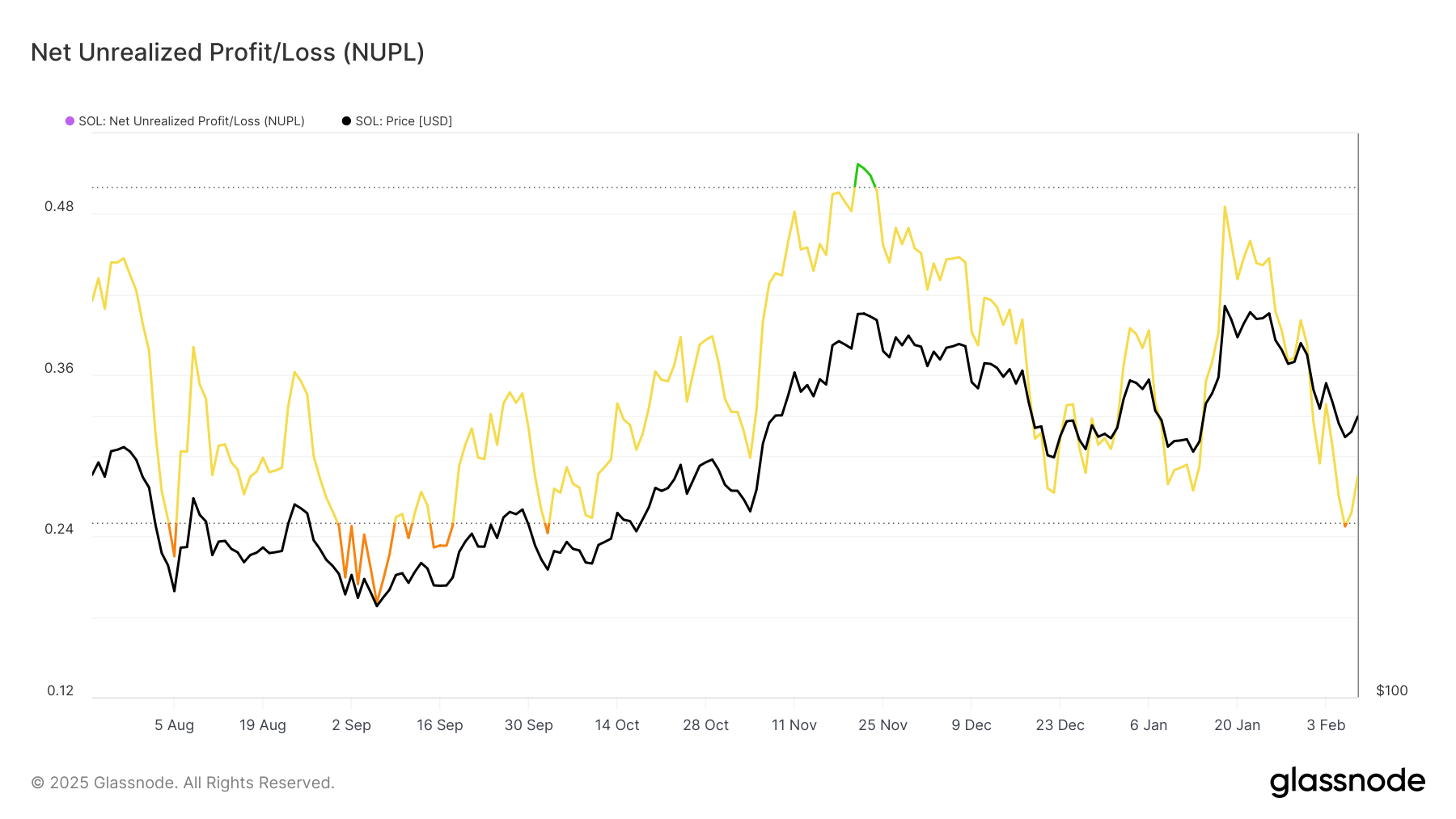

The Web Unrealized Revenue/Loss (NUPL) indicator has fallen into the Concern zone, retreating from the Optimism zone. This shift means that investor sentiment has weakened, contributing to elevated promoting stress. Traditionally, comparable dips into the Concern zone have usually preceded value reversals, signaling potential restoration.

If previous tendencies maintain, Solana may see a rebound within the coming days. Earlier situations of NUPL dropping to those ranges have triggered renewed shopping for curiosity, supporting value recoveries.

A shift in sentiment may present the momentum wanted for SOL to reclaim misplaced floor and reestablish bullish momentum.

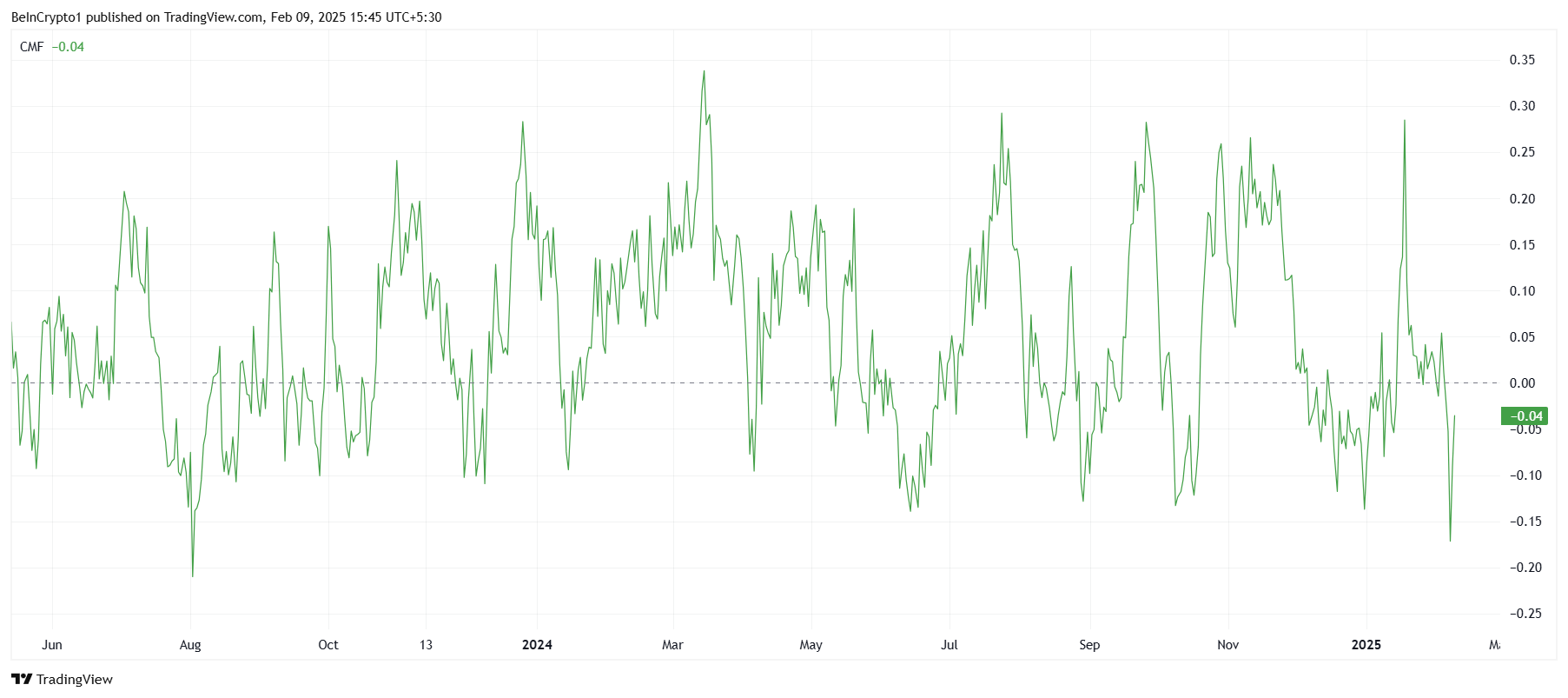

Solana’s Chaikin Cash Circulation (CMF) indicator has dropped to an 18-month low. This decline displays a surge in outflows, marking the strongest capital flight from the asset since August 2023.

Elevated promoting exercise means that traders stay skeptical, impacting SOL’s capacity to maintain upward value actions.

Sustained outflows sometimes sign bearish momentum as merchants transfer capital away from the asset.

For a development reversal to happen, Solana should entice renewed shopping for stress. If traders regain confidence, the value may stabilize, paving the best way for additional upside potential within the close to time period.

SOL Worth Prediction: A Rise Forward

Solana’s value has climbed 6% during the last 48 hours. Whereas this represents a minor restoration, it stays insignificant in comparison with the 27% decline the altcoin suffered over the previous three weeks. Extra bullish momentum is required for SOL to ascertain a sustained uptrend.

Presently buying and selling at $202, Solana has efficiently reclaimed the $200 help stage. This threshold is essential in figuring out the asset’s short-term trajectory.

If SOL manages to push previous $221, it might verify that restoration has begun, rising the chance of additional positive factors.

Nevertheless, if investor skepticism persists, Solana may face renewed promoting stress. A drop beneath the $183 help stage would invalidate the bullish outlook, resulting in prolonged losses.

The approaching days might be vital in figuring out whether or not SOL can maintain its restoration or succumb to additional declines.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.